Within the final 24-hour interval, the cryptocurrency market has misplaced practically $240 billion from its market capitalization amid a major market drawdown that has been the value of bitcoin plunge from over $102,000 to $95,000 on the time of writing.

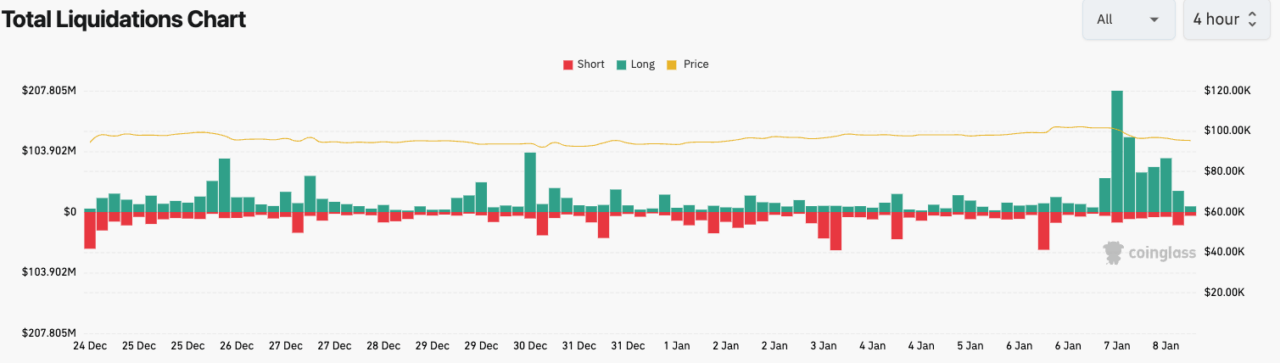

The market downturn has seen liquidations on centralized buying and selling platforms prime $700 million within the final 24-hour interval, in line with knowledge from CoinGlass, which exhibits $616 million of these liquidations had been from lengthy positions.

The latest drawdown has seen the value of varied main cryptocurrency plunge between 3.7% and 12%, with ADA enduring the most important drop among the many prime 10 cryptocurrencies by market capitalization.

Notably the drop has additionally affected conventional markets, with the S&P 500 dropping round 1.1% of its worth in yesterday’s session, whereas the NASDAQ went down by greater than 1.8%.

Gold, the valuable metallic bitcoin is commonly in comparison with a digital model of, rose amid the uncertainty. The dear metallic is up by round 0.55% during the last 24-hour interval to now commerce at $2,664.

Treasury yields have in the meantime risen considerably, with the rate of interest on the U.S. 10-year Treasury surging by round 5 foundation factors t0 now stand at 4.683%. The drawdown got here as job openings within the U.S. rose greater than anticipated in November in a possible signal the labor market is tightening.

The house’s complete market capitalization is now round $3.33 trillion after dropping by greater than 6% within the final 24 hours.

Featured picture through Pexels.