A prime govt of the most important cryptocurrency index fund agency expressed optimism concerning the affect on financial insurance policies on the digital asset sector upon the official return of Donald Trump to the White Home this month.

Bitwise Asset Administration CEO Hunter Horsley just lately offered fascinating insights on how the Trump administration might remodel the cryptocurrency business.

Deregulation Of M&As

Horsley believes that the insurance policies to be carried out by the incoming Trump administration might propel the cryptocurrency sector to new heights, particularly liberalizing mergers and acquisitions, saying that it might permit main American firms to broaden their enterprise additional via strategic acquisitions.

The Bitwise CEO thinks President-elect Trump would possibly “unfreeze” mergers and acquisitions, a welcome growth for the nation’s main firms to boost their enterprise foothold.

“Massive corporates — magazine 7, and so forth — could lastly be capable to wield their market cap,” Horsley mentioned.

He famous that for instance, retail big Amazon might purchase Instacart, or search engine powerhouse Google might buy Uber, saying, “The massive could get larger, and the center could shrink.”

Trump administration could unfreeze M&A.

Massive corporates — magazine 7, and so forth — could lastly be capable to wield their market cap. Amazon might purchase Instacart. Google might purchase Uber. and so forth and so forth

The massive could get larger, and the center could shrink.

If that occurs, I believe it’ll speed up…

— Hunter Horsley (@HHorsley) January 5, 2025

Accelerating Cryptocurrency

Horsley advised that permitting main US firms to make strategic acquisitions might gasoline the adoption of decentralized programs, benefiting the cryptocurrency panorama.

“If that occurs, I believe it’ll speed up crypto,” Horsley mentioned in a put up.

The crypto index fund govt believes if massive companies accumulate extra management, the demand for cryptocurrencies would possibly soar as a result of digital belongings function an alternative choice to these establishments.

“The conceptual premise of crypto will not be trusting massive establishments to do what’s in your greatest curiosity. The massive getting larger accentuates this,” he claimed in an X put up.

BTC market cap at present at $2.02 trillion. Chart: TradingView.com

Business Leaders Adopting Crypto

Many analysts noticed that blockchain know-how and digital belongings are capturing the eye of business giants like Amazon and Google who’re discovering alternatives to change into a part of the cryptocurrency markets.

For instance, Amazon Internet Providers launched Amazon Managed Blockchain, the retail big’s personal blockchain-related service. It permits firms to create and handle scalable blockchain networks, turning Amazon into a significant participant within the blockchain market.

Strategic Partnerships

In the meantime, Google has established strategic alliances with key blockchain initiatives and joined campaigns that push for the mixing of blockchain know-how into its cloud infrastructure, growing the search engine’s footprint within the cryptocurrency sector.

On Google Cloud, companies can now discover blockchain-as-a-service which provides them the chance to create and implement decentralized apps.

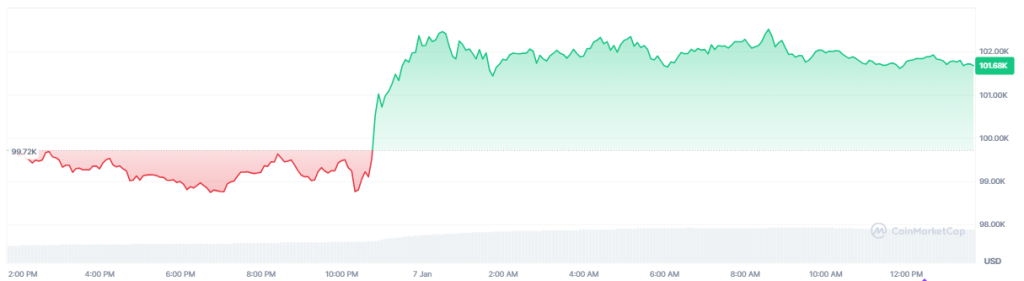

Bitcoin worth breaking the $100k degree immediately. Supply: CoinMarketCap

Horsley’s assertion is well timed because the cryptocurrency market is at present having fun with a optimistic outlook introduced by Trump who’s perceived to be pro-crypto.

Trump’s election victory fuels the expansion of the digital asset market whereby traders noticed Bitcoin surpass the $100,000 degree in early December, from about $69,000 in early November.

Featured picture from Fox Information Screengrab/AsiaTimes, chart from TradingView