- The Fed and crypto are at odds once more, with the Fed sticking to its no-rate-cut stance.

- Now, all eyes are on the crypto market: Will it emerge as a protected haven, or will it dip even deeper?

It’s solely the second week of 2025, and the strain between the Fed and the crypto market is already heating up. With volatility on the rise, Bitcoin [BTC] is dealing with challenges it has struggled with since day one.

After 15 years, the crypto market continues to be preventing to be acknowledged as a steady retailer of worth. AMBCrypto warns that this problem will solely develop as we transfer additional into this risky yr.

The Fed’s ‘cautious’ method

In lower than a month, the crypto market has seen two massive shake-offs, each linked to the Fed’s strikes on the U.S. financial system.

It’s no shock this has led many to ask: Is the Fed influencing the market, particularly when every transfer traces up with Bitcoin hitting key ranges? With such placing similarities, it’s onerous to not surprise.

What’s clear, although, is the impression. In simply two days, the crypto market cap fell from $3.60 trillion to $3.34 trillion – a 7.22% drop.

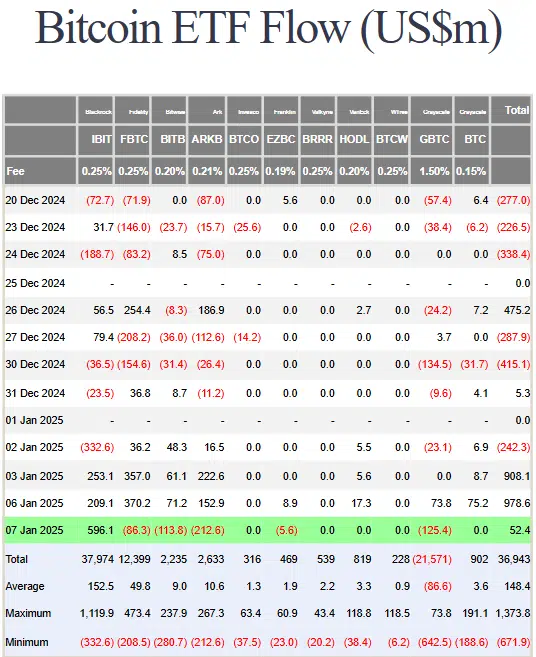

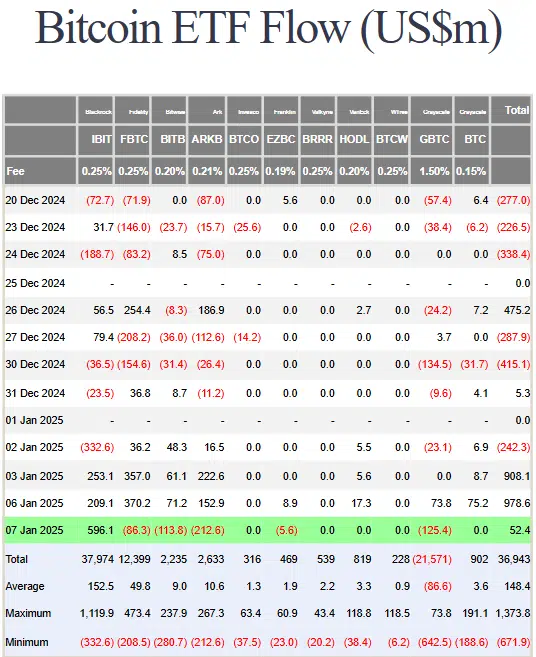

And it may not cease there. Regardless of a large $1.2 billion flowing into BTC ETFs during the last three days, Bitcoin nonetheless took a close to 6% dip in a single buying and selling day – a transparent proof of the stress the crypto market is below.

Supply: Farside Traders

So, what’s subsequent? All of us noticed how the crypto market ended This fall, with Bitcoin dipping beneath $92K, regardless of all the excitement across the “Santa Claus” rally and New Yr optimism.

An analogous sample may unfold in 2025. Even with the approaching inauguration of Trump, a bull run appears unsure. The stakes are increased than ever, and it’s anybody’s guess how the market will play out.

Nonetheless, there’s a glimmer of hope: Can crypto bounce again?

No shock – the Trump commerce is without doubt one of the few playing cards left for crypto to bounce again, and probably essentially the most helpful. But it surely’s not with out dangers.

Trump’s historical past of daring strikes, like China tariffs and difficult sanctions, makes it onerous to say if his guarantees to show the U.S. right into a crypto hub will truly occur.

On prime of that, the mounting debt disaster means the federal government could flip to bonds for funding, making it even tougher for the Fed to chop charges.

So, what’s the hope?

Learn Bitcoin’s [BTC] Worth Prediction 2025-26

Both institutional traders will set off a large provide shock, or Trump will ship on his guarantees to chop taxes, slash rules, and increase wages, doubtlessly sparking a retail funding surge into crypto.

If not, we find yourself with a ‘purchase the rumor, promote the information’ scenario. In truth, 2025 may bury crypto’s ‘retailer of worth’ standing even deeper. All eyes are on the Fed now – watch the U.S. financial calendar carefully.