- Worry and greed index, when hitting excessive ranges, have traditionally triggered corrections.

- Bitcoin’s resilience regardless of these alerts hints at a shift in sentiment.

Only a week into the brand new 12 months, Bitcoin [BTC] has already entered the greed part. After an enormous 121% return in 2024, there’s little doubt buyers are eyeing a fair greater cycle forward.

However maintain on – let’s not get forward of ourselves. The crypto market isn’t any stranger to volatility, and the ‘danger’ of investing in crypto nonetheless looms giant.

So, as we head into a brand new week, what do the on-chain information say? Will BTC proceed its upward momentum, or are we in for a pullback?

Bitcoin worry and greed index exhibits an uncommon anomaly

In 2024, Bitcoin’s worry and greed index reached excessive ranges twice, every time marking a peak adopted by a pointy correction.

The primary occasion occurred when BTC hit $73,000 in March, its earlier all-time excessive. Excessive greed took over, with buyers chasing huge returns. Nonetheless, a slight market shift triggered panic promoting, inflicting BTC to drop to $65,000 in lower than per week.

Quick-forward to This autumn and one thing stunning occurred on the twenty second of November.

Supply: CoinMarketCap

For 2 weeks, the worry and greed index flashed “inexperienced” as Bitcoin approached six figures, however the market didn’t hit a ceiling. As an alternative, BTC defied expectations and surged to a brand new all-time excessive of $108,000.

What occurred? Regardless of on-chain information—comparable to a peaking RSI, bearish MACD, and an overheated greed index—indicating a possible market correction, Bitcoin continued to climb.

AMBCrypto investigated and located a key purpose for this anomaly: BTC ETFs and company holdings. For fourteen straight days, ETFs skilled fixed inflows, whereas MicroStrategy (MSTR) made its largest buy but, buying 55,000 BTC.

This might mark a turning level. Why? Subsequent time the worry and greed index spikes and the market overheats, an analogous shopping for frenzy from ETFs and establishments may stop a correction. As an alternative, it may set BTC up for its subsequent breakthrough.

However, what’s Bitcoin’s subsequent goal?

