Analytics agency Glassnode is warning that Bitcoin (BTC) is approaching a crucial juncture that has beforehand marked the tip of the bull market.

Glassnode says on the social media platform X that it’s maintaining a detailed watch on Bitcoin’s short-term holder (STH) price foundation, a metric that tracks the common value at which traders who’ve held their BTC for lower than 155 days acquired their cash.

In line with Glassnode, historic information exhibits that Bitcoin tends to enter bear territory when its value strikes beneath the metric’s worth.

“Bitcoin’s Brief-Time period Holder (STH) cost-basis mannequin is essential for gauging sentiment amongst new traders. Traditionally, this mannequin has tracked market lows throughout bull cycles and in addition distinguished bull from bear markets.

BTC value is now round 7% above the STH cost-basis of $88,135. If the worth stabilizes beneath this degree, it will probably sign waning sentiment amongst new traders – which is commonly a turning level in market traits.”

At time of writing, Bitcoin is buying and selling at $94,425.

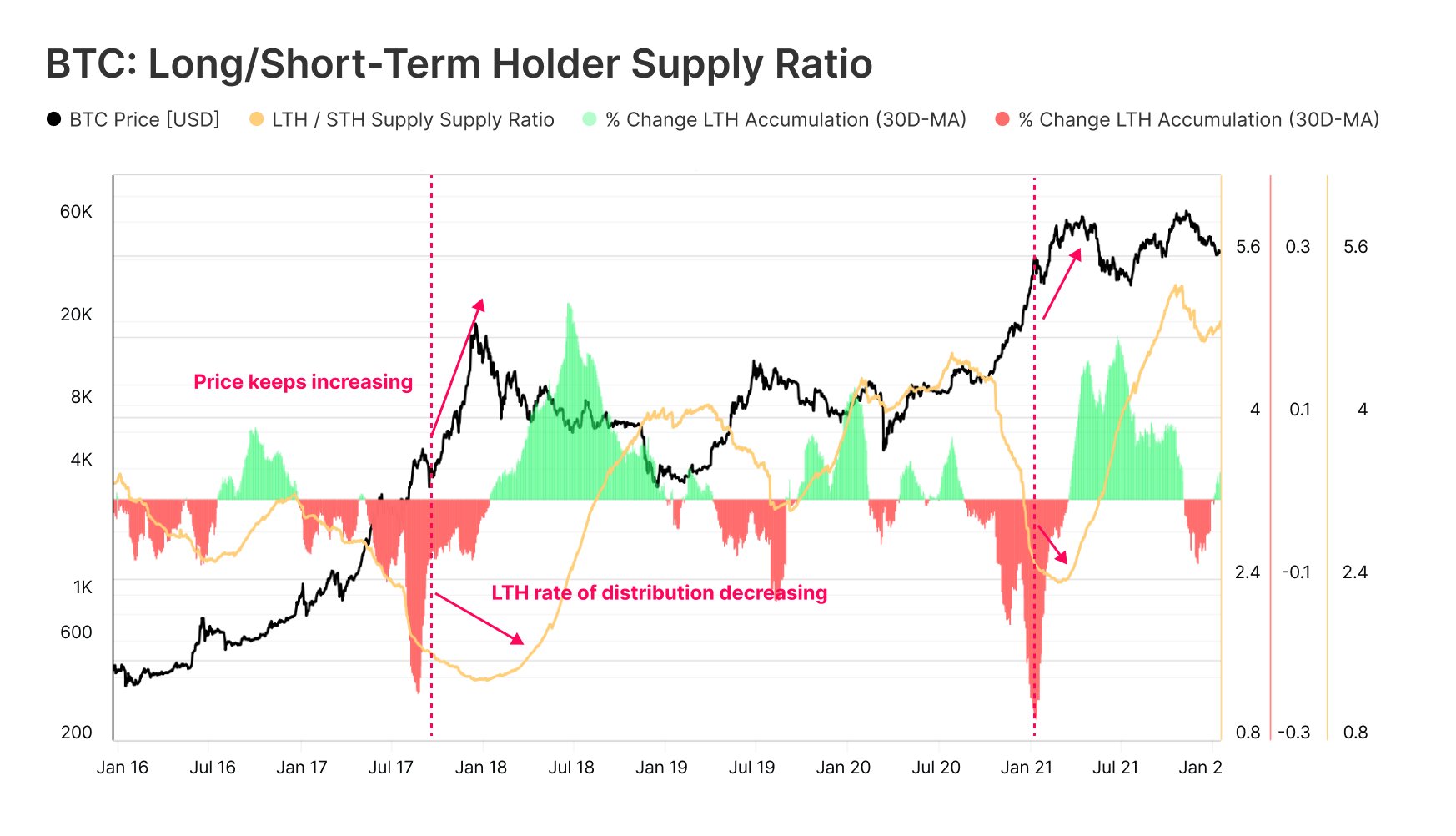

Trying on the long-term holders, or traders who’ve held their BTC for 155 days or extra, Glassnode says the cohort is unloading their Bitcoin at a drastically fast fee. In line with the analytics agency, the acute distribution of long-term holders doesn’t essentially recommend that the Bitcoin bull market is over.

