KuCoin Token has emerged as the highest performer within the cryptocurrency market, with a 3% surge over the previous 24 hours. This value hike has triggered substantial earnings for a phase of its short-term holders (STHs).

Nonetheless, the very nature of those buyers, who usually goal to capitalize on fast value actions, poses a possible risk to the sustainability of KCS’s current positive aspects. This evaluation particulars why.

Quick-Time period Holders Put KuCoin Token at Threat

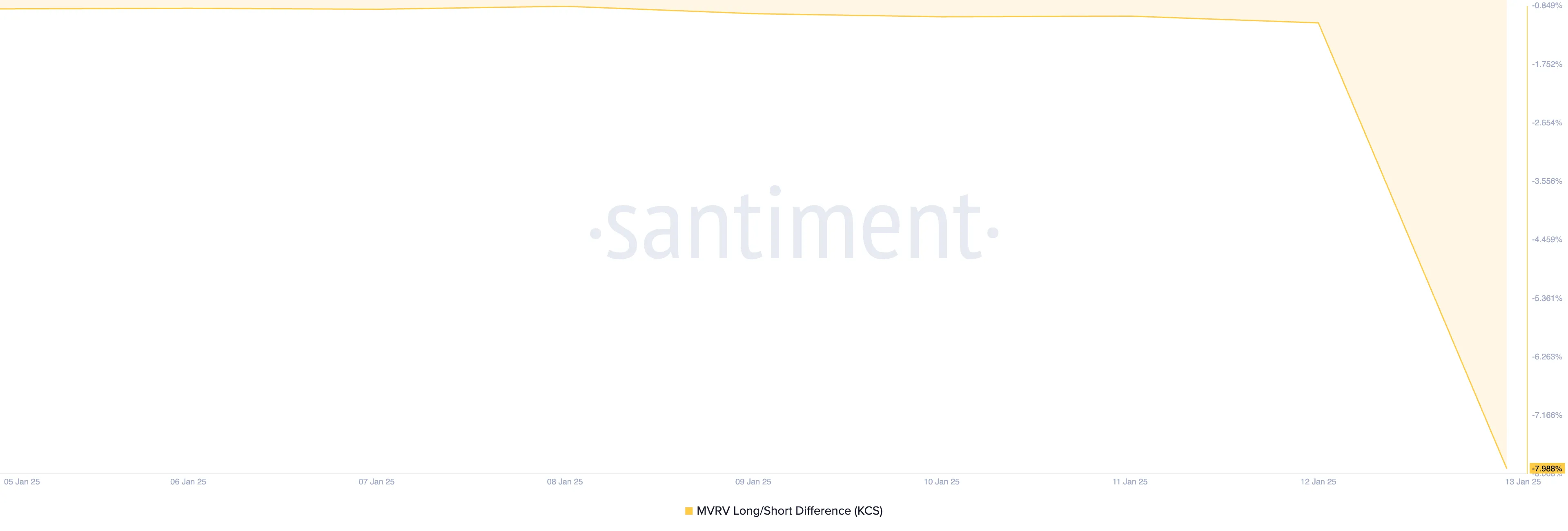

KCS has famous a 376% uptick in its buying and selling quantity over the previous 24 hours, pushing its value up 3% throughout that interval. Resulting from this hike, many KCS STHs are actually in revenue, mirrored by the readings from its MVRV Lengthy/Quick Distinction. As of this writing, this sits at a 30-day low of -7.98%.

An asset’s MVRV Lengthy/Quick Distinction measures the relative profitability between its long-term and short-term holders. When the metric’s worth is optimistic, it means that its long-term holders are extra worthwhile, indicating bullish sentiment and potential for additional value appreciation.

Then again, as with KCS, a unfavourable distinction means that Quick-Time period Holders (STHs) are extra worthwhile, signaling bearish sentiment and the potential for a value drop. These buyers, who usually maintain belongings for shorter intervals, usually tend to promote their tokens throughout short-term value fluctuations to safe earnings.