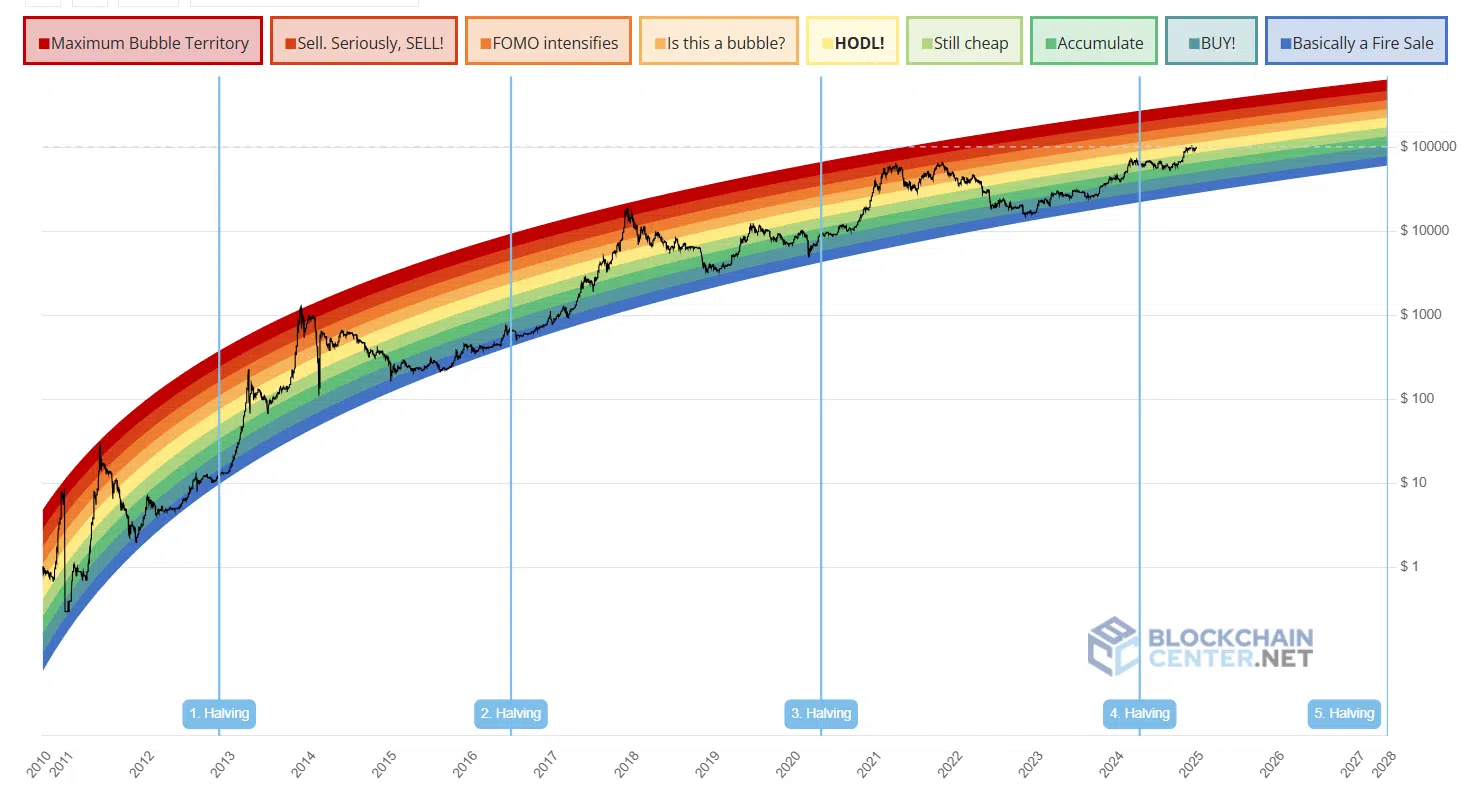

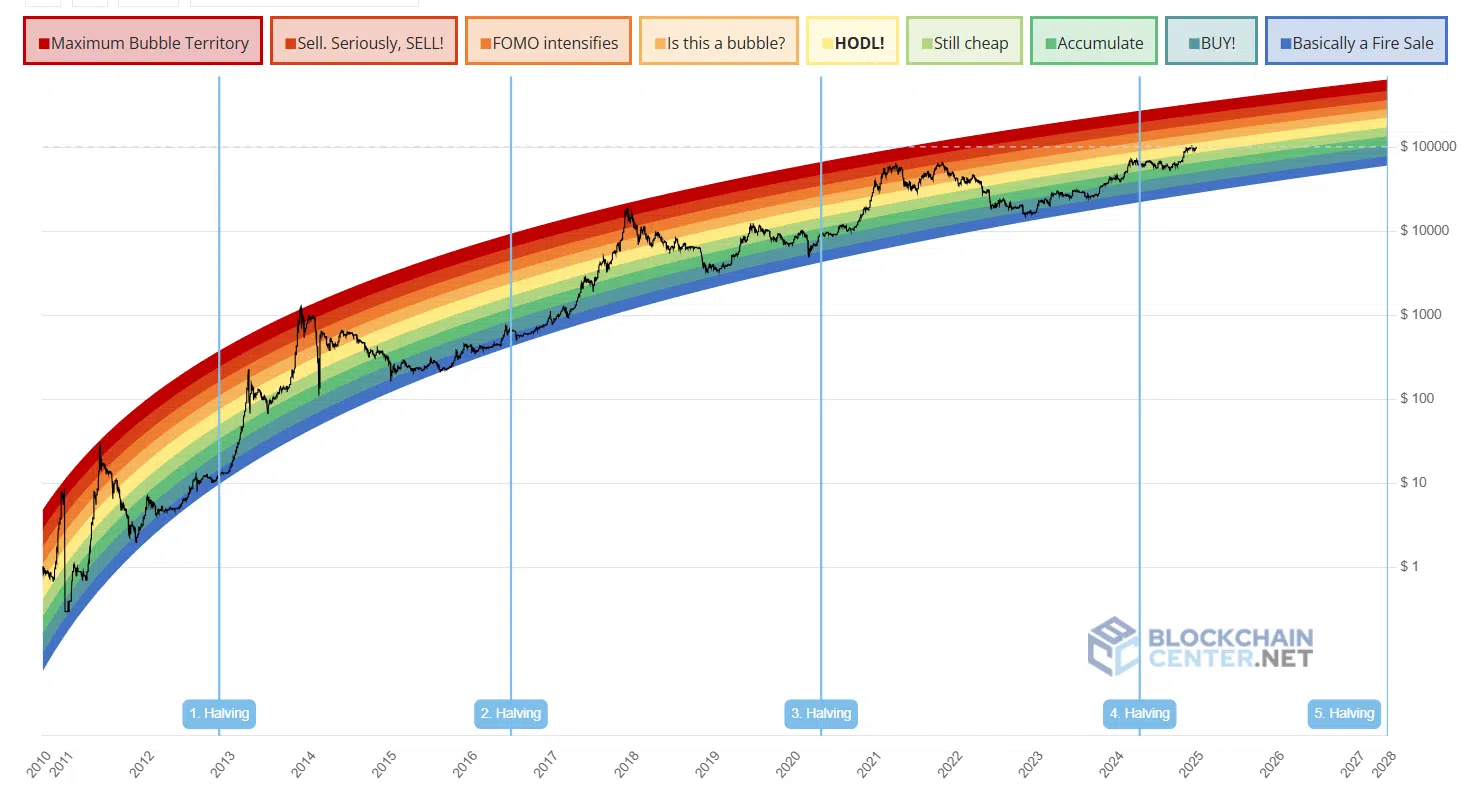

Bitcoin has formally damaged out of the “nonetheless low cost” zone on the Rainbow Chart, reflecting its spectacular rise to $101K.

Lengthy-term holders who began accumulating at $60K are reaping the rewards, sitting on important unrealized income. The market’s focus is shifting towards HODLing.

Supply: BlockChainCenter

However right here’s the place it will get attention-grabbing: this part is make or break for Bitcoin. Traditionally, the trail forward from right here may both be explosive or a pointy pullback.

Bear in mind again in March? Bitcoin entered an analogous HODL part, solely to expertise a ‘crash’ when HODLers prioritized short-term positive aspects.

Learn Bitcoin’s [BTC] Value Prediction 2025-26

Nonetheless, with the market panorama shifting – because of huge company buys and a gentle rise in BTC ETFs – the outlook has utterly modified.

The worry and greed index is exhibiting extra stability than earlier than, making it seemingly that this time, HODLing will win out. All indicators are pointing to a possible new all-time excessive for Bitcoin this week.