Miners and their function in market sentiment

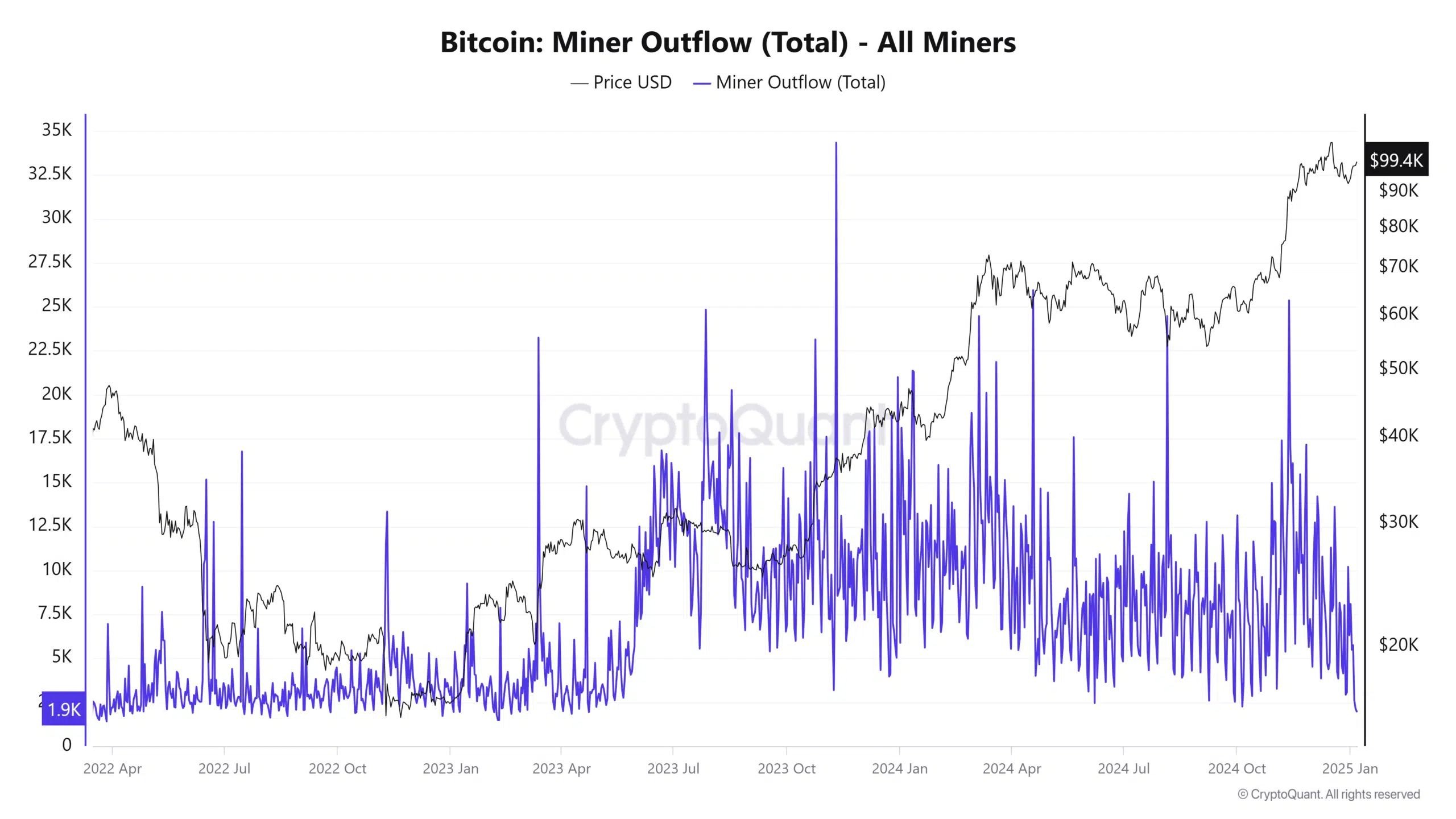

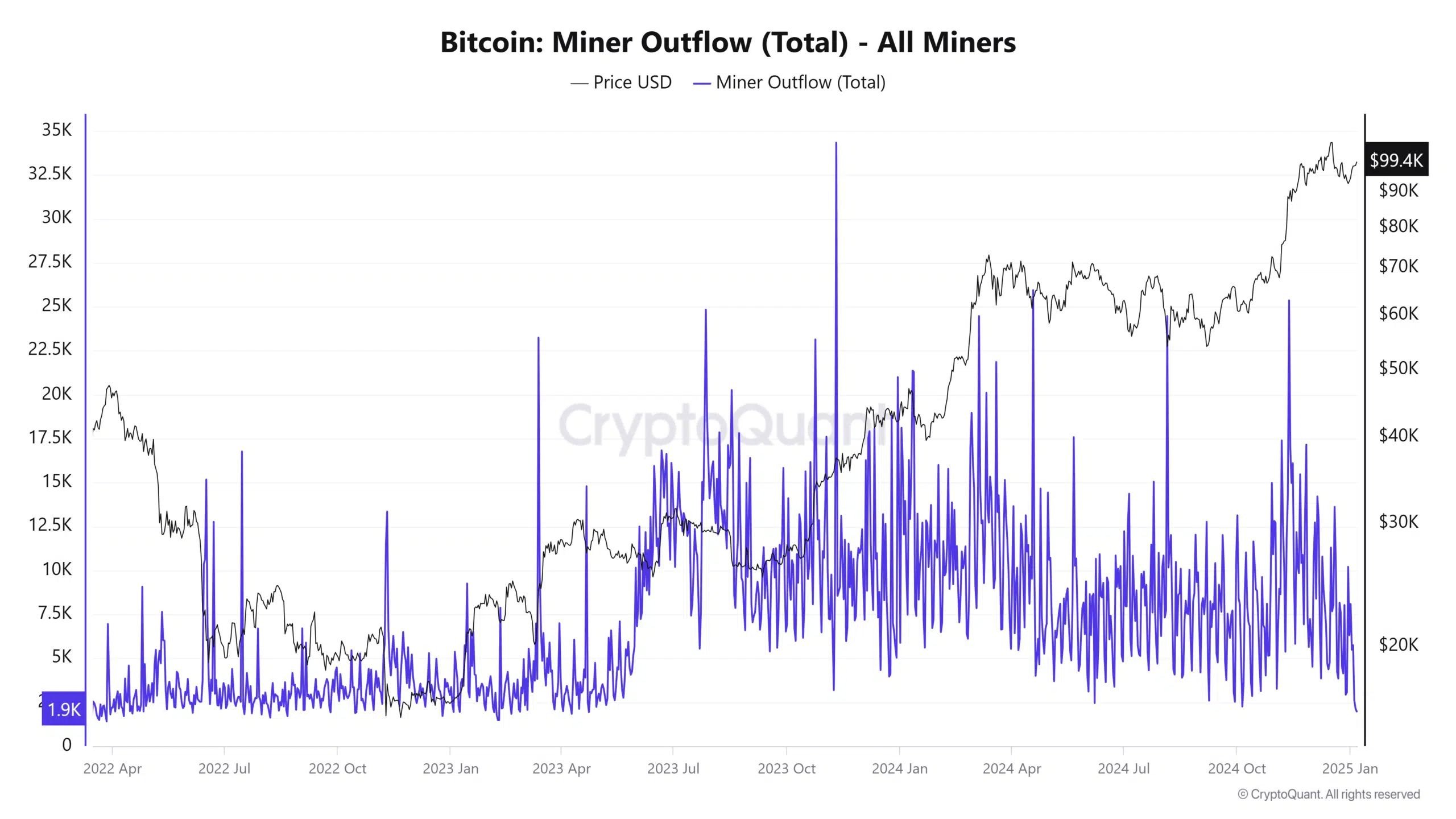

Miner outflows are a vital metric in understanding the dynamics of Bitcoin’s market cycles.

These outflows, representing the switch of Bitcoin from miners’ wallets to exchanges or different addresses, usually mirror miners’ monetary methods and sentiment.

Excessive outflows sometimes sign promoting strain, as miners capitalize on favorable value situations to cowl operational prices or lock in income.

Conversely, declining outflows recommend decreased promoting exercise, probably indicating miners’ confidence in Bitcoin’s future value appreciation.

This behavioral shift can instantly affect market sentiment, amplifying bullish or bearish tendencies.

November vs. January

November 2024 marked a interval of excessive exercise for Bitcoin miners, coinciding with BTC’s rise to $88,000. Miner outflows surged previous 25,000 BTC day by day, reflecting aggressive profit-taking at file value ranges.

As seen within the chart, this spike aligned with Bitcoin’s peak, suggesting miners had been desperate to capitalize on the heightened demand.

Supply: Cryptoquant

Nevertheless, by January 2025, outflows fell sharply to only 2,000 BTC per day, marking a drastic decline in promoting strain.

This discount signifies a possible shift in miner sentiment, probably pushed by optimism for sustained value progress or a tactical pause in promoting.

