- BTC’s short-moving common has continued to function resistance

- At press time, the funding price was optimistic, regardless of the decline

The cryptocurrency market noticed important volatility as Bitcoin (BTC) dropped beneath its important $93k help degree, earlier than recovering once more This motion raises issues about additional declines, but additionally sparks hypothesis a few potential short-term restoration.

Therefore, let’s analyze the info.

Bitcoin’s value motion – Key help breached

The worth chart illustrated Bitcoin’s latest decline, showcasing a break beneath the $93k threshold after a interval of consolidation. The drop was accompanied by better promote stress, as indicated by rising volumes. Notably, BTC struggled to take care of its place above the 50-day Transferring Common (MA), whereas the 200-day MA at $73,128 stays a long-term help.

Supply: TradingView

Bollinger Bands underlined the volatility surge, with Bitcoin nearing the decrease band at $90,987. This pointed to oversold situations, which might set off short-term shopping for curiosity on the charts.

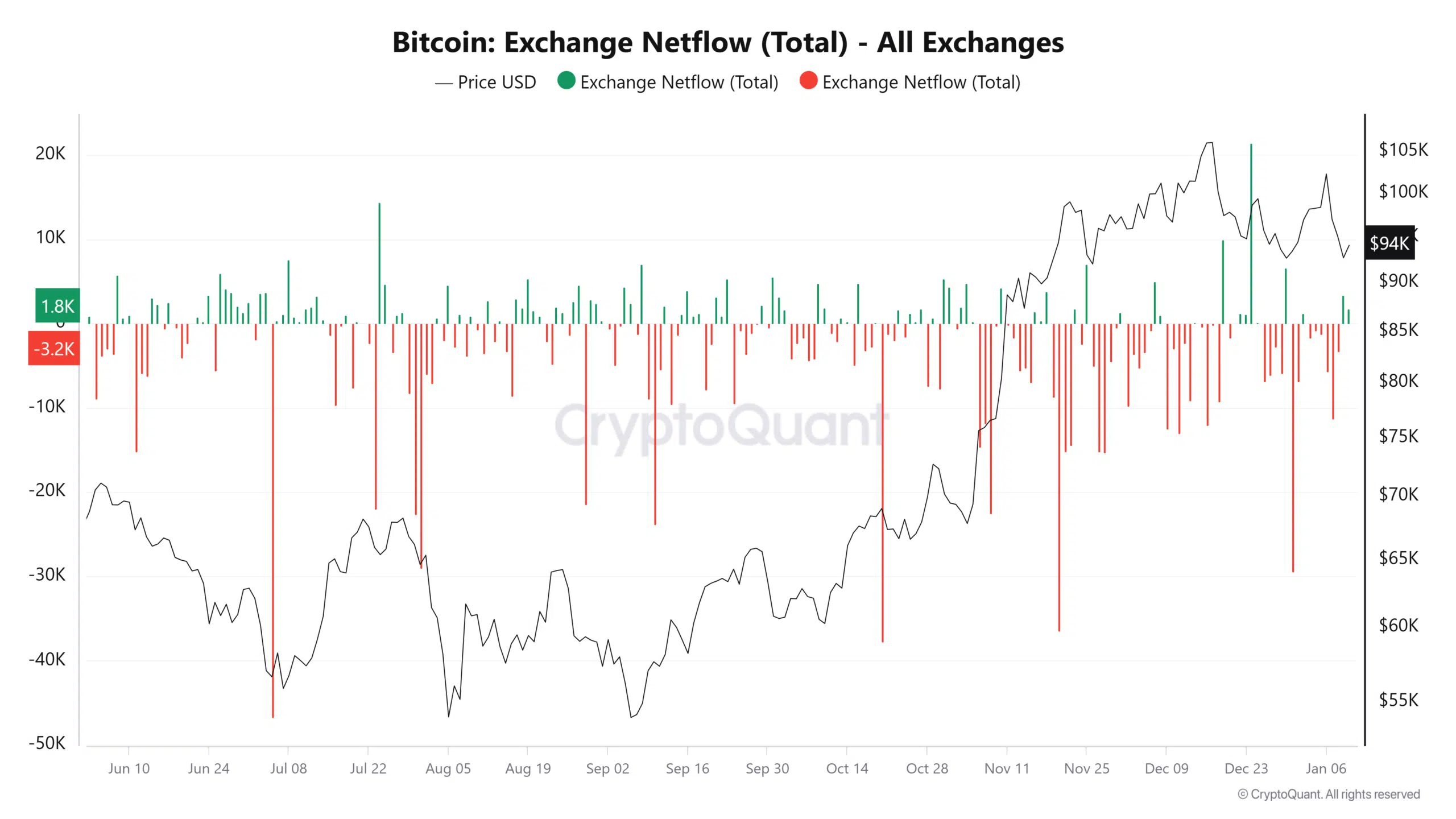

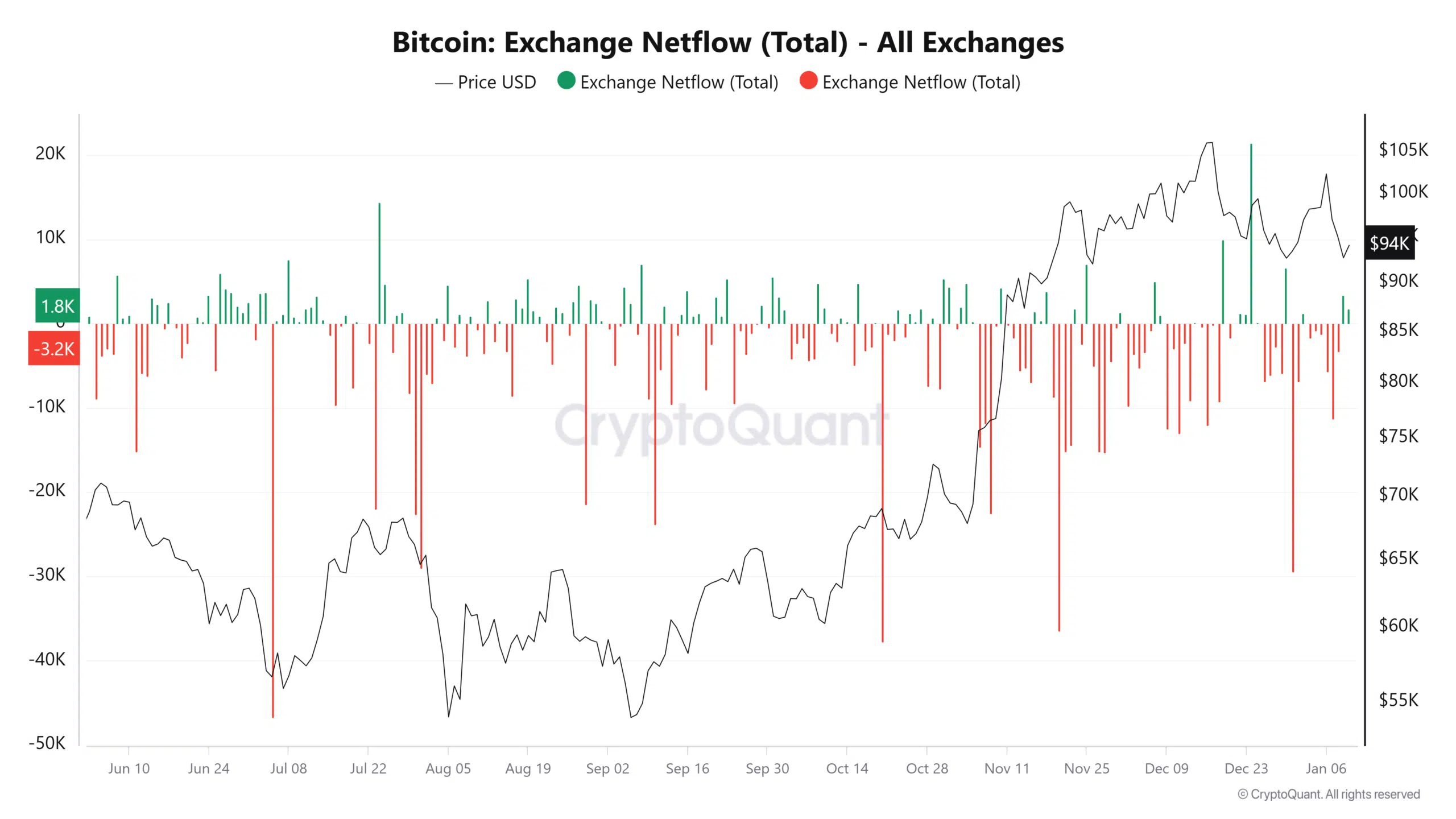

Trade netflow highlights promote stress

The change netflow chart revealed a big uptick in outflows just lately, coinciding with Bitcoin’s drop beneath $93k. Though the netflow was optimistic on 9 January with round 3,000, it has been adverse since 3 January. These outflows alluded to heightened promote stress as traders moved property to exchanges, probably to liquidate holdings.

Supply: CryptoQuant

Nevertheless, regardless of this, the broader market narrative stays intact. A sustained discount in netflows might help value stabilization.

