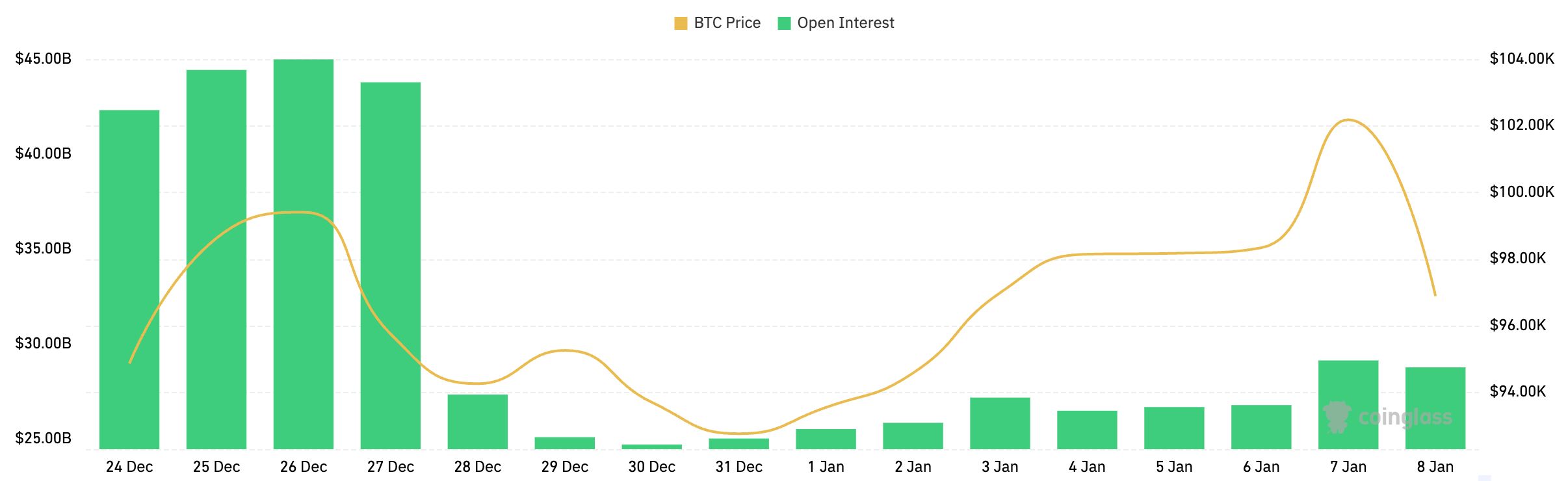

The Bitcoin choices market noticed vital volatility in December, as the entire open curiosity dropped from $44.99 billion to $29.13 billion between Dec. 26 and Jan. 7. This 35% decline marked one of many largest open curiosity flushes up to now 12 months, essentially altering the market’s positioning heading into 2025.

The first catalyst for this large unwinding was Bitcoin’s value volatility. After reaching $99,405 on Dec. 26, Bitcoin dropped sharply to $92,759 by Dec. 31, marking a 6.69% decline in simply 5 days. Whereas the 6.69% drop may not appear massive given Bitcoin’s historic volatility, the market has not too long ago turn out to be extremely delicate to drops beneath the psychological $100,000 degree. The velocity and magnitude of Bitcoin’s transfer doubtless triggered a cascade of place closures, affecting leveraged merchants who constructed up publicity in the course of the earlier rally above $100,000.

Nonetheless, information reveals that this value drop wasn’t only a bearish flip however a structural shift in how merchants method danger. Whereas open curiosity fell sharply, Bitcoin’s value recovered and even broke above $102,000 earlier than returning to $95,000. This divergence between recovering costs and diminished open curiosity signifies that merchants are extra cautious regardless of bullish value motion.

Information from CoinGlass confirmed calls represented 60.51% of open curiosity however solely 41.54% of buying and selling quantity, with places taking 58.46% of day by day quantity on Jan. 7. This distribution suggests merchants are sustaining their longer-term bullish positions whereas actively buying and selling places for cover, a notable change from mid-December when calls dominated each open curiosity and quantity.

The affect of December’s value volatility on choices positioning turns into much more obvious when inspecting market habits in the course of the decline. The sharp downward transfer benefited put holders and certain brought on vital losses for bare name sellers, resulting in place changes throughout the market. The common day by day value transfer of 1.56% throughout this era would have notably affected gamma publicity, forcing market makers to regulate their hedging positions extra regularly.

The mixture of diminished total publicity with elevated put buying and selling suggests subtle market individuals are implementing extra complicated methods relatively than taking pure directional bets. This habits is indicative of a maturing market the place danger administration takes priority over hypothesis.

As an alternative of aggressive leveraged bets, market individuals seem to make use of choices buildings providing outlined danger parameters. This method permits for upside participation whereas defending towards sharp reversals, a lesson doubtless realized from December’s volatility.

This market positioning reset may assist extra sustainable value appreciation in the long term. Nonetheless, regardless of decrease open curiosity, absolutely the degree of choices publicity nonetheless stays vital at over $29 billion. Because of this the potential for volatility continues to be current out there.

The submit Choices OI sees historic plunge as market shifts to cautious buying and selling appeared first on CryptoSlate.