Injective’s current group vote to cut back INJ’s provide has sparked a rally within the altcoin’s worth. Buying and selling at $26.29 at press time, its value has surged 33% over the previous week.

Regardless of this rally, INJ futures merchants have positioned quick bets in opposition to its value. Nevertheless, with the token poised to increase its features, these quick merchants danger dealing with a possible quick squeeze.

Injective’s Transition Boosts Market Curiosity

On January 5, a governance proposal to transition from Injective 2.0 to Injective 3.0 was authorised, with 99.99% of group members voting in favor. This improve will cut back the provision of INJ tokens, making it “one of the deflationary belongings over time.”

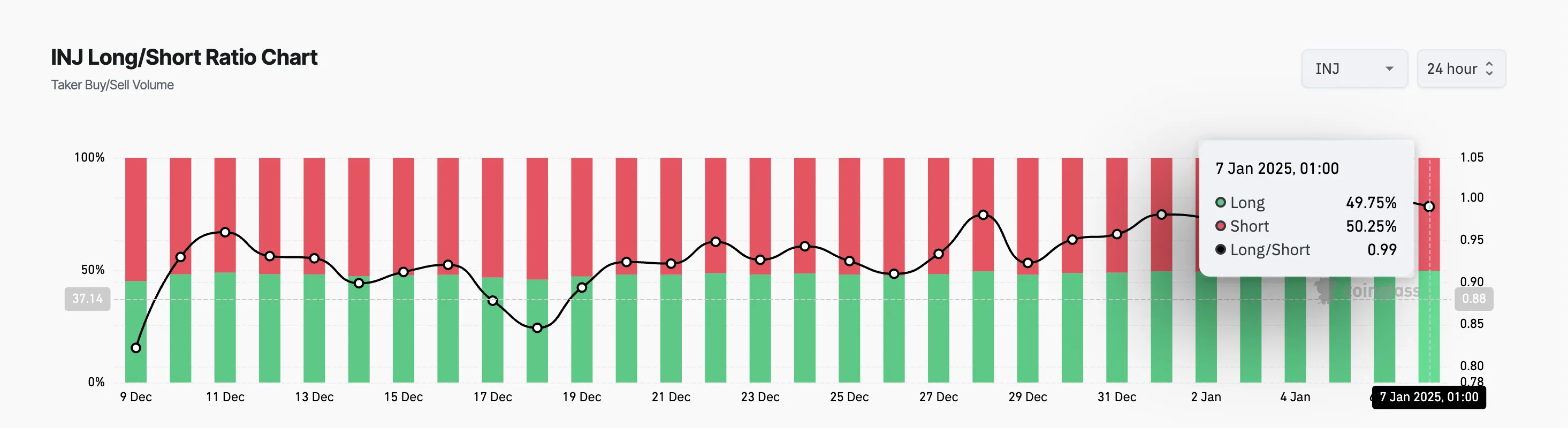

The optimistic hype round this improve is at present driving the INJ value rally, whose worth has risen by 18% prior to now two days. Apparently, regardless of this, the token’s futures merchants stay unimpressed and have continued to demand extra quick positions. That is mirrored by INJ’s Lengthy/Quick Ratio, which is 0.99 at press time.

This ratio compares the variety of lengthy positions (bets that the worth will rise) to quick positions (bets that the worth will fall) in a market. When the ratio is under 1, it signifies that there are extra quick positions than lengthy positions, suggesting a bearish sentiment amongst merchants.

Rising Demand for INJ Places Quick Merchants at Threat

Nevertheless, with rising demand for INJ, these merchants are liable to a possible quick squeeze. A brief squeeze happens when a shorted asset experiences a value enhance, forcing quick sellers to purchase again their positions to restrict losses. This shopping for strain can drive the worth even increased, making a suggestions loop that accelerates the upward pattern.

