Celestia’s (TIA) value has fallen sharply, dropping greater than 15% within the final 24 hours and nearly 40% over the previous 30 days. Its market cap is now $2.2 billion, and this decline comes as bearish alerts dominate technical indicators, together with a just lately shaped demise cross that implies the potential for additional draw back.

Whereas TIA holds the above key help at $4.54, the general market sentiment stays detrimental. A restoration would require breaking by resistance at $5.50, however present tendencies point out sellers are firmly in management.

TIA Downtrend Is Getting Stronger

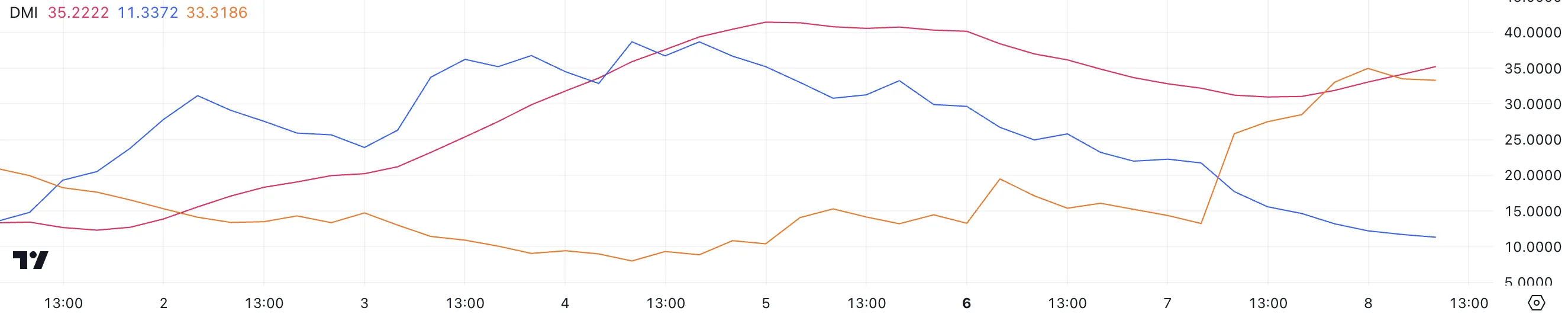

The Common Directional Index (ADX) for TIA at the moment stands at 35.2, rising from 31.2 simply someday in the past, signaling a strengthening development. The ADX measures the power of a development, whether or not bullish or bearish, on a scale from 0 to 100, with values above 25 indicating a powerful development and beneath 20 reflecting weak or absent momentum.

The rising ADX confirms that TIA’s present downtrend is gaining traction, highlighting elevated promoting stress available in the market.

The directional indicators present additional perception into the development’s dynamics. The +DI, which represents shopping for stress, has fallen sharply from 22.2 to 11.3, reflecting a major weakening of bullish momentum. In the meantime, the -DI, indicating promoting stress, has surged from 14.3 to 33.3, signaling rising bearish exercise.

This mix of declining +DI and rising -DI confirms that sellers are firmly in management. This implies that Celestia value might proceed to face downward stress except shopping for curiosity resurges to counteract the bearish momentum.

Ichimoku Cloud Reveals a Bearish Momentum for Celestia

Ichimoku Cloud exhibits TIA value dropped effectively beneath the cloud, indicating a powerful downtrend. The pink cloud (Senkou Span A and Senkou Span B) additional displays resistance overhead, as its slope is flat however nonetheless positioned above the value, suggesting no quick reversal in sentiment.

The blue line (Tenkan-sen) and the orange line (Kijun-sen) have diverged, with the blue line beneath the orange, confirming the bearish momentum.

Moreover, the inexperienced lagging span (Chikou Span) is located beneath the cloud and value, reinforcing the downtrend and the dominance of bearish sentiment within the present market setup. For any indicators of restoration, TIA would want to interrupt again into the cloud, which seems unlikely based mostly on present indicators.

TIA Worth Prediction: Will It Check $4.10 Quickly?

The current formation of a demise cross for Celestia has intensified its bearish momentum, inflicting extra value declines. A demise cross happens when a short-term shifting common crosses beneath a long-term shifting common, signaling a possible shift right into a extra extended downtrend.

This technical growth means that bearish sentiment is at the moment dominant, including downward stress to TIA value motion.

Regardless of the bearish setup, TIA value nonetheless holds a essential help stage at $4.54. If this help is damaged, the value might proceed its descent towards $4.16, signaling a deeper correction.

Conversely, if TIA manages to get well and set up an uptrend, the value might purpose for its nearest robust resistance at $5.50.

Disclaimer

In step with the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.