Disclaimer: The opinions expressed by our writers are their very own and don’t symbolize the views of U.Immediately. The monetary and market data supplied on U.Immediately is meant for informational functions solely. U.Immediately will not be accountable for any monetary losses incurred whereas buying and selling cryptocurrencies. Conduct your personal analysis by contacting monetary specialists earlier than making any funding selections. We imagine that each one content material is correct as of the date of publication, however sure presents talked about could now not be out there.

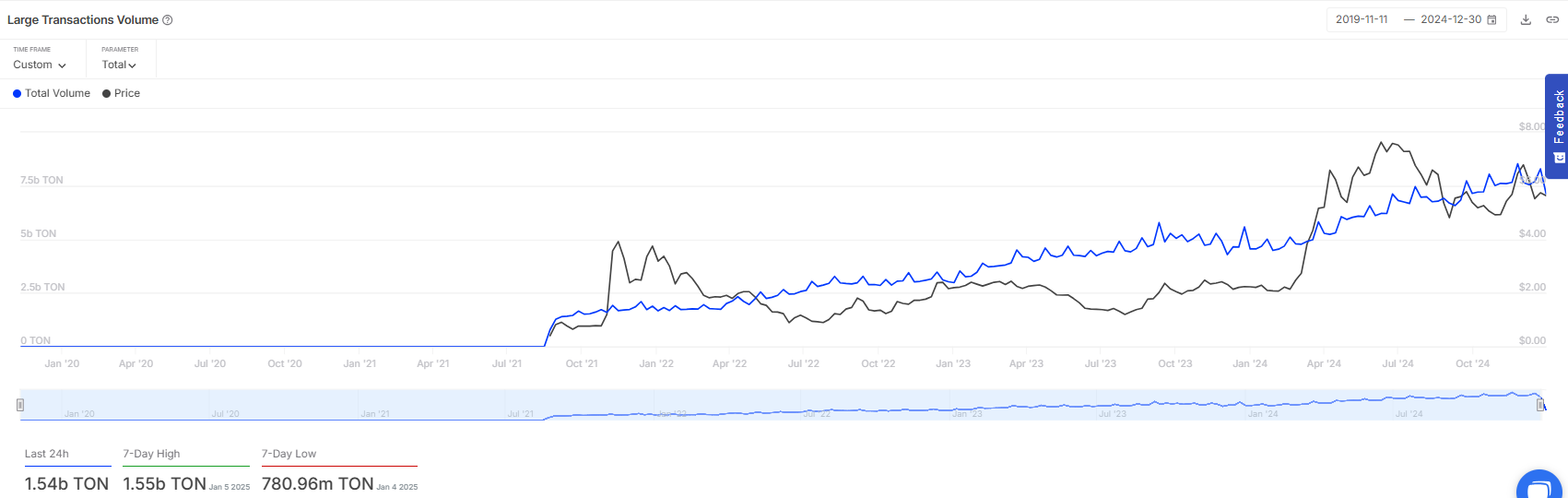

Toncoin (TON) has surged considerably in giant transaction quantity within the final 24 hours, signaling important whale exercise regardless of a $482 million market sell-off throughout the crypto sector. On-chain information reveals a rise in TON transactions valued at over $100,000, indicating that enormous holders are actively accumulating or redistributing their holdings.

The crypto market extended its sell-off from Tuesday’s session into Thursday, with crypto positions value $482 million liquidated within the final 24 hours, in keeping with CoinGlass information. The substantial liquidations throughout numerous crypto belongings replicate the promoting strain that has affected nearly all of digital belongings.

Bitcoin slipped for the third consecutive day, down 2.26% within the final 24 hours. Most different main tokens slid as properly. Dogecoin was down 3.83%, whereas Cardano (ADA) fell 6.83%.

Amid this, Toncoin has mirrored a surge in giant transaction volumes, which, in keeping with IntoTheBlock information, are available at $8.21 billion, or 1.54 trillion TON in crypto phrases, representing a 94% improve within the 24-hour timeframe. A rise in giant transaction quantity often depicts a surge in whale exercise, both shopping for or promoting.

On the time of writing, TON was displaying preliminary indicators of rebound, up 0.09% within the final 24 hours and down 7.49% previously week.

Inflation issues stoke market sell-off

The crypto market prolonged its sell-off as traders weighed the Federal Reserve’s December Assembly minutes launched on Wednesday. Fed officers hinted through the assembly that the tempo of rate of interest cuts may gradual this yr, elevating issues about inflation.

“Virtually all contributors judged that upside dangers to the inflation outlook had elevated,” in keeping with the assembly minutes. “As causes for this judgment, contributors cited current stronger-than-expected readings on inflation and the seemingly results of potential adjustments in commerce and immigration coverage.”

A slew of job information has been launched this week, and traders are eagerly awaiting the nonfarm payrolls report on Friday — one of many remaining essential items of information to be revealed earlier than the Fed’s assembly on the finish of January.