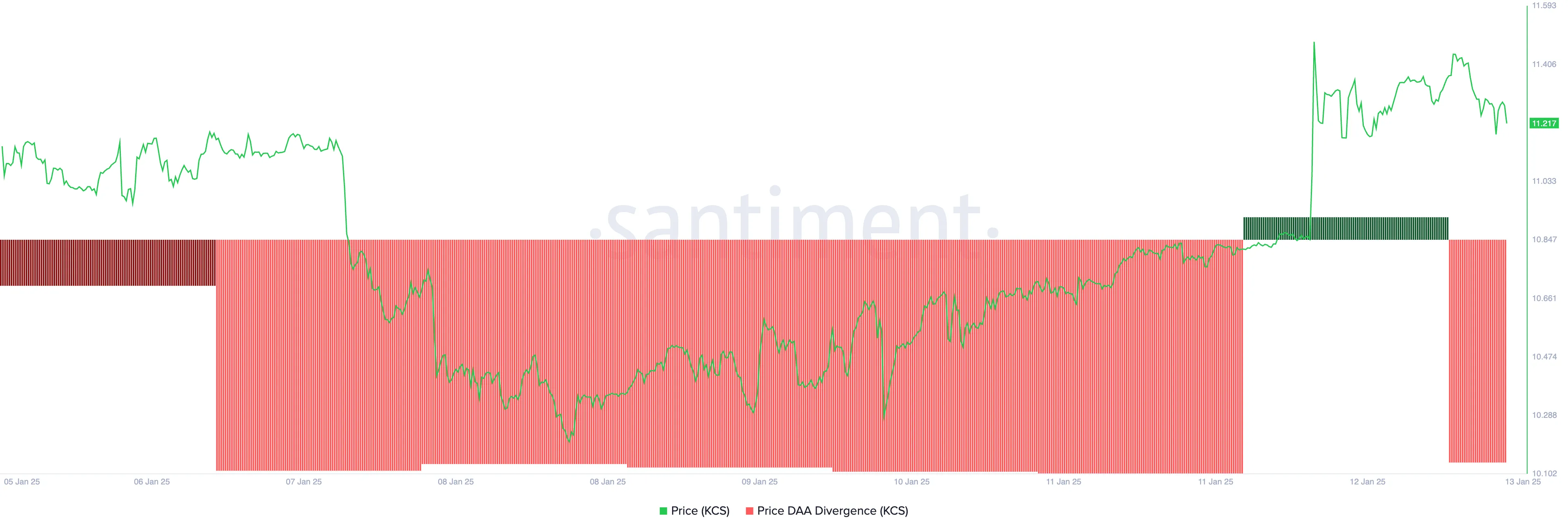

Furthermore, regardless of KCS’s value hike, its Value DAA (Each day Lively Addresses) Divergence indicator has solely flashed promote indicators in the present day.

This implies that whereas the value is climbing, community exercise doesn’t help the rally, hinting at underlying weak spot. If this pattern persists as speculative merchants take earnings, a KCS value reversal is imminent.

KCS Value Prediction: Bearish Divergence Factors to Potential Reversal

An evaluation of the KCS/USD one-day chart exhibits the potential formation of a bearish divergence between the altcoin’s value and its Chaikin Cash Stream (CMF). At press time, this indicator is in a downward pattern at 0.01 and is poised to fall beneath the zero line.

An asset’s CMF measures cash circulation into and out of its market. When it declines throughout a value rally like this, a bearish divergence is shaped. This divergence indicators that promoting stress is growing, doubtlessly undermining the sustainability of the upward momentum.

If KCS’ CMF slips beneath zero, confirming the strengthening selloffs, its value will reverse its present pattern and fall to $10.15.

Nonetheless, if shopping for stress will increase, this bearish outlook can be invalidated. In that state of affairs, KCS’ value might breach resistance at $11.42 and climb towards $13.82.

Disclaimer

According to the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.