“Even at costs about 12% beneath all-time highs, Bitcoin Lengthy-Time period Holders (LTHs) are nonetheless distributing, however at a slower fee. But, the 30-day p.c change in LTH provide means that the speed of distribution has probably peaked, reaching extremes seen in earlier cycles…

In previous cycles, costs continued to climb even after LTH distribution peaked. This infers {that a} peak in distribution doesn’t all the time align with a right away macro high.”

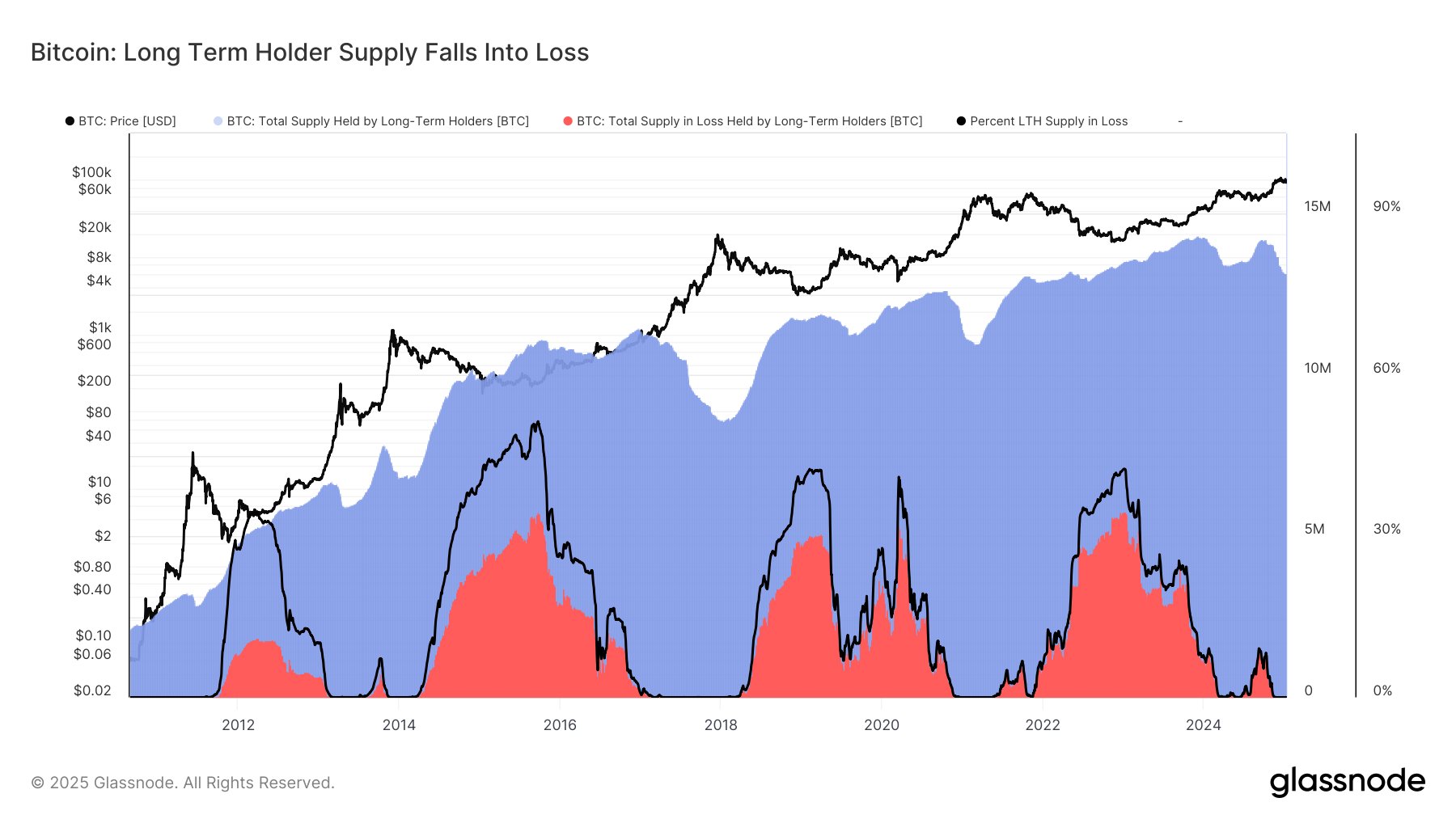

Glassnode concludes its evaluation by noting that the majority long-term holders are within the inexperienced.

“One other issue to contemplate: Bitcoin LTH provide in loss stays at 0%. Almost all Lengthy-Time period Holders are nonetheless in revenue. Traditionally, when LTHs expertise persistent losses that develop in severity, it has typically marked the true finish of a cycle. For now, that’s not the case.”

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Test Worth Motion

Observe us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any losses you might incur are your accountability. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in affiliate marketing online.

Generated Picture: Midjourney