The distinction reveals a market transition, as miners’ cautious method indicators a decreased liquidity provide, probably reinforcing bullish momentum.

Miner conduct and Bitcoin’s value tendencies

The evolving conduct of Bitcoin miners has important implications for BTC’s value trajectory in 2025. Traditionally, elevated miner outflows have launched promoting strain, probably dampening value rallies.

Conversely, decreased outflows can sign miner confidence in Bitcoin’s long-term worth, probably fostering bullish market sentiment.

Current information signifies a considerable decline in miner outflows, suggesting a strategic shift in the direction of holding property.

This pattern aligns with projections from analysts at H.C. Wainwright, who anticipate Bitcoin reaching $225,000 by the top of 2025, pushed by historic value cycles and growing institutional adoption.

Moreover, the launch and profitable integration of ETFs, together with favorable regulatory developments, have bolstered market optimism.

Bernstein analysts predict Bitcoin might attain $200,000 by late 2025, reflecting a optimistic outlook on the cryptocurrency’s future.

Learn Bitcoin’s [BTC] Worth Prediction 2025-26

On this context, miners’ decreased promoting exercise could contribute to a constrained provide, probably amplifying value appreciation.

Nevertheless, buyers ought to stay vigilant, as shifts in miner conduct can introduce volatility, highlighting the significance of monitoring these dynamics in forecasting Bitcoin’s market efficiency for 2025.