Bitcoin (BTC) has dropped 5.5% prior to now 24 hours, falling under the $100,000 mark, regardless of a 38% surge in buying and selling quantity to $67 billion. The decline stems from bearish indicators in key metrics, together with the 7-day MVRV Ratio and heightened whale exercise, each indicating mounting promoting stress.

Whereas BTC’s EMA traces preserve a bullish outlook, a fast decline in short-term EMAs suggests a possible bearish reversal if a dying cross happens. The following few days will likely be pivotal as BTC approaches essential assist and resistance ranges, which may form its subsequent directional transfer.

MVRV Ratio Reveals BTC Might Proceed Dropping

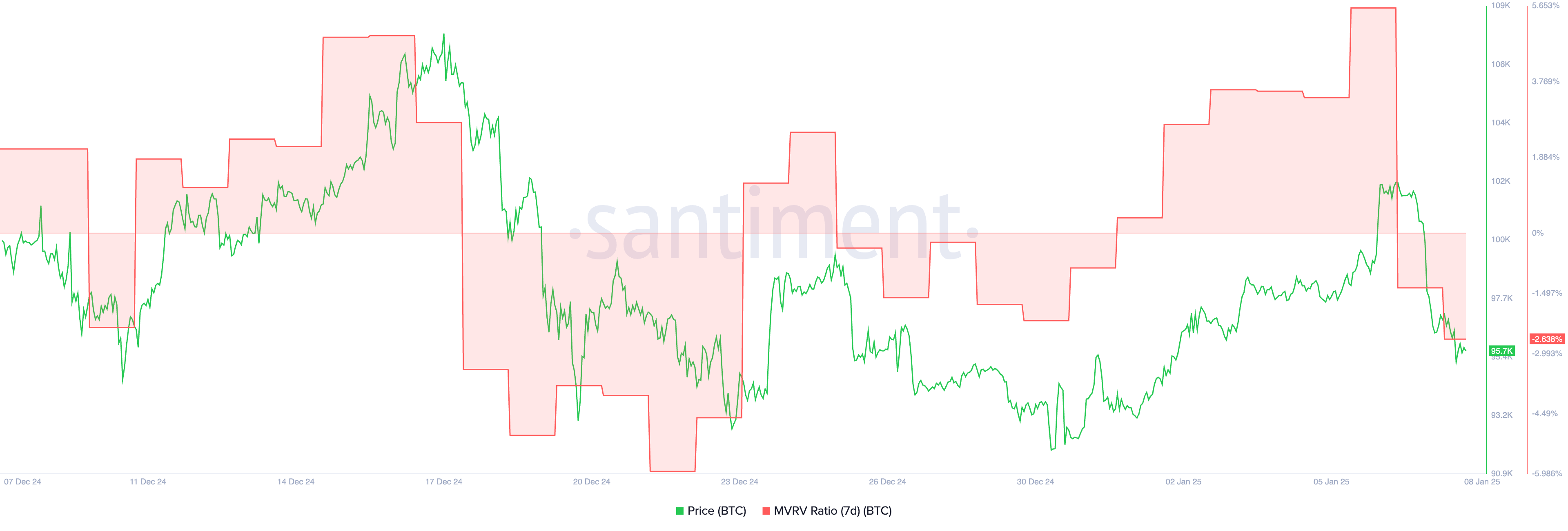

The 7-day Market Worth to Realized Worth (MVRV) Ratio for Bitcoin is presently at -2.63%, a big drop from 5.6% recorded two days in the past. The MVRV Ratio measures whether or not BTC holders are in revenue or loss by evaluating the market worth (present value) to the realized worth (common buy value).

Unfavourable MVRV values, like the present one, point out that, on common, BTC holders are in a loss place, doubtlessly signaling a interval of market capitulation or undervaluation.

Historic traits counsel that BTC’s 7D MVRV Ratio may decline additional to ranges round -5% or -6% earlier than a restoration begins, as noticed between December 20 and December 23.

If this sample repeats, BTC may expertise extra promoting stress within the brief time period, doubtlessly testing decrease assist ranges.