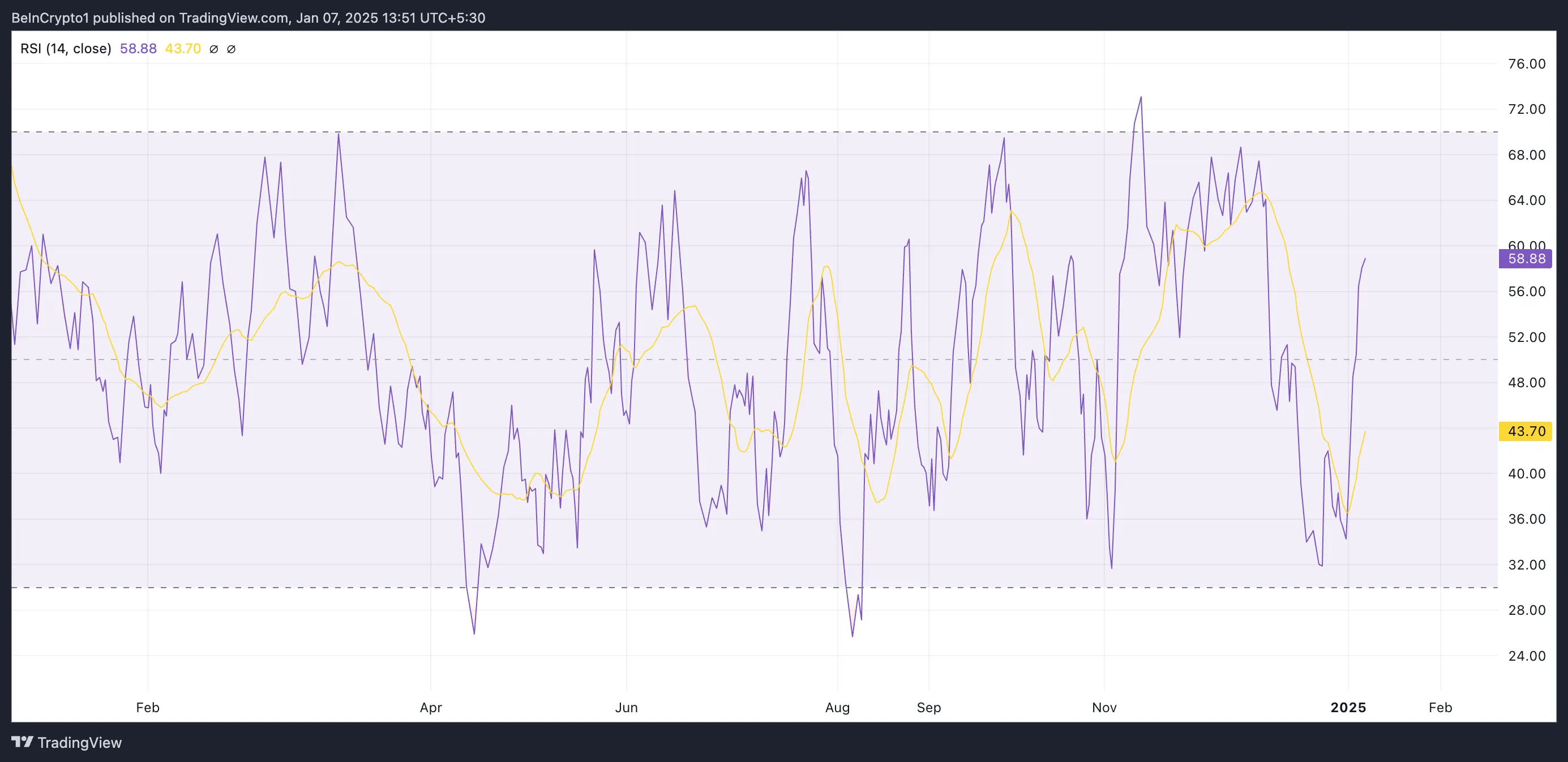

INJ’s rising Relative Power Index (RSI) is worthy of observe right here. At press time, this momentum indicator is in an uptrend at 58.88.

The RSI indicator measures an asset’s oversold and overbought market situations. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a correction. However, values underneath 30 point out that the asset is oversold and will witness a rebound.

At 58.88, INJ’s RSI signifies that the asset is in a impartial to barely bullish zone. Value momentum exhibits extra shopping for than promoting strain however will not be but overbought.

