Shiba Inu (SHIB) has surged almost 14% prior to now week, bringing its market cap to $14 billion and solidifying its spot because the second-largest meme coin after DOGE. Whereas the current rally indicators energy, SHIB’s RSI signifies a reasonable bullish part, leaving room for extra features if momentum builds additional.

The ADX exhibits SHIB continues to be in an uptrend, however weakening as promoting stress grows. A possible golden cross might drive SHIB to check resistance ranges for additional upside. Nevertheless, dropping momentum would possibly result in a correction towards key help ranges.

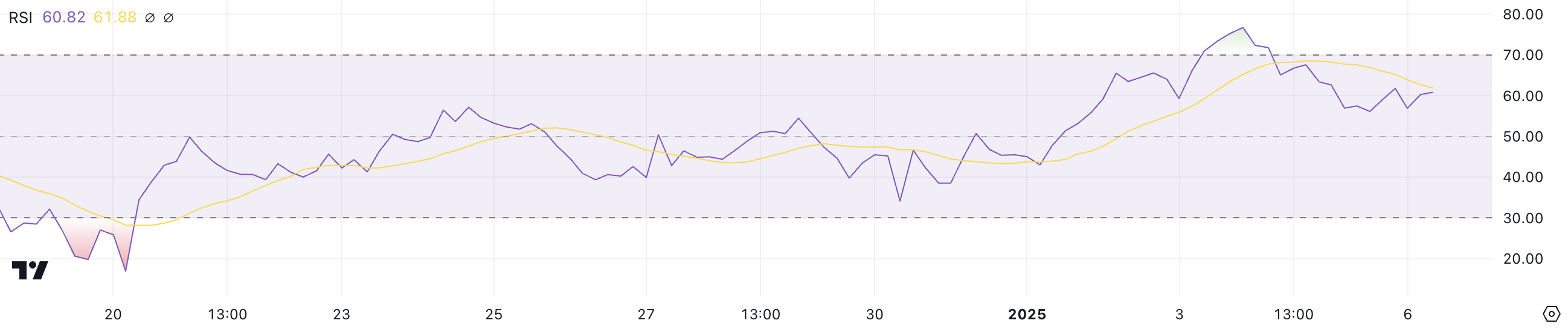

Shiba Inu RSI Is Down After Touching 76

Shiba Inu Relative Energy Index (RSI) is presently at 60.8, recovering from its dip to 56 on January 5 after peaking at 76 on January 3. The RSI is a momentum indicator that measures the velocity and magnitude of value actions on a scale from 0 to 100.

Readings above 70 point out overbought circumstances, typically signaling a possible pullback, whereas readings beneath 30 recommend oversold circumstances and the potential for a value rebound.

At its present degree, SHIB RSI signifies a bullish part however stays beneath the overbought zone, suggesting room for additional value appreciation.

This positioning displays reasonable shopping for stress, indicating potential short-term features if the RSI rises nearer to 70. Nevertheless, if the RSI begins to drop once more, it might sign waning momentum and the potential for consolidation or a retracement in value.

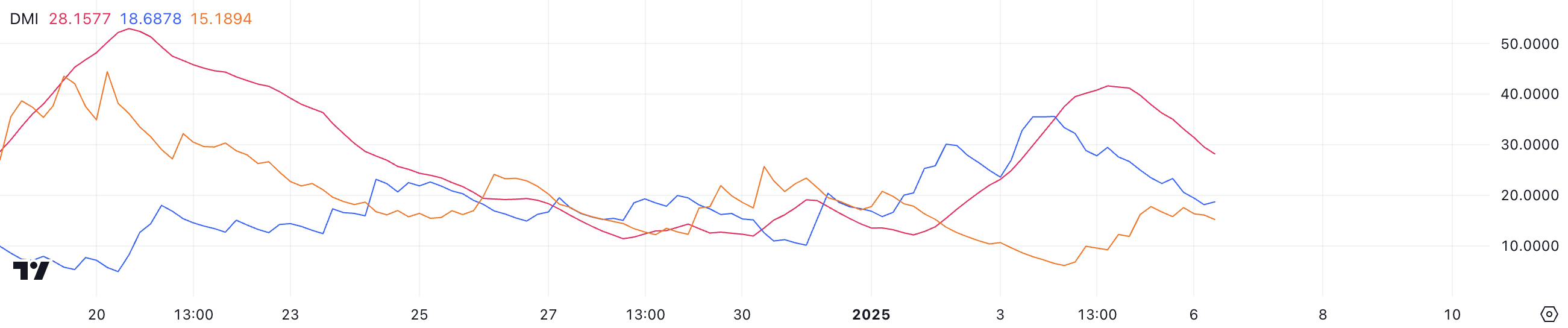

SHIB DMI Exhibits the Uptrend Is Nonetheless Robust

SHIB’s Common Directional Index (ADX) presently stands at 28.1, down considerably from 41.6 simply two days in the past. The ADX measures the energy of a development on a scale of 0 to 100, with values above 25 indicating a powerful development and values beneath 20 signaling weak or absent momentum.

Regardless of the decline, the ADX stays above 25, suggesting that Shiba Inu continues to be in an uptrend, although the energy of this development has diminished.

