dogwifhat (WIF) worth has skilled a pointy decline, falling roughly 15% within the final 24 hours and dropping beneath $1.60 for the primary time in 4 months. This latest dip provides to a 47% loss over the previous 30 days, reflecting important bearish momentum available in the market, with a number of of the largest meme cash dropping greater than 10% within the final 24 hours.

The present downtrend exhibits no indicators of abating, with technical indicators suggesting additional potential draw back. If WIF fails to stabilize, it could quickly take a look at the assist at $1.32, and dropping that degree might push it as little as $1.07. Nonetheless, a reversal might happen if market sentiment round meme cash improves, offering WIF a chance to problem resistance ranges at $1.73 and doubtlessly climb again towards $2.2.

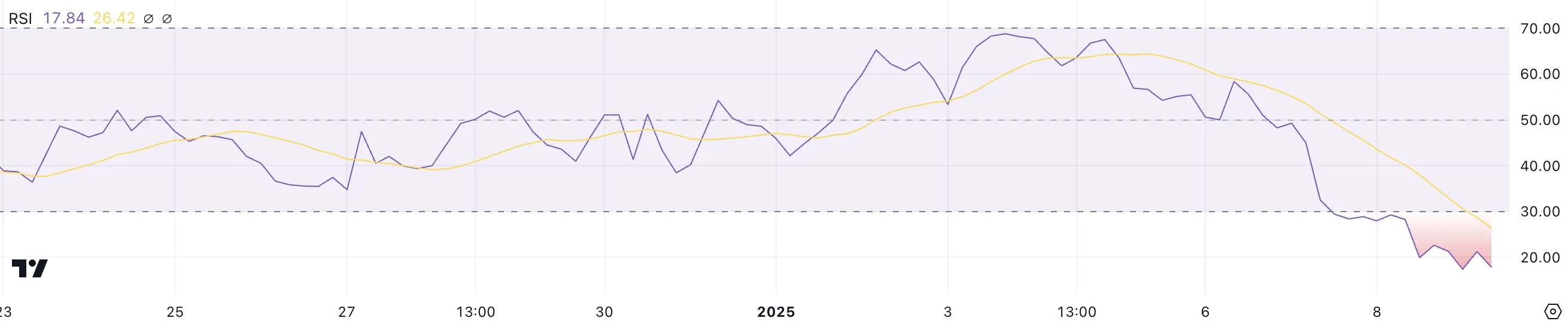

WIF RSI Dropped to Oversold Zone

The Relative Energy Index (RSI) for dogwifhat has plunged to 17.8, marking a pointy transfer into the oversold territory after remaining impartial between December 20 and January 7. RSI is a extensively used momentum indicator that measures the velocity and magnitude of worth actions on a scale of 0 to 100.

Values above 70 point out overbought situations and a possible for a pullback, whereas values beneath 30 recommend oversold situations, typically signaling the opportunity of a worth rebound.

At its present degree of 17.8, WIF RSI signifies excessive bearish momentum and heavy promoting stress available in the market. Such a low RSI studying means that the latest sell-off might have been overdone. That might doubtlessly create situations for a restoration if patrons re-enter the market.

Nonetheless, the steep decline additionally displays weak sentiment, and except renewed shopping for curiosity emerges, WIF worth might proceed to consolidate or decline additional within the quick time period.

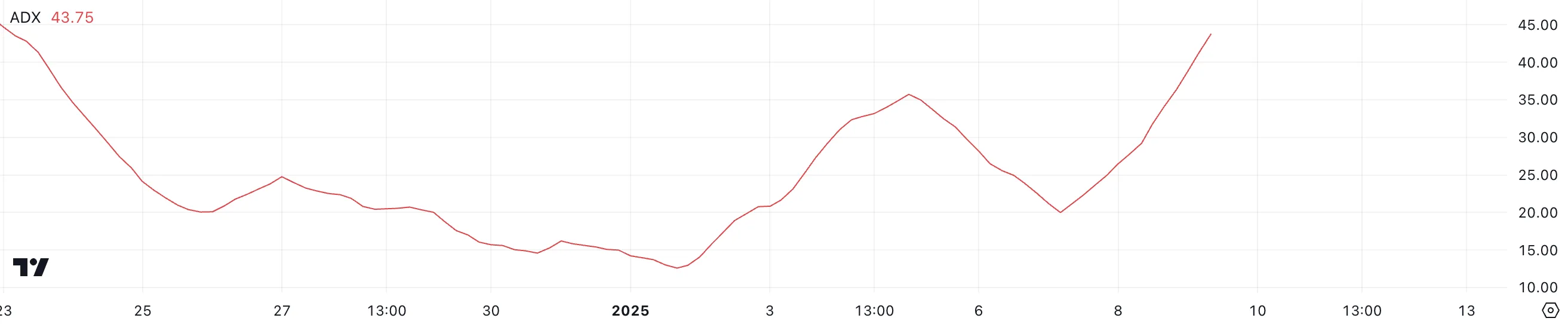

Dogwifhat Downtrend Is Rising Quick

WIF Common Directional Index (ADX) has surged to 43.7, rising sharply from 19.9 in simply at some point. The ADX is a technical indicator used to measure the power of a development, no matter its course, on a scale from 0 to 100.

Values above 25 point out a powerful development, whereas these beneath 20 recommend weak or absent momentum. The fast improve in WIF’s ADX indicators a big strengthening of the present development.

Provided that WIF is at present in a downtrend, the ADX at 43.7 highlights the rising dominance of bearish momentum.

This means that promoting stress is intensifying, and additional worth declines may very well be anticipated except patrons step in to counteract this damaging development.

WIF Value Prediction: A Potential 30% Additional Correction?

If the continued downtrend for dogwifhat worth continues, it could quickly take a look at its subsequent vital assist at $1.32. A break beneath this degree might deepen the decline, driving WIF right down to $1.07 — its lowest worth since mid-August 2024. Such a transfer would signify a possible 30% correction from present ranges.

Then again, if the market sentiment round meme cash improves, WIF worth may benefit from renewed enthusiasm. In such a case, the value would possibly rise to problem the resistance at $1.73. A profitable breakout above this degree might pave the way in which for additional good points, with $2.2 as the following goal.

Disclaimer

According to the Belief Venture tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.