Bitcoin’s value dropped sharply beneath $95,000 on Jan. 8, erasing beneficial properties made earlier within the week when it briefly surpassed $100,000.

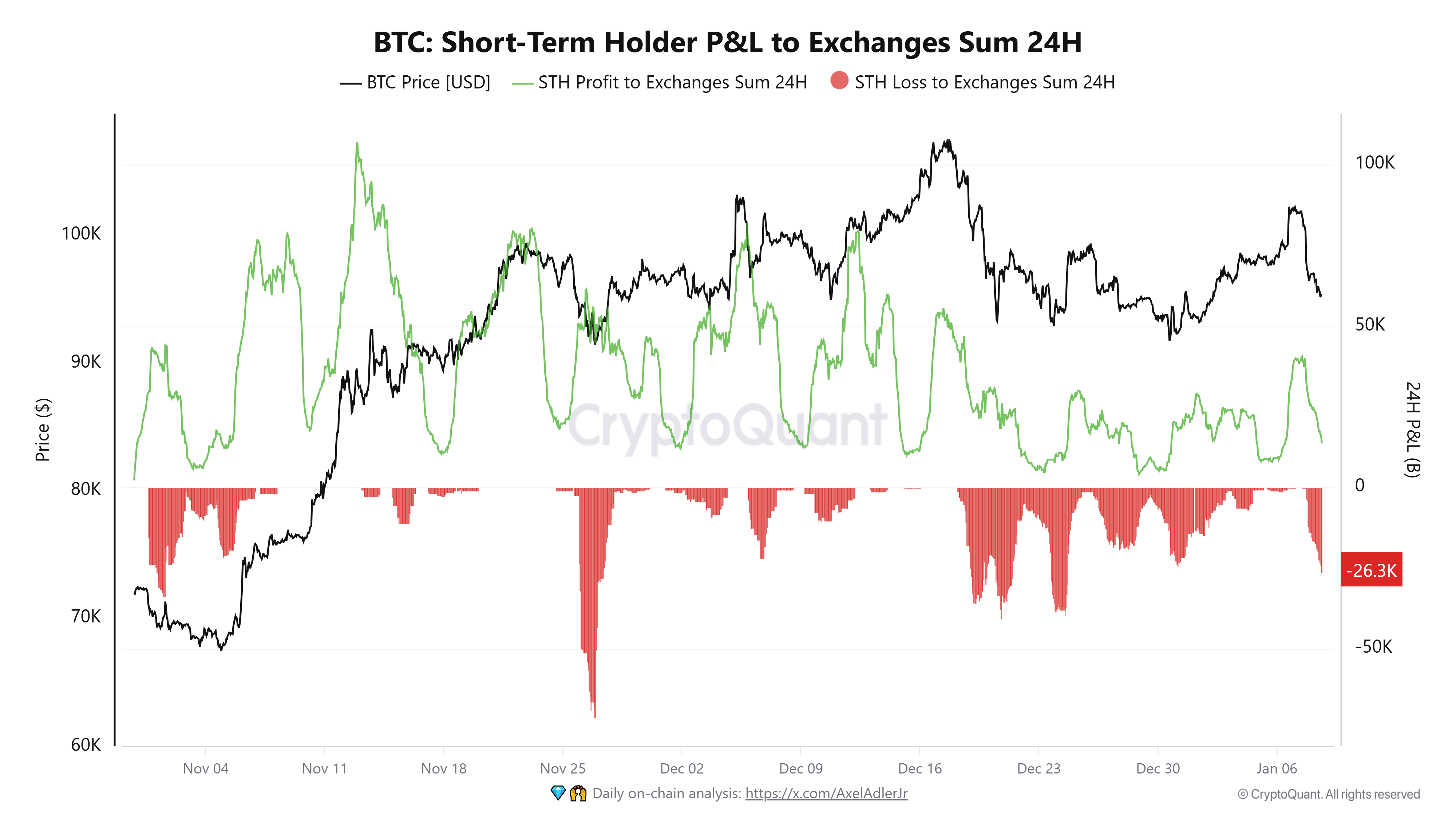

Knowledge from CryptoQuant reveals that short-term holders (STHs)—traders holding Bitcoin for lower than 155 days—had been key gamers on this sell-off. Over 26,000 BTC valued at greater than $2.4 billion had been moved to exchanges at a loss.

