Bitwise CEO and co-founder Hunter Horsley believes many extra publicly traded firms will add Bitcoin (BTC) to their steadiness sheets in 2025.

The top of the crypto asset supervisor Bitwise says on the social media platform X that traders might even see much more firms adopting Bitcoin as a company technique this yr.

“A serious theme in 2025 goes to be the arrival of corporates: Bitcoin Commonplace Firms. There are numerous non-public firms like Bitwise Investments that maintain Bitcoin on the steadiness sheet as properly. Thrilling to see.”

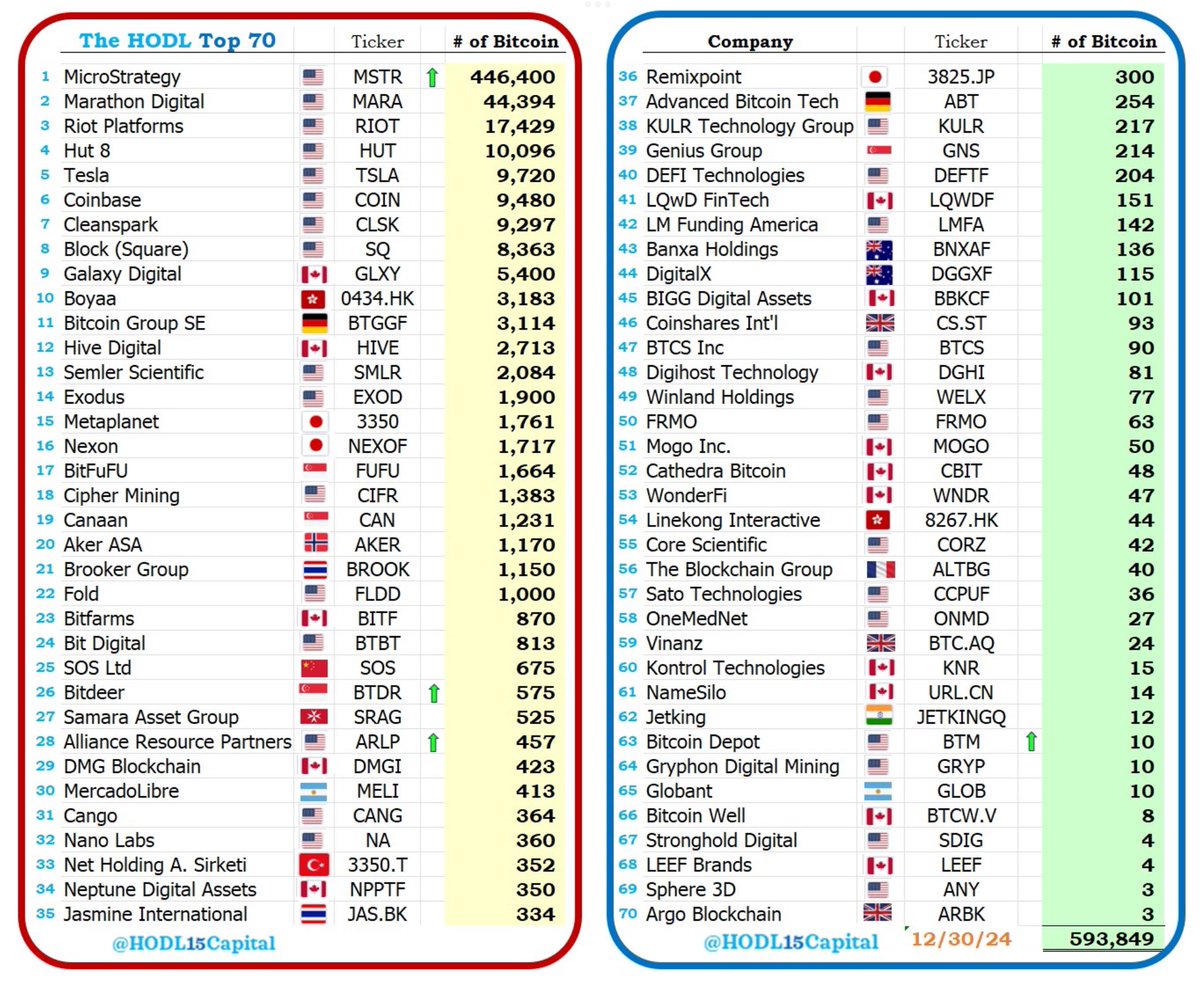

He additionally cites a report by crypto investor HODL15Capital that reveals firms already holding Bitcoin are persevering with to build up extra BTC. He notes that the biggest publicly-traded company holder of Bitcoin, MicroStrategy, may supply firms a roadmap on how they may accumulate the highest digital asset.

“11 publicly-traded firms purchased extra Bitcoin since [December 30th, 2024] in response to HODL15Capital. 2025 goes to see a number of companies becoming a member of the Bitcoin normal. [MicroStrategy founder Michael] Saylor has written the playbook for a motion.”

Horsley additionally believes 2025 could result in an explosion of tokenized small companies which can be targeted on using synthetic intelligence (AI) brokers.

“I feel AI could result in an explosion of firms and tokenized firms.

The idea:

- A single individual can use AI to make a way more area of interest model of a software program service. For instance, mobile-only CRM (buyer relationship administration) for impartial electricians that want to adapt to California legal guidelines.

- This may higher serve long-tail markets.

- This might result in an explosion of recent ‘micro’/area of interest firms, that perhaps do $100,000-$1 million a yr.

- The creator may tokenize the corporate and in doing so acquire two advantages: (A) pull ahead the earnings, (B) permit prospects to grow to be shareholders and advocates.

AI may massively enhance the variety of area of interest companies. These may by no means go public, however may tokenize. It could possibly be a serious new long-tail capital market.”

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Verify Worth Motion

Observe us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any losses you could incur are your duty. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please notice that The Every day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney