For the reason that starting of the yr, Bitcoin’s value has been unable to revisit its $108,230 all-time excessive. This has diminished the profitability of the coin’s short-term holders (STHs), placing extra downward strain on its value.

As demand leans additional, BTC’s value might see new declines. Right here is why.

Bitcoin Brief-Time period Holders Rely Their Losses

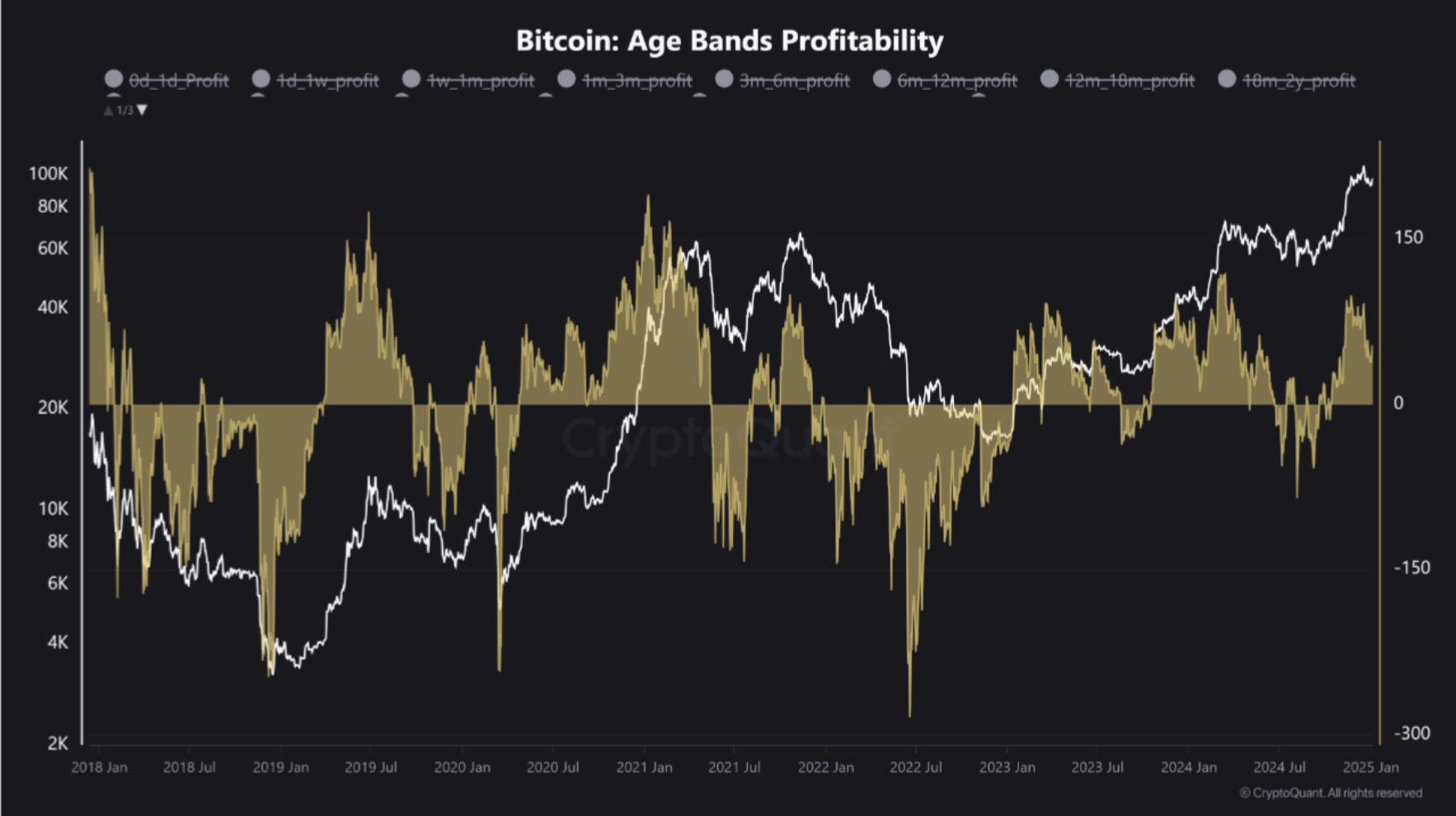

In a brand new report, pseudonymous CryptoQuant analyst Crazzyblockk famous a decline within the profitability of BTC investments for short-term holders (those that have held their cash for lower than 155 days).

The analyst assessed the profitability ranges for all Bitcoin age bands and located that “following Bitcoin’s rally to the $108,000 stage and the next failure to reclaim this important value level, the profitability margin for short-term holders has declined considerably.”