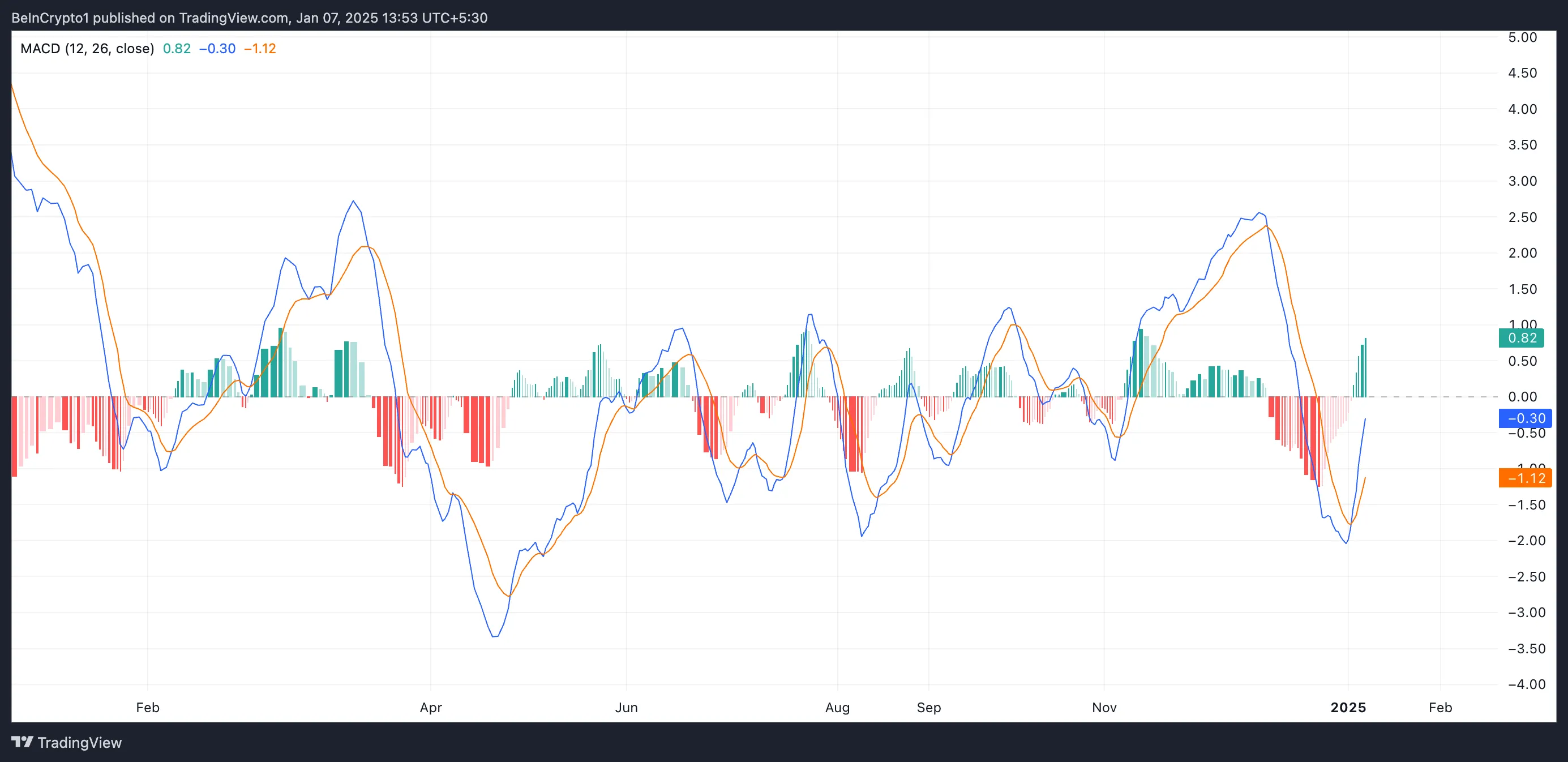

Additional, readings from INJ’s Shifting Common Convergence Divergence (MACD) indicator help this bullish outlook. At press time, the token’s MACD line (blue) rests above its sign line (orange).

When this indicator is ready up this fashion, it signifies bullish momentum. Which means if the pattern persists, the Injective token value might proceed to rise.

INJ Value Prediction: Can Momentum Push the Value Above $30?

As shopping for strain climbs, INJ’s value might breach the resistance fashioned at $28.72. If the bulls can maintain this momentum, INJ might rally again above $30 and revisit its multi-month excessive of $35.26.

However, if the quick bets win and the Injective token value reverses its present pattern, it might plummet to $24.44.

Disclaimer

According to the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.