Bitcoin Whales Are Accumulating at a Sluggish Tempo

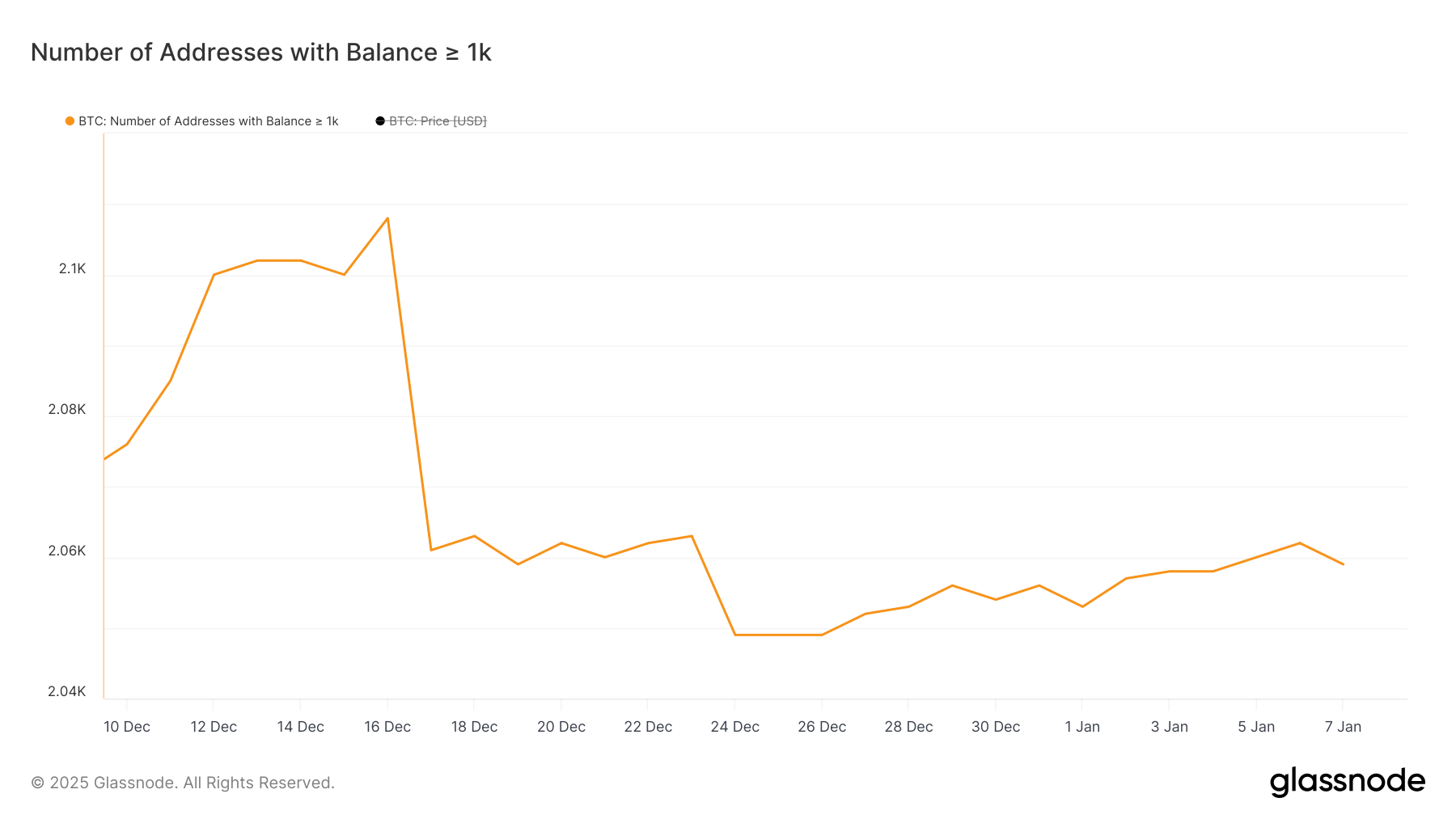

The variety of Bitcoin whales holding no less than 1,000 BTC reached a month-high of two,108 on December 16 earlier than sharply dropping to 2,061 simply someday later. Monitoring whale exercise is essential as a result of these giant holders can considerably affect the market by means of their shopping for or promoting habits.

When whale numbers decline, it typically signifies profit-taking or diminished confidence, which might apply downward stress on costs. Conversely, a rise in whale exercise usually displays accumulation, signaling confidence and doubtlessly supporting value stability or progress.

After reaching a month-low of two,049 between December 24 and December 26, the variety of Bitcoin whales has been recovering steadily, presently standing at 2,059 as of January 7. This gradual enhance suggests renewed accumulation by giant traders, a constructive signal for market sentiment.

The restoration from the lows may point out that whales are regaining confidence in BTC’s potential upside, though they aren’t accumulating BTC at a quick tempo, which may counsel they’re nonetheless ready to see the place BTC value goes.

BTC Worth Prediction: Can It Return to $100,000 Quickly?