The directional indicators present extra perception into SHIB momentum. The +DI, representing shopping for stress, has dropped to 18.6 from 35 three days in the past, reflecting diminished bullish exercise. In the meantime, the -DI, which signifies promoting stress, has risen to fifteen.1 from 6.4 over the identical interval, highlighting a rising bearish sentiment.

This shift means that whereas the uptrend persists, the steadiness of energy is shifting, with sellers gaining floor. If this development continues, SHIB’s value might face consolidation or perhaps a reversal except shopping for stress regains dominance.

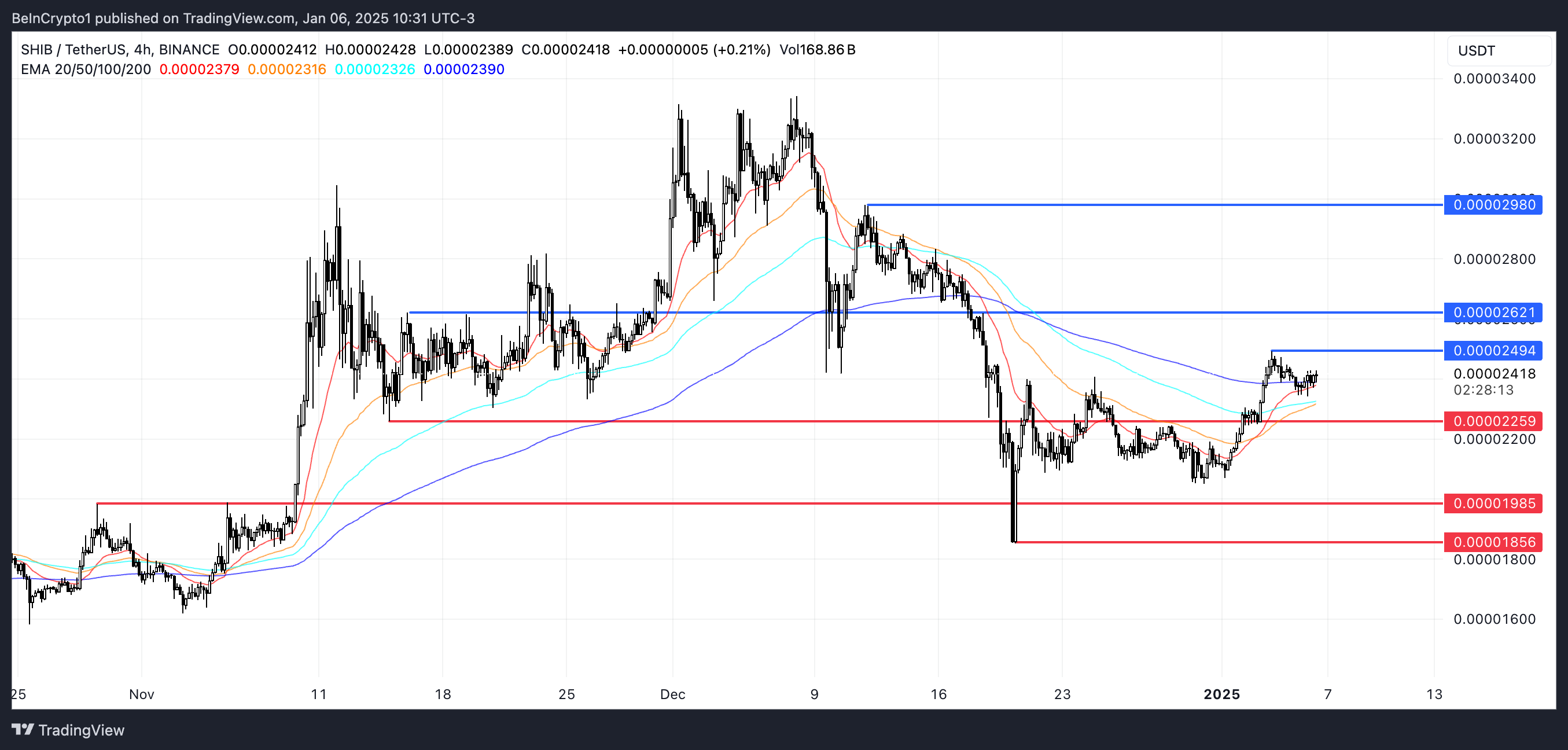

SHIB Value Prediction: A Potential 23% Surge

Shiba Inu EMA traces point out {that a} golden cross could also be on the horizon, because the shortest-term EMA is approaching a crossover above the longest-term EMA. This potential bullish sign might reignite shopping for momentum, permitting SHIB to check the resistance at $0.0000249.

If this degree is damaged, SHIB value might proceed its upward trajectory, concentrating on $0.000026 and probably $0.0000298, representing a potential 23.6% upside.

Nevertheless, if the golden cross fails to materialize and the development reverses, as steered by the weakening DMI, SHIB might face draw back dangers. The primary important help lies at $0.000022, and a break beneath this degree might speed up promoting stress.

In such a situation, SHIB value would possibly decline additional to check $0.0000198 and even $0.0000185, marking a big correction in its value.

Disclaimer

Consistent with the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.