MicroStrategy’s govt chairman, Michael Saylor, mentioned the agency bought 258,320 BTC at a complete price of $22.07 billion, which equates to a mean worth of $85,450 per Bitcoin.

The choice yielded outstanding returns for the corporate, leading to a BTC annual yield of 74.3%. This enhanced shareholder worth by $14.06 billion, translating to roughly $38.5 million day by day positive aspects.

The corporate’s technique, which includes modern financing via Bitcoin-backed inventory gross sales, displays its proactive stance on crypto investments. In the meantime, this marks the agency’s most important annual acquisition because it embraced a Bitcoin-focused method in 2020.

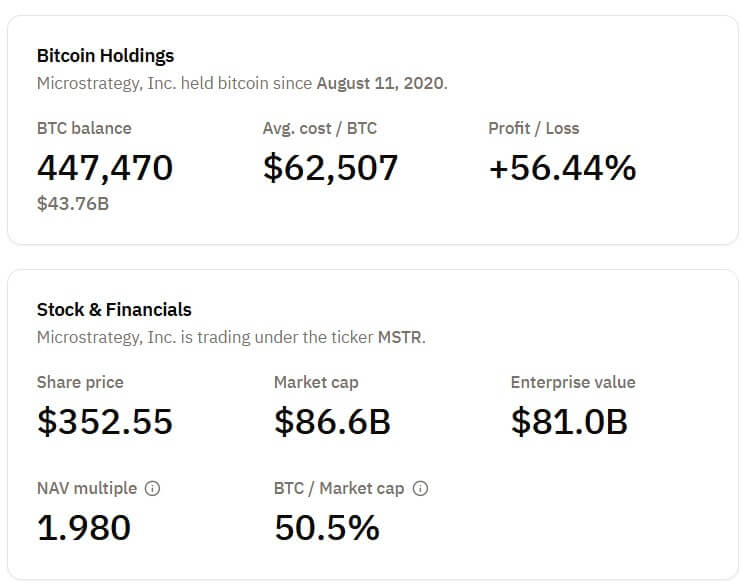

As of Dec. 31, 2024, MicroStrategy owned 447,470 BTC, which solidifies its place as the most important company Bitcoin holder. These property have been acquired at a complete price of $27.97 billion however now exceed $43 billion in present market worth, in line with Bitcoin Treasuries knowledge.

Notably, its Bitcoin holdings valuation equates to greater than 50% of the corporate’s close to $87 billion valuation.