Fibonacci ranges trace at potential bounce

Utilizing the Fibonacci Retracement indicator, Bitcoin’s fast help lies on the 0.382 Fib degree ($93,311). The 0.618 Fib degree at $101,849 serves as a possible restoration goal if bullish momentum builds.

Traditionally, these ranges have acted as pivotal zones for development reversals or continuations.

Supply: TradingView

The relative stability across the $93k degree steered an ongoing battle between bulls and bears. A decisive shut above $95k might reinforce a short-term bounce, whereas failure may result in a retest of decrease Fib ranges.

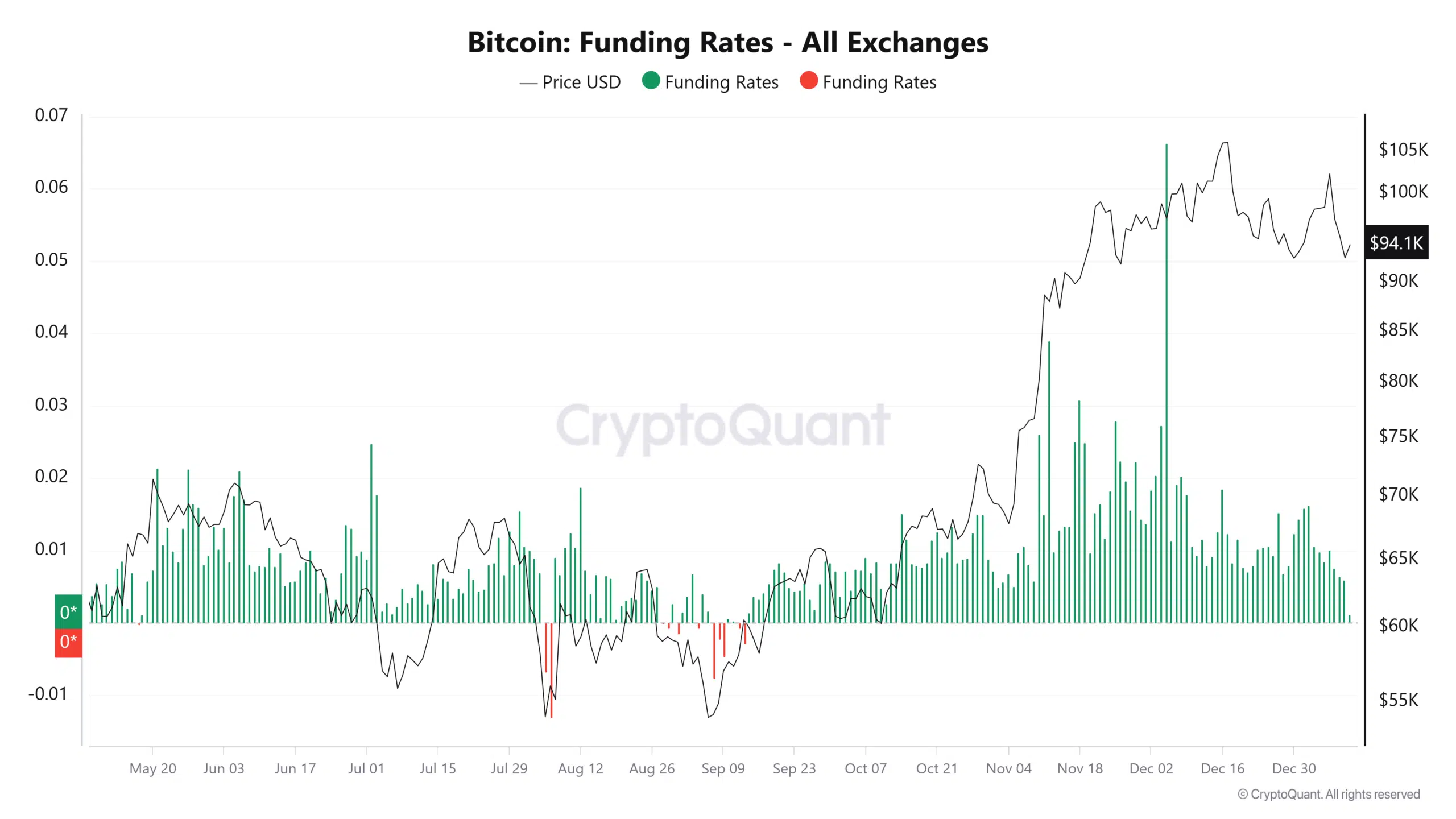

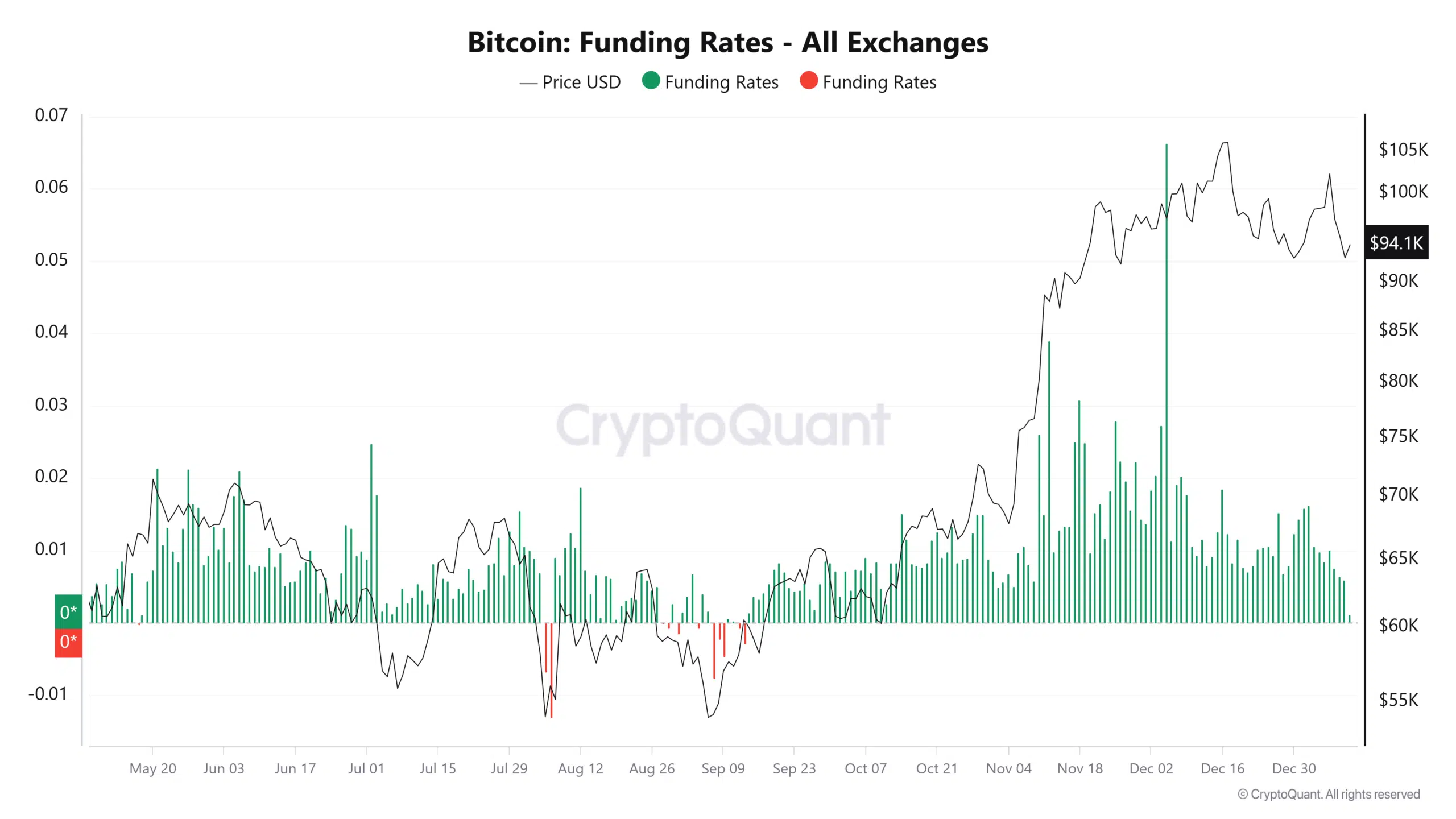

Funding charges and market sentiment

Funding charges throughout exchanges present perception into market sentiment. Optimistic funding charges (indicating lengthy positions outnumber shorts) have been moderating, reflecting warning amongst leveraged merchants.

An evaluation of the funding price revealed that although it stays optimistic, there have been notable declines over the previous couple of days.

Supply: CryptoQuant

A decline in funding charges in the course of the latest sell-off pointed to bearish sentiment and decreased confidence within the crypto’s fast restoration.

Bounce or breakdown?

Bitcoin’s press time trajectory highlighted a precarious steadiness. Whereas technical indicators pointed to a potential short-term restoration, the prevailing market sentiment appeared to lean bearish. Key ranges to observe embrace $93,311 for help and $95,000 for a bullish pivot.

– Learn Bitcoin (BTC) Value Prediction 2025-26

The approaching days shall be important in figuring out whether or not Bitcoin can bounce again or succumb to additional draw back stress.