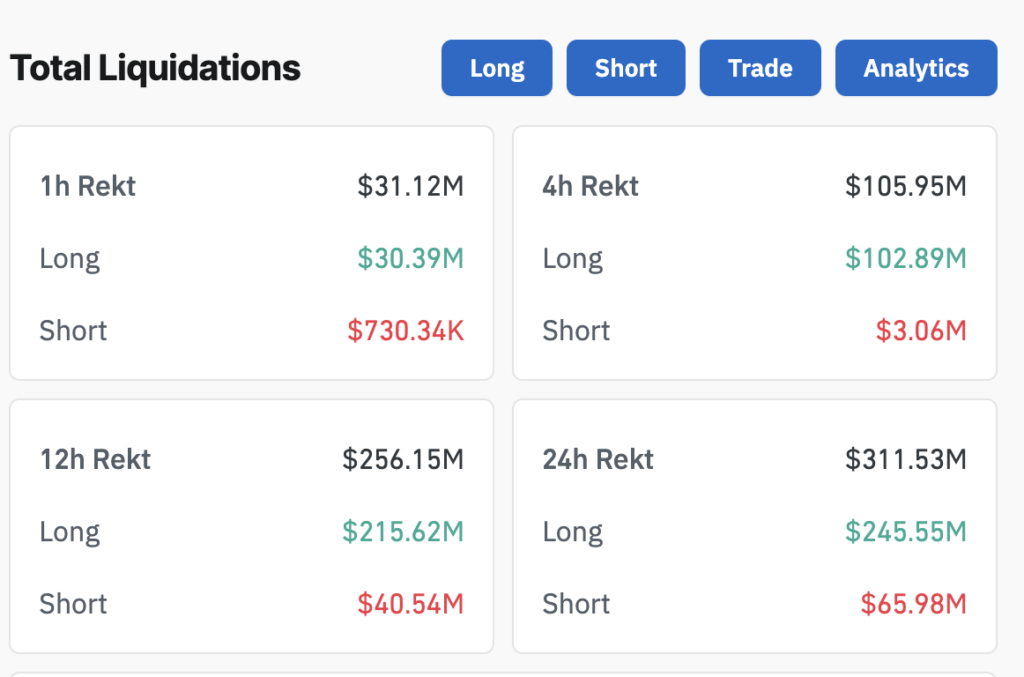

Bitcoin’s latest volatility triggered $311.53 million in complete crypto liquidations over the previous 24 hours, buying and selling between $95,000 and $92,000. This motion adopted an preliminary 2% rise offset by a 3% decline because the Asia markets opened.

Knowledge from Coinglass reveals that lengthy positions accounted for 78.82% of liquidations, totaling $245.55 million. Brief positions noticed $65.99 million in liquidations. Binance led with $127.18 million liquidated, 81.21% from lengthy positions. OKX and Bybit adopted with $79.50 million and $52.87 million liquidated, respectively, equally dominated by lengthy liquidations.

Bitcoin remained essentially the most liquidated asset, with $44.91 million from lengthy positions and $20.43 million from shorts. Ethereum adopted at $34.31 million liquidated from longs and $18.11 million from shorts. Different belongings, together with Solana, XRP, and Dogecoin, collectively contributed to the liquidations, reflecting broader market instability.

The most important single liquidation occurred on Binance’s BTCUSDT pair, valued at $8.21 million. Over 132,800 merchants had been affected, as crypto liquidations have remained elevated regardless of a slight decline in open curiosity. OI has fallen to $60 billion from a excessive of $71 billion on Dec. 18.