Este artículo también está disponible en español.

As Bitcoin (BTC) continues its pullback into the low $90,000 vary, analysts are divided on how a lot additional the highest cryptocurrency may fall earlier than a possible bounce. Nevertheless, long-term market observers stay assured, emphasizing that short-term worth motion doesn’t alter their perception in BTC’s eventual rise to 1,000,000 {dollars} or extra within the coming years.

Bitcoin To Attain $1.5 Million By 2035

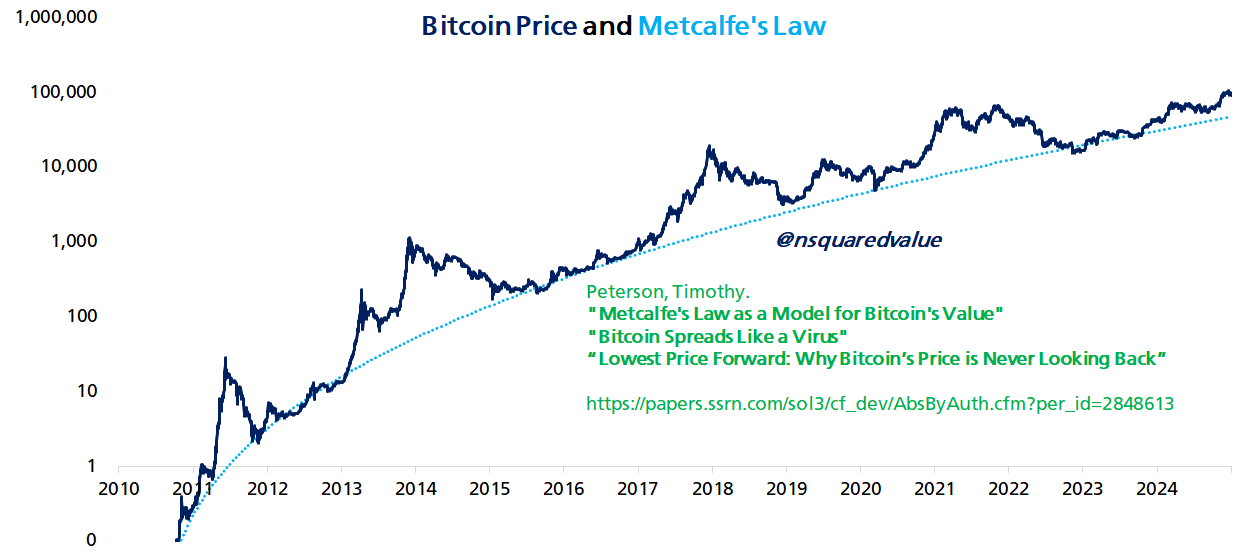

Cryptocurrency fanatic Timothy Peterson not too long ago shared his projection on X, predicting that Bitcoin is on monitor to achieve $1.5 million by 2035, based mostly on Metcalfe’s Regulation. This forecast represents an nearly 15-fold enhance from its present worth over the subsequent decade.

For the uninitiated, Metcalfe’s Regulation states that the worth of a community is proportional to the sq. of the variety of its customers, that means because the variety of contributors grows, the community’s utility and worth enhance exponentially. In Bitcoin’s context, this means that its worth rises considerably as extra folks undertake and use the community.

Associated Studying

Peterson is the writer of the broadly mentioned paper titled “Metcalfe’s Regulation as a Mannequin for Bitcoin’s Worth”, which makes use of the legislation to challenge Bitcoin’s worth trajectory. Identified for his bullish stance on Bitcoin, Peterson has lengthy argued that BTC’s world adoption is inevitable. His paper states:

Conventional foreign money fashions fail with bitcoin, however varied mathematical legal guidelines which clarify community connectivity supply compelling rationalization of its worth.

Peterson has additionally demonstrated accuracy in figuring out key market pattern reversals. For example, he accurately recognized Bitcoin’s native backside in September of final 12 months.

BTC To Dip Additional Earlier than Bounce?

Whereas Peterson’s bullish $1.5 million prediction is music to the ears of Bitcoin bulls, the cryptocurrency’s present worth motion may go away them uneasy. On the time of writing, over $524 million price of liquidations have occurred prior to now 24 hours, with $136 million in BTC alone.

Associated Studying

Crypto analyst Keith Alan weighed in on Bitcoin’s current worth motion, stating that “this dip isn’t carried out dipping.” In keeping with Alan, the sell-side strain is actively pushing the worth down, with consumers seemingly ready for decrease ranges to make important purchases. He defined:

It’s clear that the promote facet is making an attempt to push the worth down. It’s not clear if the purchase partitions are associated to the identical entity pushing worth down, however what is evident is that they don’t have any conviction for these worth ranges, and a few or all of this liquidity might transfer or spoof.

Alan recognized $91,500 as a possible assist degree, with $86,500 appearing as a secondary line of protection. He famous that greater than $300 million in bid liquidity exists inside this vary, making it probably that BTC might rebound from these ranges.

Alan additionally highlighted {that a} drop to $86,500 would characterize a 20% decline from Bitcoin’s current all-time excessive (ATH) of $108,135. Nevertheless, if this assist fails to carry, there’s a threat of BTC sliding additional to $77,900 to fill the CME hole.

Quite the opposite, crypto analyst Ali Martinez not too long ago emphasised that BTC could also be on monitor to $275,000 based mostly on the cup and deal with sample formation on the weekly chart. At press time, BTC trades at $92,805, down 3.3% prior to now 24 hours.

Featured picture from Unsplash, Charts from X and TradingView.com