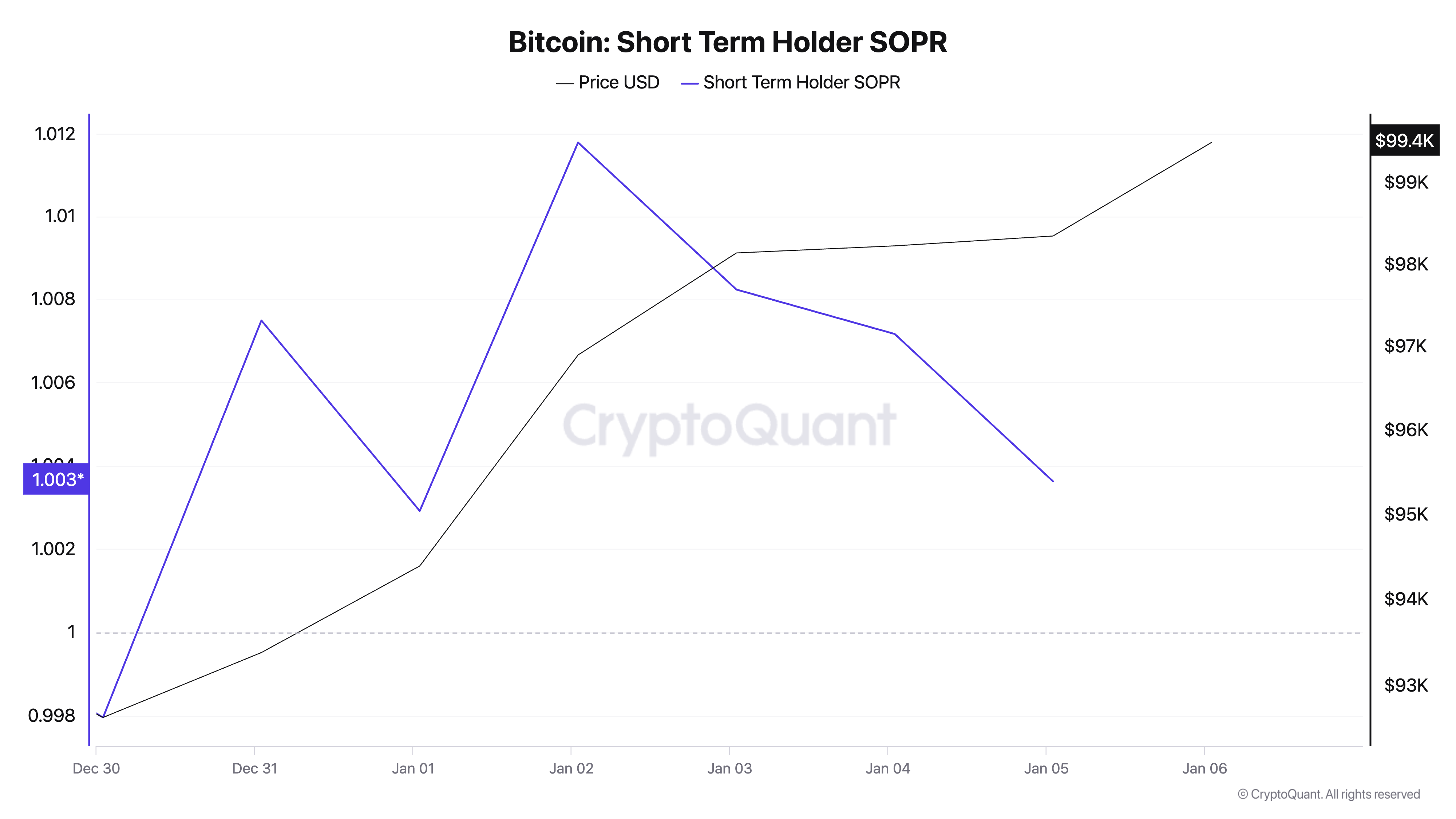

BeInCrypto’s evaluation of the coin’s Spent Output Revenue Ratio for its STHs confirms the analyst’s place. In response to CryptoQuant, this has maintained a downward development since January 2.

The Brief-Time period Holder Spent Output Revenue Ratio (STH-SOPR) gauges the profitability of short-term holders of a specific crypto asset. It usually gives insights into whether or not buyers who’ve held a specific asset for lower than 155 days are in a worthwhile or unprofitable place.

When its worth declines, short-term Bitcoin holders are more and more promoting at a loss reasonably than at a revenue. This displays declining market confidence amongst latest patrons, suggesting weaker demand for the main coin.

On how this may increasingly affect BTC’s value, Crazzyblockk stated:

“A drop in profitability for short-term holders typically supplies a transparent sign of weakening market demand and bearish sentiment over the quick and medium time period. Subsequently, beneath present situations, this means an elevated chance of value corrections pushed by diminished demand and subdued efficiency.”

BTC Worth Prediction: Is a Decline to $91,000 Imminent?

BTC is presently buying and selling at $100,943. If promoting strain intensifies as a consequence of short-term holders (STHs) dealing with elevated losses, the worth might drop to $91,488.

Nonetheless, if sentiment shifts and BTC witnesses a resurgence in new demand, this may increasingly propel the Bitcoin value previous the $100,000 stage and towards the all-time excessive of $108,230.

Disclaimer

In keeping with the Belief Undertaking pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.