Information reveals the Bitcoin Worry & Greed Index has declined to a impartial stage lately. Right here’s what this might suggest for the cryptocurrency’s value.

Bitcoin Worry & Greed Index Is Now Pointing At ‘Impartial’

The “Worry & Greed Index” refers to an indicator created by Various that tells us in regards to the common sentiment current among the many merchants within the Bitcoin and wider cryptocurrency markets.

This metric makes use of the information of the next 5 elements to calculate its worth: volatility, buying and selling quantity, social media sentiment, market cap dominance, and Google Developments.

When the indicator has a worth better than 53, it means the buyers as a complete share a sentiment of greed. However, it being beneath 47 implies the dominance of concern out there. All values within the vary mendacity between these cutoffs correspond to a internet impartial mentality.

In addition to these three essential sentiments, there are additionally two ‘excessive’ ones referred to as the intense concern and excessive greed. The previous happens at or above 75 and the latter at or beneath 25.

Now, right here is how the Bitcoin Worry & Greed Index is trying for the time being:

As displayed above, the indicator has a worth of fifty, which suggests the general sentiment out there is precisely within the steadiness. It is a stark change from yesterday, when the index was sitting at 69.

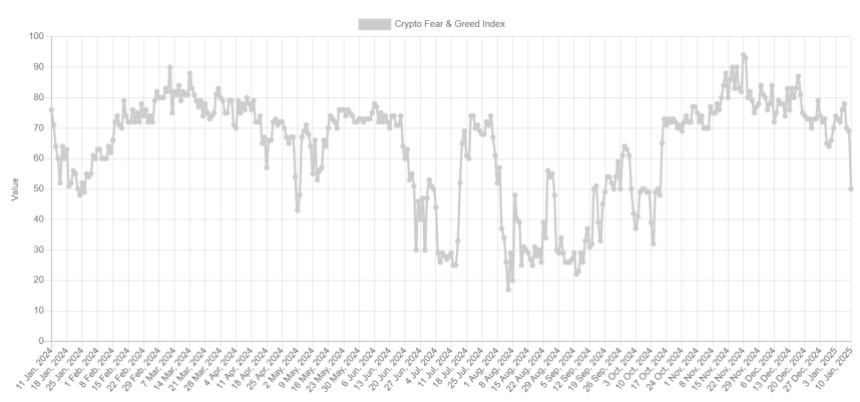

The under chart reveals how the Worry & Greed Index has seen its worth change over the previous twelve months.

Only a few days in the past, the indicator’s worth was even larger at 78, that means that the market held a majority sentiment of maximum greed. The sharp drop within the investor mentality since then is a results of the Bitcoin restoration rally really fizzling out and turning right into a value crash.

That is the primary time for the reason that first half of October that the index has dropped into the impartial territory. Between then and now, the market solely carried an optimistic ambiance because the asset’s value was following an upwards trajectory.

With this reset, although, it seems the buyers at the moment are not sure about the way forward for the cryptocurrency. If historical past is something to go by, this will likely not really be a foul factor.

Bitcoin and different digital belongings have typically tended to maneuver in a means that goes opposite to the expectations of the gang; excessive greed is the place main tops have occurred, together with the one from final yr, and excessive concern is the place bottoms have taken place.

Whereas the market hasn’t turn out to be fearful but, the truth that there isn’t any longer an extra of hype may nonetheless be one thing that may assist the worth discover a reversal. It now stays to be seen how BTC and the market sentiment would develop within the coming days.

BTC Worth

On the time of writing, Bitcoin is floating round $94,200, down virtually 4% within the final seven days.