The cryptocurrency market is enduring a big sell-off that noticed the value of the flagship cryptocurrency bitcoin (BTC) plunge greater than 4% from practically $103,000 to now stand at round $97,900.

The sell-off has affected most prime digital currencies, with Ethereum’s ether dropping round 7% of its worth within the final 24-hour interval, whereas XRP is down by greater than 5% and Solana by greater than 6%. Among the many prime cryptocurrencies, a few of the worst affected embrace Avalanche (AVAX) and Chainlink (LINK), which fell greater than 9% every.

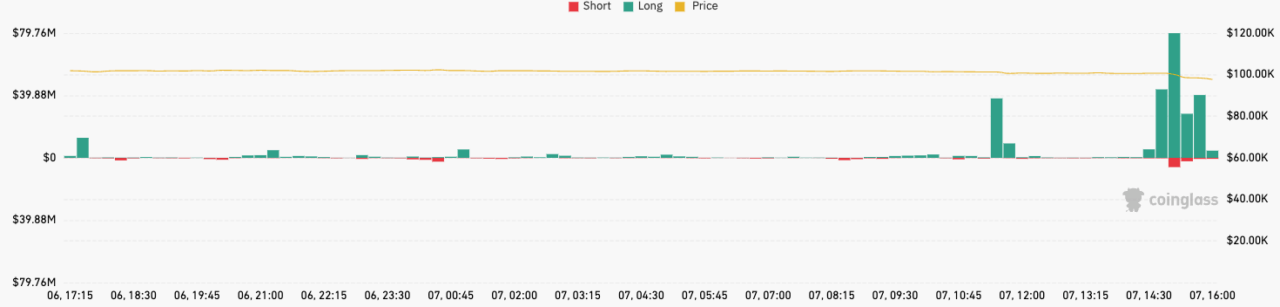

The sudden market downturn has seen liquidations within the cryptocurrency area surge to over $150 million within the final hour, a big degree that helped carry 24-hour liquidations to round $388 million, in accordance with CoinGlass information.

The cryptocurrency market is at present experiencing a decline on account of a number of components which embrace a drawdown in conventional markets, with the S&P 500 dropping round 0.3% of its worth in right this moment’s session, whereas the NASDAQ is down by greater than 1%.

Treasury yields have in the meantime risen considerably, with the rate of interest on the U.S. 10-year Treasury surging by round 5 foundation factors t now stand at 4.683%. The drawdown got here as job openings within the U.S. rose greater than anticipated in November in a possible signal the labor market is tightening.

Moreover, profit-taking by long-term holders, who could also be promoting off parts of their holdings after important good points, may very well be contributing to downward strain on costs.

Featured picture by way of Pexels.