In an interview with David Gura on Bloomberg Markets on Wednesday, outgoing Securities and Change Fee (SEC) Chair Gary Gensler reviewed his tenure and the function of crypto throughout the US capital markets. Gensler, who has lower than two weeks left in his time period, remained steadfast on his stance towards the digital asset area, calling it “rife with unhealthy actors” and stressing that “lots of them won’t survive.”

Crypto Is Nonetheless The ‘Wild West’

Gensler started by addressing the criticism he has confronted throughout his tenure. “It’s an amazing privilege to be in a task like this,” he stated, highlighting that he’s the thirty third SEC chair and credit President Joe Biden for the appointment. “You stroll into this central sq. and also you debate these essential issues for 330 million People,” he added.

Requested whether or not the extent of scrutiny he has skilled is completely different in comparison with his time as head of the Commodity Futures Buying and selling Fee (CFTC) through the international monetary disaster, Gensler acknowledged, “It does change.” Nonetheless, he maintained that the fee’s chief focus stays “looking for on a regular basis People, attempting to decrease the price of the markets […] It doesn’t shock me that there’s some in the course of the market who[…] may need ideas on that and object.”

Turning to crypto, Gensler echoed a theme he has repeatedly underscored since taking workplace: The digital asset trade accounts for lower than 1% of the US capital markets—he positioned the complete capital market at roughly “$120 trillion”—but it has demanded important SEC consideration.

He stood by his earlier “Wild West” depiction of crypto, declaring, “It’s a area that constructed up round non-compliance.” He additionally invoked the enforcement actions pursued below each his tenure and that of his predecessor, Jay Clayton. “Jay introduced 80 enforcement actions on this space. We’ve introduced in about 100 in our 4 years,” Gensler stated. “It’s possibly about 5% of what we do in our regulation enforcement,” he famous, explaining that the remaining 95% targets conventional scammers and fraudsters.

Highlighting how sentiment-based and risky the area is, Gensler divided the digital asset world into two elements: “This area, it’s rife with unhealthy actors. Let me simply cut up the sector into two only for a minute. The general public is aware of rather a lot about Bitcoin, which relying upon its market worth on any given day, is 2 thirds to 80% of the market worth of crypto. After which there’s every thing else. Or some individuals say Bitcoin and Ethereum and every thing else.”

He was blunt in his evaluation that the opposite “10,000 or 15,000” that are tasks with no fundamentals which solely revenue from sentiment shifts. “I’ve by no means seen a area that’s a lot wrapped up in sentiment and never a lot about fundamentals. And these 10,000 to fifteen,000 tasks, lots of them won’t survive. They’re like enterprise capital investments. They’re not going to outlive.”

Gensler additionally highlighted that there’s an enormous variety of “small pump and dump schemes”. Particularly referencing high-profile enforcement actions, Gensler said: “We’ve lived via just a few years the place, , they grew to become infamous, however they’re in jail. The Sam Bankman-Fried, the CZ’s and Do Kwon’s the place tens of billions of {dollars} had been misplaced by buyers.”

Gensler was additionally requested concerning the shift from his time at MIT—the place he studied digital belongings—to his enforcement-heavy method on the SEC. He addressed the general public notion that he could be a “champion” of crypto by noting the distinction between educational inquiry and regulatory tasks. “Once you’re in academia […] you may research one thing and observe it […] However then whenever you’re on this job […] constructing upon my predecessor[…] It’s a area rife with challenges and noncompliance with the securities legal guidelines.”

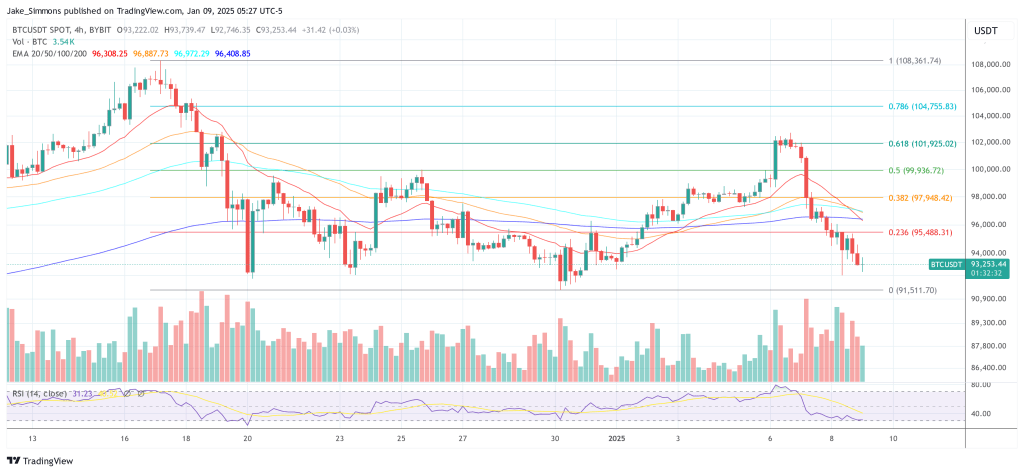

At press time, Bitcoin traded at $93,253.

Featured picture from YouTube, chart from TradingView.com