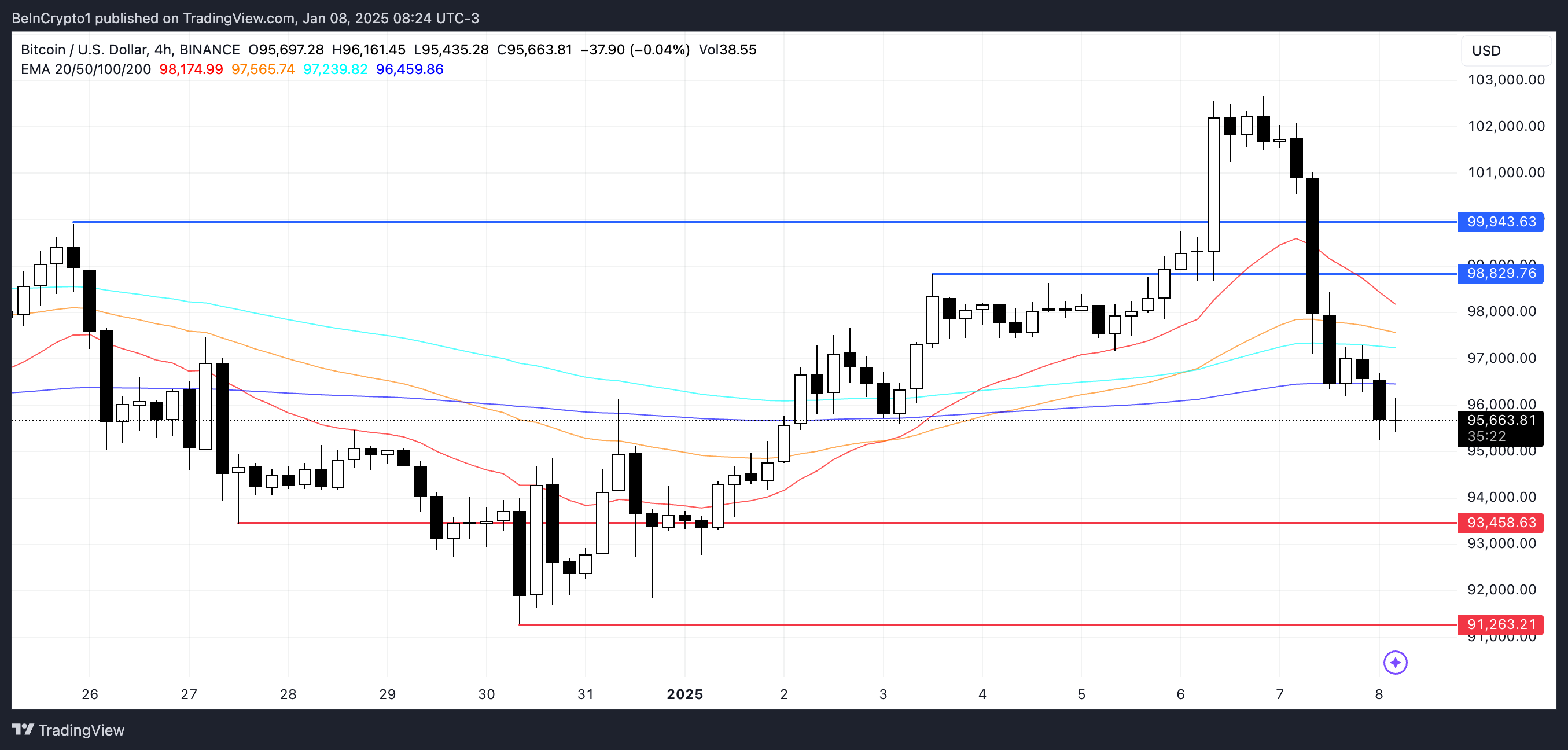

BTC EMA traces present that short-term EMAs are nonetheless above the long-term ones, sustaining a bullish construction. Nonetheless, the short-term traces are declining shortly, indicating weakening momentum.

If this pattern persists and a dying cross types— the place the short-term EMA crosses under the long-term EMA — it may sign a bearish reversal. On this situation, Bitcoin value may check assist at $93,400, and a break under this degree would possibly push the worth additional all the way down to $91,200.

Conversely, if the present downtrend is halted and bullish momentum returns, BTC value may check the resistance at $98,800. A profitable breakout above this degree would possibly pave the way in which for additional good points, with $99,900 as the following goal.

Ought to this momentum persist, BTC may goal to retest ranges round $102,000, signaling a possible restoration from its current decline. The end result relies upon closely on whether or not shopping for stress can counter the rising bearish indicators from the EMA traces.

Disclaimer

According to the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.