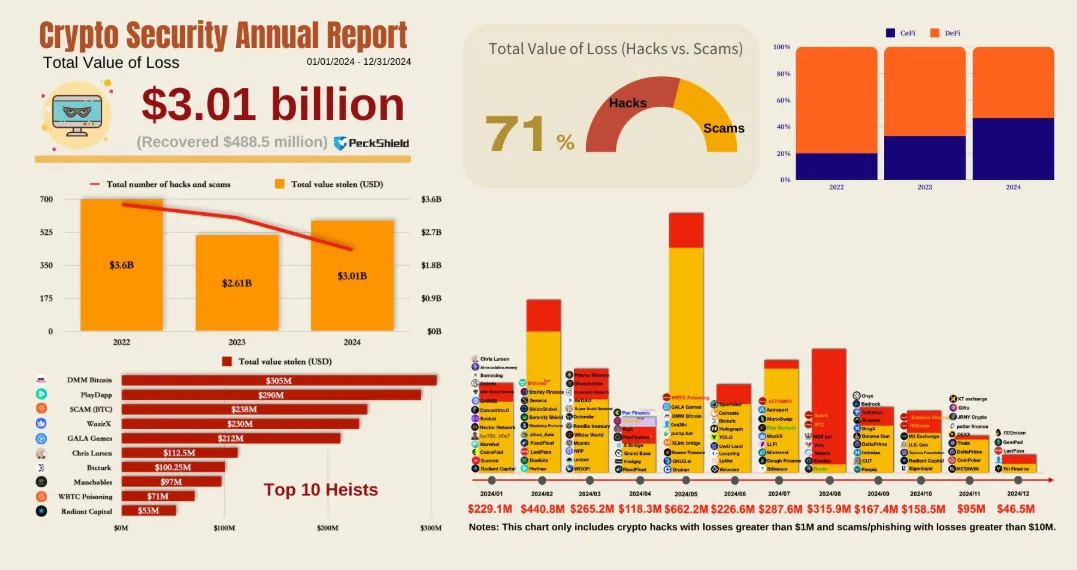

In accordance with a report by blockchain safety agency PeckShield, the cryptocurrency sector skilled a pointy rise in safety breaches in 2024, with losses totaling $3.01 billion.

This marked a 15% improve from 2023’s $2.61 billion, reflecting rising vulnerabilities within the fast-paced digital asset market.

PeckShield‘s Breakdown of 2024 Crypto Losses

PeckShield’s evaluation reveals that the majority of 2024’s losses got here from crypto hacks, which accounted for $2.15 billion, or 71% of the entire. The remaining $834.5 million stemmed from varied scams, comparable to phishing assaults, Ponzi schemes, and fraudulent funding platforms.

Regardless of these large losses, efforts to recuperate stolen funds have proven some success. In accordance with PeckShield, roughly $488.5 million value of cryptocurrencies had been reclaimed by means of blockchain tracing and enforcement actions.

The report additionally highlights the highest 10 heists of the yr, highlighting the numerous scale of particular person incidents. These ranged from breaches of decentralized finance (DeFi) platforms to focused assaults on main exchanges. Notable incidents embrace:

- AlphaX DeFi Hack — $320 million stolen in February.

- Lumos Bridge Exploit — $250 million drained in July.

- DeltaTrade Change Breach — $180 million stolen in October.

These high-profile circumstances point out the continued safety challenges throughout the DeFi ecosystem. It means that the sector stays a chief goal for hackers resulting from its open-source nature and enormous swimming pools of digital property.

Month-to-month Tendencies in Hacking Exercise

A bar graph accompanying the report illustrates the distribution of losses all year long. As indicated within the chart beneath, peaks had been noticed in March and September, coinciding with main protocol vulnerabilities and intervals of heightened market exercise.

The rise in assaults throughout these months signifies the necessity for steady safety audits and real-time monitoring of sensible contracts. Whereas hacks dominated the losses, scams additionally performed a major position. Scammers capitalized on the rising adoption of cryptocurrency, focusing on inexperienced customers with guarantees of excessive returns.

One of many largest scams of the yr concerned a pretend funding platform that siphoned $140 million from unsuspecting buyers earlier than disappearing. This incident mirrors the significance of public schooling and thorough due diligence in mitigating dangers.

The surge in crypto-related crimes has caught the eye of regulators and legislation enforcement companies worldwide. In November, France’s Autorité nationale des jeux (ANJ) launched an investigation into fraudulent crypto operations. Elsewhere, the FBI labored intently with blockchain analytics corporations to recuperate stolen funds and prosecute offenders.

PeckShield’s report stresses the significance of warning for crypto market members because the business continues to develop.

“The crypto wild west is alive and kicking. $3B misplaced in 2024 reveals the stakes are greater than ever. Time to sharpen these digital defenses or threat being a sitting duck,” one consumer on X commented.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.