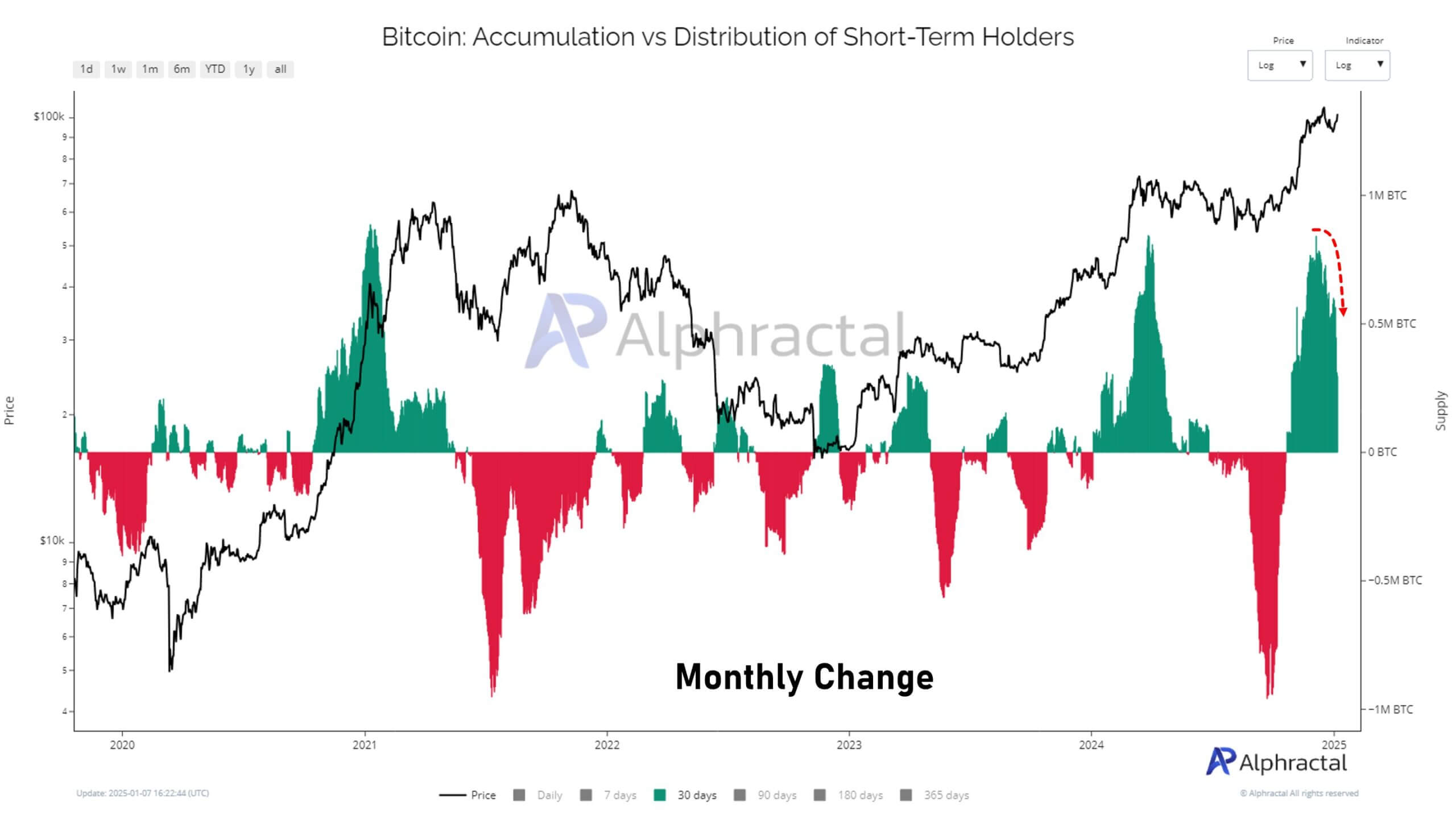

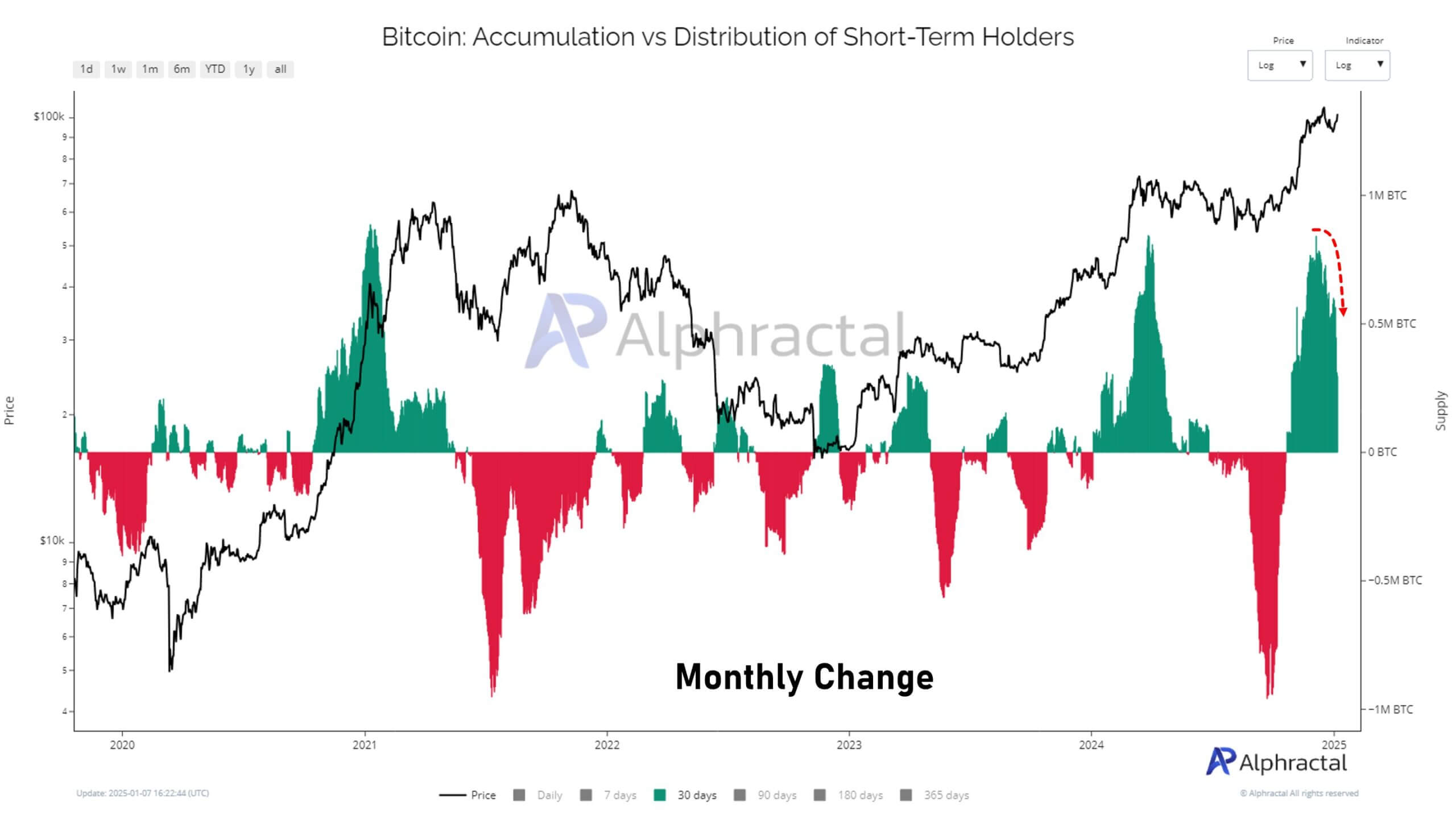

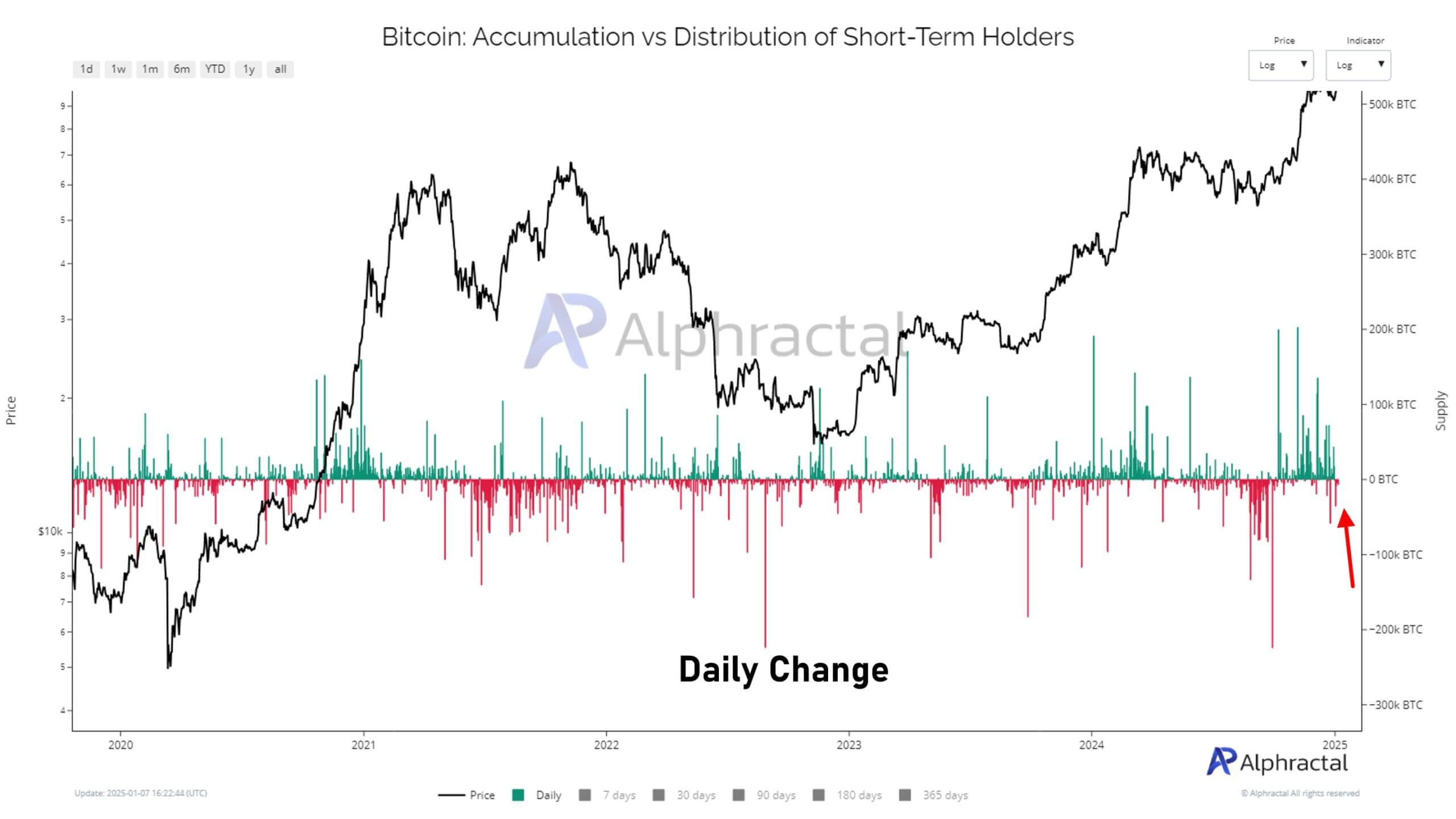

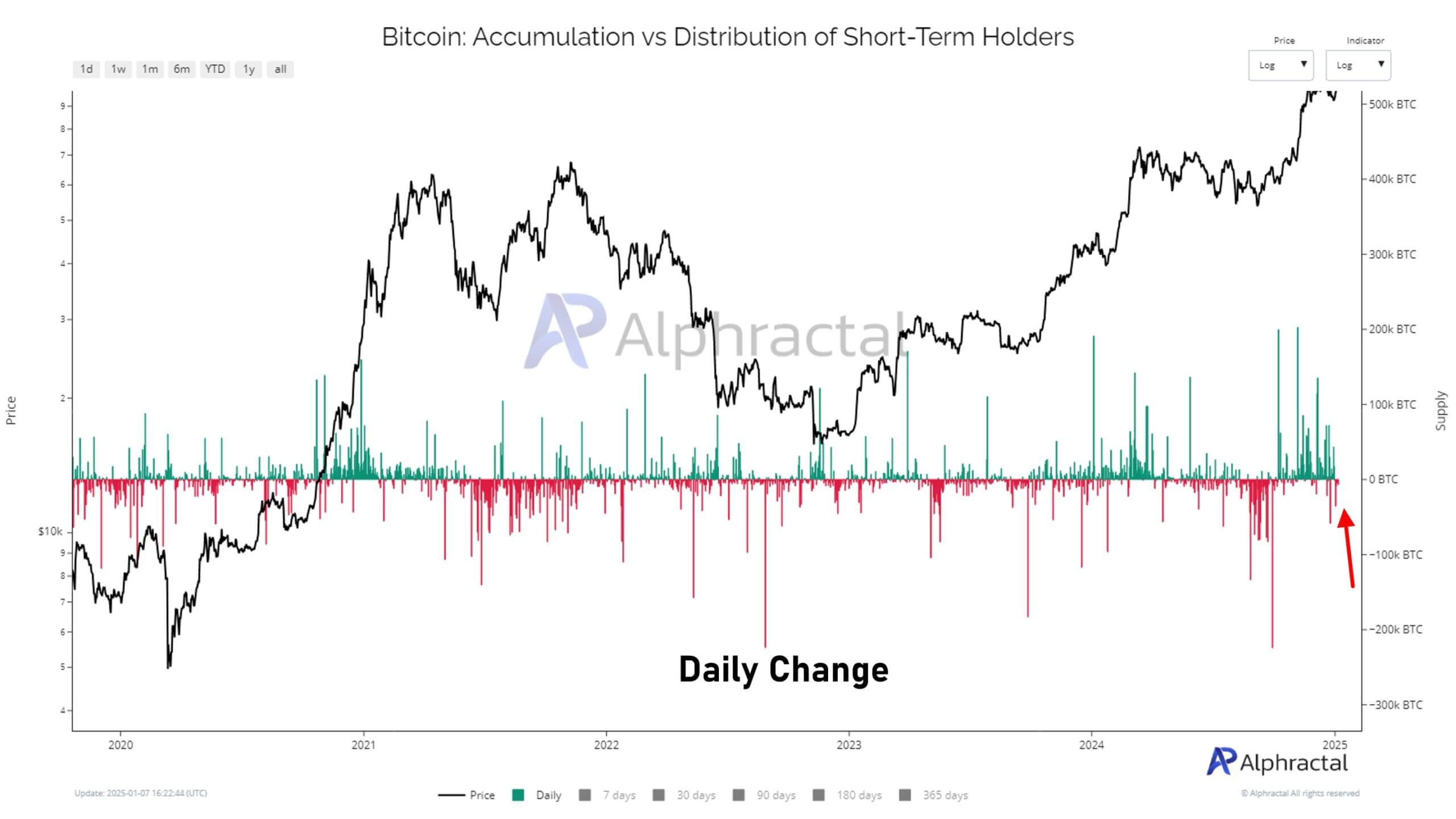

In the meantime, additional evaluation from Alphractal confirmed that this wave of promoting strain coincides with a broader decline in accumulation tendencies amongst this cohort of traders.

In line with the agency, the “Accumulation vs. Distribution of STH” metric reveals that STHs have a rising choice for liquidating reasonably than accumulating their BTC holdings.

Moreover, STH accumulation has steadily declined since Dec. 5. This weakening demand from these traders aligns with Bitcoin’s current value unstable actions, demonstrating how their actions can considerably affect market tendencies.