The crypto market is ready to see $2.27 billion in Bitcoin and Ethereum choices expire immediately, a growth that might set off short-term worth volatility and impression merchants’ profitability.

Of this complete, Bitcoin (BTC) choices account for $1.81 billion, whereas Ethereum (ETH) choices signify $459 million.

Bitcoin and Ethereum Holders Brace For Volatility

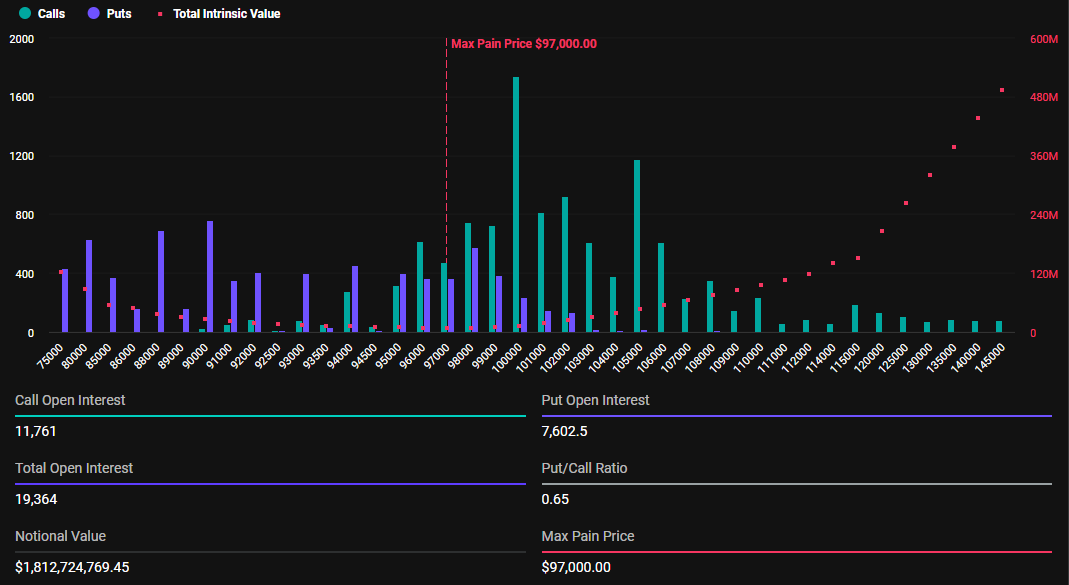

In keeping with knowledge on Deribit, 19,364 Bitcoin choices will expire immediately, barely decrease than the yr’s opener, the place 19,885 BTC contracts went bust final week. The choices contracts due for expiry immediately have a put-to-call ratio of 0.65 and a most ache level of $97,000.

The put-to-call ratio signifies a usually bullish sentiment regardless of the pioneer crypto’s ongoing descent away from the $100,000 mark.

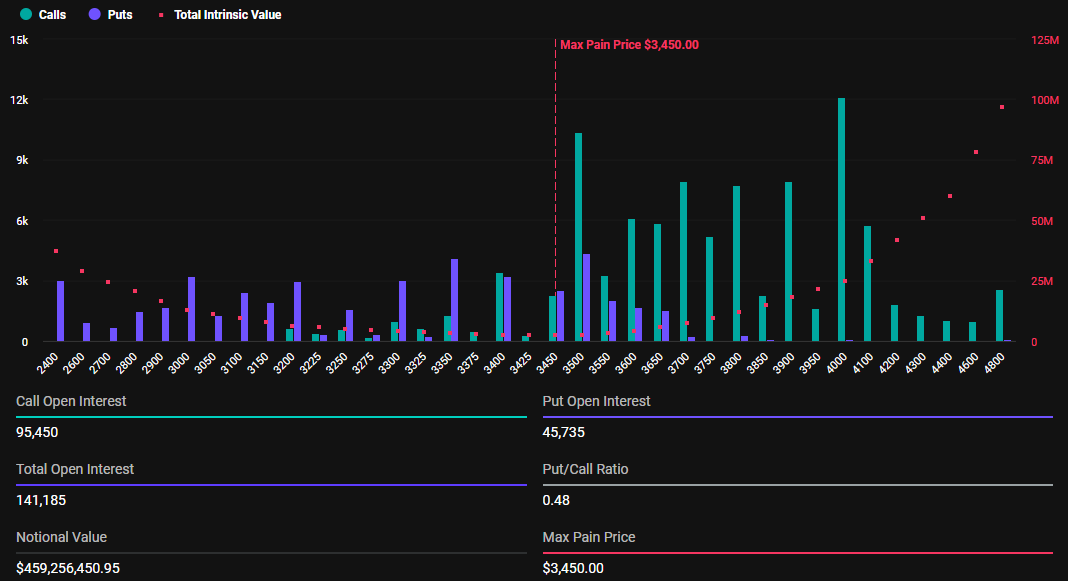

141,185 Ethereum choices will even expire immediately, down from 205,724 within the first week of 2025. With a put-to-call ratio of 0.48 and a max ache level of $3,450, the expirations might affect ETH’s short-term worth motion.

Because the choices contracts close to expiration at 8:00 UTC immediately, Bitcoin and Ethereum costs are anticipated to method their respective most ache factors. In keeping with BeInCrypto knowledge, BTC was buying and selling for $93,792 as of this writing, whereas ETH was exchanging palms for $3,258.

This implies that costs may rise as sensible cash goals to maneuver them towards the “max ache” degree. In keeping with the Max Ache idea, choices costs are inclined to gravitate towards strike costs the place the very best variety of contracts, each calls and places, expire nugatory.

Value strain on BTC and ETH is more likely to ease after 08:00 UTC on Friday when Deribit settles the contracts. Nonetheless, the sheer scale of those expirations might nonetheless gasoline heightened volatility within the crypto markets.

“Is it a breakout or one other consolidation,” Deribit posed in a put up on X (Twitter).

In the meantime, analysts stay divided concerning the subsequent directional bias for Bitcoin’s worth. Whereas some hope for additional upside, others guess on draw back if the assist round $92,000 breaks. Elsewhere, Glassnode signifies a weakening of short-term demand momentum out there.

“Bitcoin short-term demand momentum has continued to weaken. One key indicator: Sizzling Capital (capital revived over the past 7 days) has plunged 66.7% from its December 12 peak of $96.2 billion to $32.0 billion,” Glassnode wrote.

The recent capital metric usually gauges short-term buying and selling exercise and liquidity. The decline implies a steep drop in speculative exercise. Merchants who had been beforehand energetic in transferring Bitcoin have pulled again, indicating waning confidence or curiosity in short-term buying and selling alternatives. With much less capital circulating actively, Bitcoin’s general liquidity could also be diminishing.

This makes it tougher for big trades to happen with out impacting costs, probably resulting in elevated volatility. A plunge of this magnitude, from $96.2 billion to $32 billion, might mirror broader bearish sentiment. Components like macroeconomic uncertainty, tightening financial insurance policies, and even regulatory developments could possibly be inflicting short-term merchants to retreat.

The drop in scorching capital might point out merchants transferring to the sidelines, ready for clearer market course. This decrease demand momentum might weigh on Bitcoin’s potential to maintain or rally from present worth ranges. With out recent capital or elevated exercise, downward worth strain might intensify.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.