Crypto markets brace for an eventful week with a number of ecosystem developments within the pipeline. From Sonic’s new token itemizing on the Binance trade to the huge ONDO token unlock, markets might witness volatility this week.

Ahead-looking traders might think about structuring their buying and selling methods across the following occasions this week.

Sonic’s S Itemizing on Binance

In a December 24 weblog put up, Binance introduced plans to delist all current Fantom (FTM) spot buying and selling pairs on January 13. This transfer aligns with Fantom’s rebranding and token swap initiative, paving the way in which for the itemizing of Sonic’s new token, S.

FTM tokens will likely be transformed to Sonic tokens at a 1:1 ratio, making certain customers obtain the identical variety of S tokens as their FTM holdings. The preliminary circulating provide of S will likely be roughly 2.88 billion, with a complete provide of three.175 billion — matching FTM’s metrics on the launch of the Sonic chain.

FTM token holders who select to not improve to the S token can proceed utilizing FTM on the Opera community. Nonetheless, collaborating in transactions, governance, and different actions on the Sonic community would require the S token.

This rebranding units the stage for Sonic’s mainnet launch in February, which is able to introduce a number of new options. These embody a decentralized trade (DEX) and a local RPC, aimed toward enhancing community reliability and scalability.

Aerodrome DEX Improve

Model 2 (V2) of Slipstream, the trade that established Aerodrome as the highest Layer-2 (L2) decentralized trade (DEX), is ready to launch this week. Aerodrome describes the improve as combining DeFi’s best liquidity swimming pools with dynamically adjusting charges based mostly on market volatility. This enhancement goals to ship an on-chain expertise just like an order guide whereas providing larger returns to customers.

“Lastly delivering an onchain order book-like expertise that delivers most rewards again to customers,” Aerodrome defined.

Since they carried out Slipstream in April, the protocol has had robust showings in roughly all key metrics. These advantages come as Slipstream defends liquidity supplier positions by permitting them to outline ranges for offering that liquidity (concentrated liquidity). Since Slipstream went dwell, Aerodrome has climbed from round 20% to 60% dominance over Uniswap on Base.

Slipstream V2 from Aerodrome gives decrease charges, quicker transactions, improved liquidity, and elevated income. Dynamic charges and different new options accompany this launch, probably boosting fee rewards by as much as 40%.

The common APR (annual proportion fee) to this point has been 53.17%, so if it will increase by 40%, it’ll rise to 74.44%. This improvement might impression the Aerodrome’s liquidity and value.

