As crypto continues to realize traction within the mainstream economic system, its adoption is increasing past area of interest circles. A brand new survey from the asset administration agency Bitwise confirms this narrative.

The survey affords insights into how US monetary advisors are integrating crypto into consumer portfolios and planning for the long run.

Crypto Turns into Mainstream: 56% of Advisors Extra More likely to Make investments

The survey, performed between November 14 and December 20, 2024, reveals a big shift in monetary advisors’ perceptions and actions towards cryptocurrency.

A stunning consequence of the 2024 US elections has been the marked enhance in advisors’ enthusiasm for cryptocurrency. About 56% of surveyed advisors acknowledged that the election outcomes made them extra prone to put money into crypto in 2025.

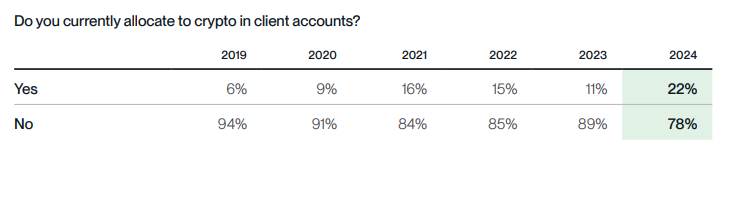

The variety of advisors incorporating crypto into consumer portfolios has surged. In 2024, 22% of advisors reported allocating to crypto in consumer accounts, a dramatic enhance from simply 11% in 2023.

In accordance with the survey, the demand for crypto amongst shoppers is stronger than ever. Additionally, 96% of advisors reported receiving questions on cryptocurrency from their shoppers in 2024.

Amongst advisors already investing in crypto, 99% plan to both preserve or enhance their crypto allocations in 2025.

“Should you had any doubt that 2024 was an enormous inflection level for crypto, this 12 months’s survey dispels it. Advisors are awakening to crypto’s potential like by no means earlier than, they usually’re allocating like by no means earlier than. However maybe most staggering is how a lot room we nonetheless must run, with two-thirds of all monetary advisors—who advise thousands and thousands of People and handle trillions in property—nonetheless unable to entry crypto for shoppers,” Bitwise CIO Matt Hougan famous.

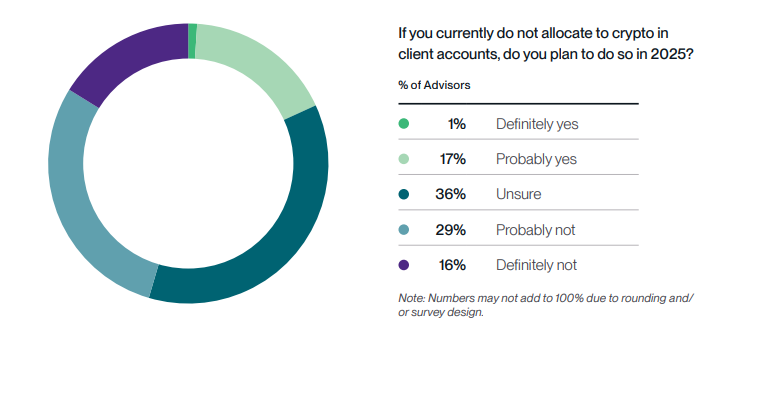

Furthermore, 19% of advisors who had beforehand prevented crypto publicity mentioned they’re now “undoubtedly” or “in all probability” planning to put money into crypto property for shoppers. This marks a notable enhance from 8% in 2024.

But, regardless of the rising adoption of crypto, entry stays a problem. Solely 35% of advisors can buy crypto instantly in consumer accounts, highlighting a barrier to wider adoption.

Looking forward to 2025, crypto fairness ETFs stay probably the most favored automobile for publicity to crypto. This choice displays the rising curiosity in funding merchandise that present publicity to the crypto market relatively than particular person cryptocurrencies.

Whereas issues round regulatory uncertainty stay, they’ve considerably diminished in comparison with earlier years. In 2024, 50% of advisors cited regulatory challenges as a serious impediment, down from 60-65% in earlier surveys, suggesting that readability is bettering.

Moreover, Bitwise surveyed 400 monetary advisors, together with unbiased registered funding advisors, broker-dealer representatives, monetary planners, and wirehouse representatives from throughout the US.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.