Crypto inflows totaled a modest $48 million final week, reflecting a risky market response to shifting macroeconomic indicators and up to date financial coverage developments within the US.

This important change in comparison with the primary week of 2025 signifies that the transient post-US election rally might have ended, with macroeconomic situations as soon as once more driving asset costs.

Hawkish Fed Impacts Crypto Inflows

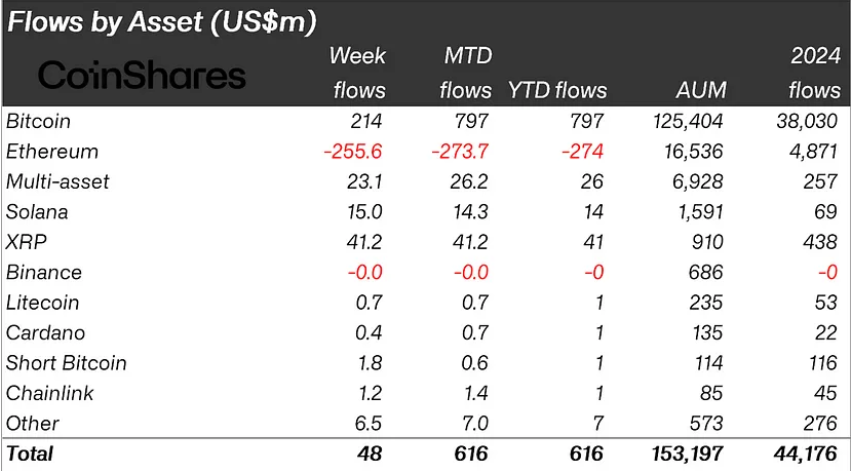

The most recent CoinShares report reveals that digital property noticed almost $1 billion in inflows in the course of the first half of the week ending January 11. Nevertheless, stronger-than-expected macroeconomic information and the discharge of the US Federal Reserve’s minutes led to outflows of $940 million within the latter half of the week.

“This implies that the post-US election honeymoon is over, and macroeconomic information is as soon as once more a key driver of asset costs,” the report learn.

Certainly, the Federal Open Market Committee (FOMC) minutes from final week mirrored the Fed’s rising issues about inflationary pressures. Policymakers are particularly involved about President-elect Donald Trump’s proposed fiscal insurance policies.

The minutes offered little indication of a possible fee lower within the close to time period, additional solidifying the Fed’s hawkish stance. As BeInCrypto reported, this stance has exerted downward stress on threat property, together with cryptocurrencies.

Bitcoin, the main digital asset, exemplified this pattern. Regardless of recording inflows of $214 million earlier within the week, it skilled important outflows later, mirroring broader market sentiment. However, Bitcoin stays the best-performing digital asset year-to-date, with cumulative inflows of $797 million.

The abrupt shift in sentiment disrupted what had been a promising begin to 2025. Throughout the first week of the yr, crypto inflows reached a powerful $585 million. This momentum appeared poised to proceed, however the newest macroeconomic developments have dampened enthusiasm.

With macro tendencies now again as key market drivers, key US financial information launched later this week might affect Bitcoins and crypto sentiment. Particularly, the Shopper Worth Index (CPI) and Producer Worth Index (PPI) may very well be pivotal in assessing the economic system’s trajectory and, by extension, investor sentiment towards cryptocurrencies.

Buyers will intently monitor the CPI and PPI studies, in addition to jobless claims, for any indicators of easing inflation or labor market cooling. Such information might present clues in regards to the Fed’s subsequent strikes, doubtlessly providing a clearer outlook for digital asset markets.

Regardless of the latest setback, the long-term outlook for cryptocurrencies stays optimistic forward of Trump’s inauguration subsequent week.

Based on BeInCrypto information, Bitcoin remains to be holding above the $90,000 psychological stage, buying and selling at $91,565 as of this writing. However, the percentages favor the draw back amid fading demand, with some analysts anticipating one other leg down for BTC to backside out across the $70,000 vary.

“Taking part in out textbook Wyckoff Distribution for Bitcoin. We might see $80,000 and even increased $70,000 costs,” one dealer wrote.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.