FDIC Vice Chair Travis Hill has criticized previous actions by federal businesses that restricted banks’ involvement in crypto actions.

He mentioned these measures, together with the usage of “pause letters,” hindered innovation and created the notion that regulators had been blocking blockchain growth.

Calls to Finish Restrictive Banking Practices Like Operation Chokepoint

Hill urged an finish to practices resembling “Operation Chokepoint” and referred to as for modifications to the enforcement of the Financial institution Secrecy Act. He highlighted the necessity to scale back the strain on banks to close down accounts over fears of heavy penalties for non-compliance.

He additionally expressed assist for higher collaboration with the crypto sector.

In a speech revealed Friday, Hill prompt the FDIC take a extra open method to digital belongings. He emphasised the necessity for clearer tips on how banks can safely interact with cryptocurrencies.

Hill, who has been Vice Chair since 2022, is anticipated to function appearing chair of the company, which insures US financial institution deposits.

“There’s a wholesome steadiness between (1) permitting banks to evolve with the occasions and (2) making certain banks proceed to handle dangers prudently, and in recent times the FDIC has finished a poor job placing that steadiness,” he mentioned.

His feedback come because the crypto business raises issues about regulatory overreach. Coinbase sued the FDIC in June, accusing the company of making an attempt to sever ties between the banking and crypto sectors.

The lawsuit, which additionally sought entry to the “pause letters,” alleged that these actions unfairly focused the business.

Push for Clearer Crypto Tips

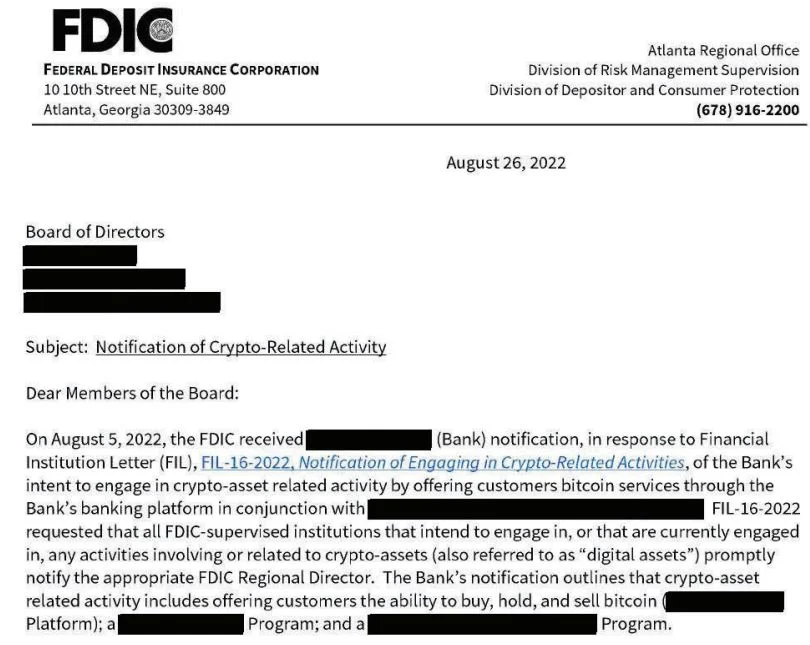

A 2023 report from the FDIC’s Workplace of Inspector Common revealed that between March 2022 and Might 2023, the company despatched “pause letters” to a number of banks. These letters requested that banks halt crypto-related actions whereas offering extra data for evaluation.

The report highlighted a scarcity of clear requirements for coping with digital belongings.

Hill criticized the shift towards dealing with crypto instances on a person foundation moderately than providing clear and constant tips.

He additionally addressed comparisons to the 2013 Division of Justice initiative referred to as Operation Chokepoint. The initiative focused industries like payday lending and firearms by limiting their entry to banking companies.

“Whereas adopting a brand new method to digital belongings — and placing an finish to any and all Choke Level-like techniques — are important first steps, regulators additionally have to reevaluate our method to implementing the Financial institution Secrecy Act (BSA),” Hill mentioned.

Crypto advocates have used the time period “Operation Chokepoint 2.0” to explain a covert effort by regulators to isolate the crypto business.

Paperwork obtained by Coinbase counsel that the FDIC discouraged banks from partaking with crypto companies beneath the guise of managing reputational dangers.

“Whereas all of us share the aim of making certain criminals and terrorists usually are not utilizing the banking system to fund drug trafficking, terrorism, and different severe crimes, the present BSA regime creates an incentive for banks to shut accounts moderately than danger large fines for insufficient BSA compliance,” the FDIC Vice Chair additional elaborated.

Business leaders, together with Cardano founder Charles Hoskinson, have referred to as for unity in response to what they describe as aggressive debanking measures. The controversy has additionally drawn consideration from political figures. David Sacks, the brand new Crypto Czar, has vowed to handle alleged banking restrictions concentrating on crypto companies.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.