Este artículo también está disponible en español.

The introduction of Spot Bitcoin exchange-traded funds (ETFs) in the USA marked a historic milestone for the cryptocurrency market. These Spot Bitcoin ETFs, which first went stay within the US on January 11, 2024, have had huge success in only one yr, making them the best ETF launch in historical past.

Associated Studying

Because it stands, US-based Spot Bitcoin ETFs have now grow to be one of many main drivers of Bitcoin’s worth development and performed an enormous function in Bitcoin’s break above $100,000. Moreover, these US-based Spot Bitcoin ETFs are actually collectively the largest holders of Bitcoin.

Efficiency Metrics Of US-Based mostly Spot Bitcoin ETFs

For years, the US Securities and Alternate Fee (SEC) resisted the approval of Spot Bitcoin ETFs, making their eventual approval in January 2024 a notable turning level for the crypto business. Significantly, the SEC accepted the primary 11 Spot Bitcoin ETF functions on January 10, 2024.

All of the Spot Bitcoin ETFs have demonstrated a constructive efficiency of their inaugural yr aside from Grayscale’s GBTC. The launch of spot Bitcoin ETFs was met with record-breaking enthusiasm, as these funds registered the very best buying and selling volumes of any ETF launch in historical past throughout their first few days of operation.

Aside from opening the Bitcoin and crypto business to conventional traders who would in any other case not spend money on cryptocurrencies, many massive Bitcoin holders additionally noticed the ETFs as one of the simplest ways to speculate in an effort to make the most of their regulatory readability.

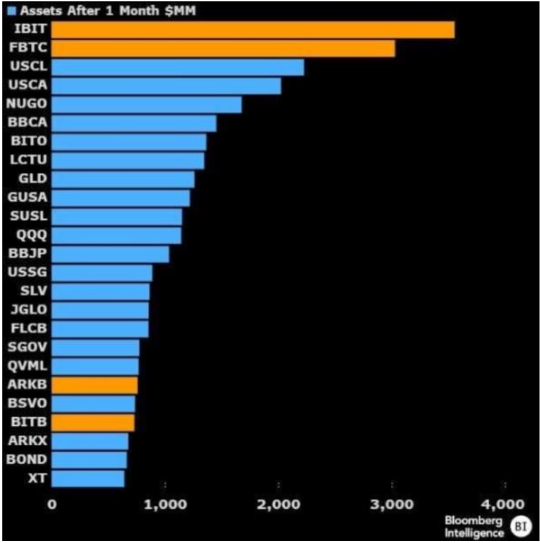

Significantly, BlackRock’s iShares Bitcoin Belief (IBIT) and Constancy’s Constancy Clever Origin Bitcoin Fund have led the cost with substantial inflows all year long. These two funds shortly established themselves as dominant gamers, with every witnessing over $3 billion in inflows inside their first 20 days of buying and selling.

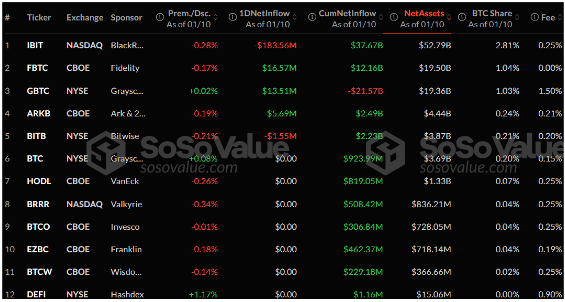

On the time of writing, US-based Spot Bitcoin ETFs now collectively management about $107.64 billion in Bitcoin belongings, which represents about 5.75% of the entire Bitcoin market cap, in response to information from SoSoValue. Since they started buying and selling one yr in the past, these ETFs have witnessed a cumulative whole web influx of $36.22 billion.

When it comes to cumulative web inflows, the IBIT has witnessed the very best influx quantity within the tune of $37.67 billion, whereas FBTC follows behind with $12.16 billion. These two have been sufficient to steadiness the $21.57 web outflows from the pre-existing Grayscale Bitcoin Belief, which was transformed to a Spot Bitcoin ETF.

Different ETF suppliers have additionally witnessed cummulative web inflows previously yr, with ARK 21Shares Bitcoin ETF and Bitwise Bitcoin ETF additionally at $2.49 billion and $2.43 billion, respectively, on the time of writing. Nevertheless, the remaining seven ETF suppliers have but to cross the $1 billion threshold in cumulative web inflows, indicating a extra uneven distribution of investor curiosity throughout the business.

Associated Studying

The place Do Spot Bitcoin ETFs Go From Right here?

The one manner for Spot Bitcoin ETFs is up, particularly on the longer timeframe in 2025 and past. Crypto traders are optimistic a couple of important inflow of capital into these ETFs in anticipation of crypto-positive insurance policies to be launched by the incoming Trump administration.

On the time of writing, Bitcoin is buying and selling at $94,057.

Featured picture from Pexels, chart from TradingView