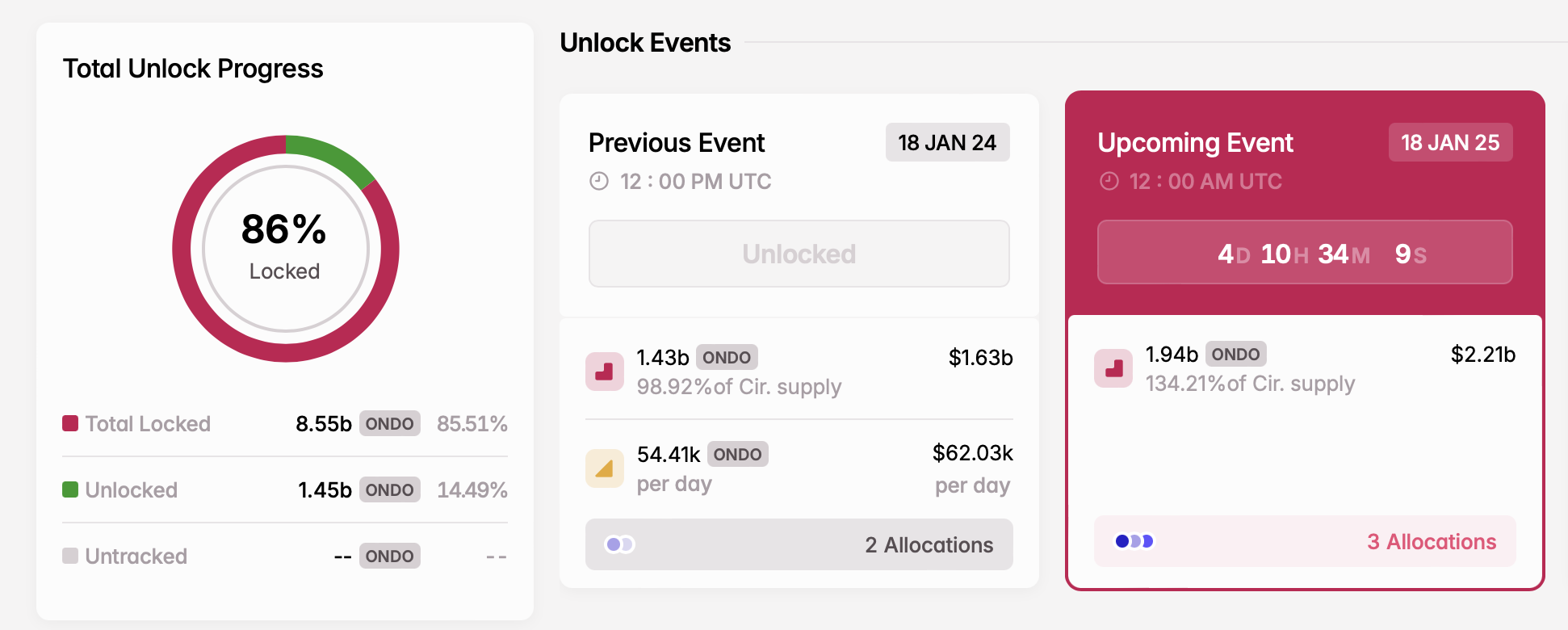

ONDO Token Unlock

The ONDO token unlock on January 18 is among the many high crypto occasions this week. As BeInCrypto reported, Ondo Finance will launch 1.94 billion ONDO tokens, presently valued at $2.15 billion. This unlock represents 134.21% of the present circulating provide. The tokens will likely be allotted for personal sale members, ecosystem development, and protocol improvement.

A current survey confirmed that 90% of unlocks create damaging value stress, with bigger occasions inflicting sharper declines. The report confirmed that investor unlocks exhibit extra managed value conduct in comparison with crew unlocks.

Relating to tokens allotted towards ecosystem improvement, these have uniquely optimistic results. They usually end in value will increase (+1.18% on common) as they inject liquidity or incentivize ecosystem development. The tokens sometimes serve for infrastructure improvement, contributing to long-term ecosystem development.

Solv Protocol Token Launch

One other vital crypto information this week is the launch of Solv Protocol’s native token SOLV on January 17. Solv Finance is a decentralized platform targeted on liquidity and yield infrastructure for digital belongings, together with offering a liquid staking resolution for Bitcoin. The protocol has constructed a decentralized Bitcoin reserve that now holds over 25,000 BTC.

The venture lately raised $22 million in a funding spherical, giving it a valuation of roughly $200 million. As Bitcoin DeFi merchandise proceed to see development in Whole Worth Locked (TVL) and adoption, Solv Protocol is rising as a key participant within the area.

The SOLV token will likely be listed on Binance and Bitget exchanges, the place it’ll commerce towards USDT, BNB, FDUSD, and TRY on Binance. Moreover, the protocol includes a public sale providing that features a Binance mega drop, presenting a possibility for Binance Coin (BNB) holders to profit.

“Rewards Method relies on locked BNB rating + Web3 Quest Bonus (with Binance pockets),” Binance stated.

Mode’s AI Terminal Launch

Mode’s AI Terminal is without doubt one of the high crypto highlights this week. This AI-powered chat co-pilot permits customers to carry out DeFi actions, probably remodeling how customers work together with DeFi protocols.

James Ross, the founding father of Mode, said that AI’s most important impression on DeFi will likely be remodeling how customers work together with protocols and networks.

Reasonably than navigating complicated DeFi app interfaces, customers can use Mode’s AI Terminal and Agent to seamlessly execute transactions and deploy contracts immediately on-chain. This innovation goals to simplify and improve the DeFi person expertise.

Blast Cell Platform Launch

Blast can also be making headlines this week with the anticipated launch of its cellular platform. Alongside this, the Layer-2 community is predicted to unveil a significant tokenomics improve. These developments intention to enhance person expertise and increase adoption, positioning BLAST as a token to observe intently.

“We’ve been heads down for months, and we’re lastly near launch. We’re placing within the closing touches on Blast’s cellular platform, tokenomics updates, and different key bulletins. Every thing will go dwell subsequent month,” Blast stated in a December put up.

In a follow-up put up this previous weekend, the L2 community urged all Blast Dapps to distribute Factors and Gold to customers forward of these modifications.

“There will likely be no January Gold distribution. All customers ought to make sure that to signal into the Blast web site with their wallets as nicely,” Blast defined.

US CPI

Rounding up the record this week is the US CPI (Client Value Index) report, due on Wednesday. This US financial information is more likely to affect Bitcoin by signaling inflation developments and Fed coverage. In addition to the CPI, the upcoming Trump inauguration additionally has markets on edge. It marks the primary pro-Bitcoin administration to ascend the Oval Workplace within the US.

“Macro is guiding the dialogue proper now. Eyes on the PPI tomorrow and the CPI on Thursday. We’re one week away from the primary pro-Bitcoin administration within the US…Sure, we would go decrease, however the truth that we’re not going up proper now signifies that Trump’s inauguration seems to be much less and fewer like a sell-the-news occasion,” one person on X opined.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.