Este artículo también está disponible en español.

Bitcoin skilled important promoting stress after efficiently breaking above the $100K mark, a psychological milestone that had traders buzzing with optimism. Nonetheless, the celebration was short-lived as BTC failed to carry this crucial stage, dropping as little as $92,500 in lower than three days. This sharp downturn has reignited considerations in regards to the market’s stability and Bitcoin’s skill to maintain its upward momentum.

Associated Studying

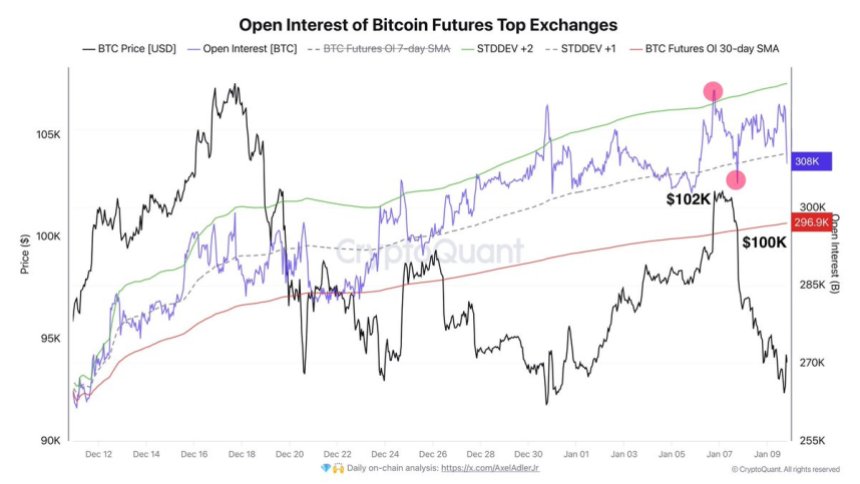

Axel Adler, a distinguished CryptoQuant analyst, shared beneficial insights into the latest market exercise. He revealed that the most important deleveraging previously week happened between January 6 and seven, when Bitcoin’s worth fell from $102K to $100K as a result of liquidations. This wave of pressured promoting pushed costs decrease, permitting bears to regain management and drive Bitcoin’s worth down additional to $92,500.

The present market circumstances have left traders questioning Bitcoin’s subsequent transfer. Will it stabilize and discover assist to mount one other rally, or will the bearish momentum result in a deeper correction? With the market sentiment teetering between worry and cautious optimism, all eyes stay on Bitcoin because it navigates this crucial part.

Bitcoin Regains Floor After Aggressive Promote-Off

Regardless of experiencing an aggressive drop that noticed Bitcoin plummet to $92K, the cryptocurrency has managed to seek out key assist at this crucial stage. Prior to now few hours, BTC has pushed above this threshold, climbing to $95K, providing a glimmer of hope for bullish traders. The power to carry and rebound from this assist stage suggests potential resilience, however uncertainties stay.

Distinguished CryptoQuant analyst Axel Adler shared insightful information on X in regards to the latest market dynamics. He famous that the most important deleveraging within the final week occurred between January 6 and seven, when Bitcoin’s worth dropped from $102K to $100K as a result of a wave of liquidations. This liquidation occasion worn out overleveraged positions and set the stage for bearish exercise. Capitalizing on the chaos, bears opened shorts, additional driving the worth right down to $92K.

Regardless of the latest restoration, Adler warns that the present 9K BTC discount in open curiosity (OI) doesn’t present a definitive sign of stress easing out there. This leaves Bitcoin’s subsequent transfer unsure, with traders carefully watching how the worth motion unfolds within the coming days.

Associated Studying

The restoration to $95K is a optimistic signal, however BTC should reclaim greater ranges to verify bullish momentum and stabilize the market. Till then, merchants stay cautious because the potential for additional volatility looms.

BTC Holds Key Degree: Bulls Eye Increased Floor

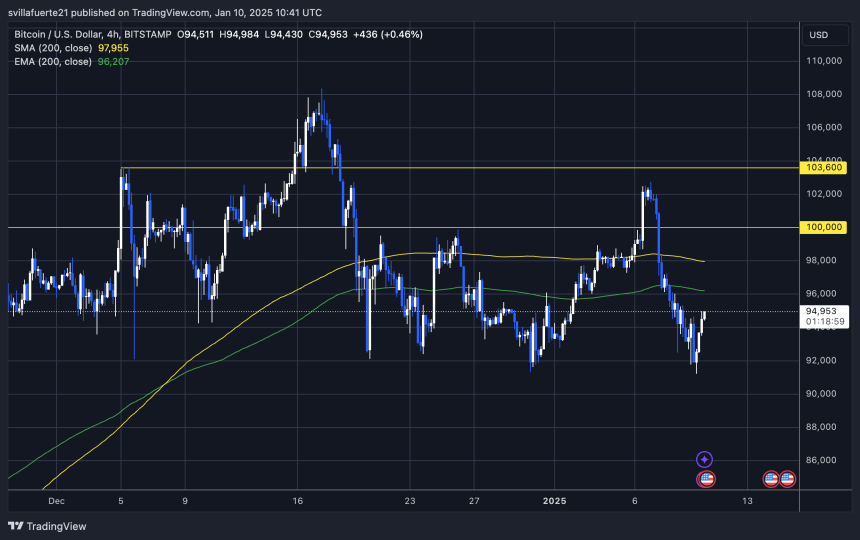

Bitcoin is buying and selling at $95,000, holding above a crucial assist stage and sitting simply 2% under its 4-hour 200 EMA at $96,200. The 200 MA, one other important indicator, lies 3% away, including additional significance to Bitcoin’s present place. These technical ranges are pivotal for assessing short-term market momentum and potential bullish restoration.

For bulls to reclaim the uptrend, the $95K stage should maintain as a basis for additional upward motion. A decisive push to reclaim the $98K and $100K ranges is essential. These worth factors function key resistance ranges that, as soon as surpassed, may set the stage for a strong leg up, paving the way in which for Bitcoin to revisit its all-time highs.

Failing to carry above $95K may open the door to elevated bearish stress, doubtlessly sending BTC right into a deeper consolidation and even testing decrease demand zones. Nonetheless, holding the road at present ranges and constructing momentum may restore investor confidence and create the circumstances wanted for a sustained rally.

Associated Studying

As Bitcoin consolidates, merchants and analysts alike are carefully monitoring these crucial ranges to gauge the cryptocurrency’s subsequent transfer. A breakout above the $100K mark may reignite bullish sentiment and set a extra outlined path for the market.

Featured picture from Dall-E, chart from TradingView