The crypto markets are witnessing an enormous surge in liquidations as Bitcoin (BTC) out of the blue drops to a brand new 2025 low, dipping under $90,000 for the primary time this 12 months.

New information from market intelligence platform Coinglass exhibits merchants noticed liquidations over the last 24 hours to the tune of $716.05 million, principally by these betting lengthy on Bitcoin and Ethereum (ETH).

The flagship crypto asset dipped to a 2025 low of about $89,800 on Monday earlier than returning to the $90,000 vary. Bitcoin is buying and selling for $91,701 at time of writing, down 3.5% within the final 24 hours.

In the meantime, ETH is buying and selling for $3,019 at time of writing, down 8.1% within the final 24 hours.

A number of standard analysts are weighing in on Bitcoin after the sudden market dip.

Crypto analyst and dealer Michaël van de Poppe tells his 763,200 followers on the social media platform X that he’s leaning bullish on Bitcoin if it may well maintain $92,000 as assist on the each day chart.

“Bitcoin has taken all of the liquidity and bounces up firmly. Good issues taking place. If this doesn’t shut above $92,000 and we wish to take liquidity once more, brace for $85,000. Nevertheless, adjustments are substantial that we’re going to check greater.”

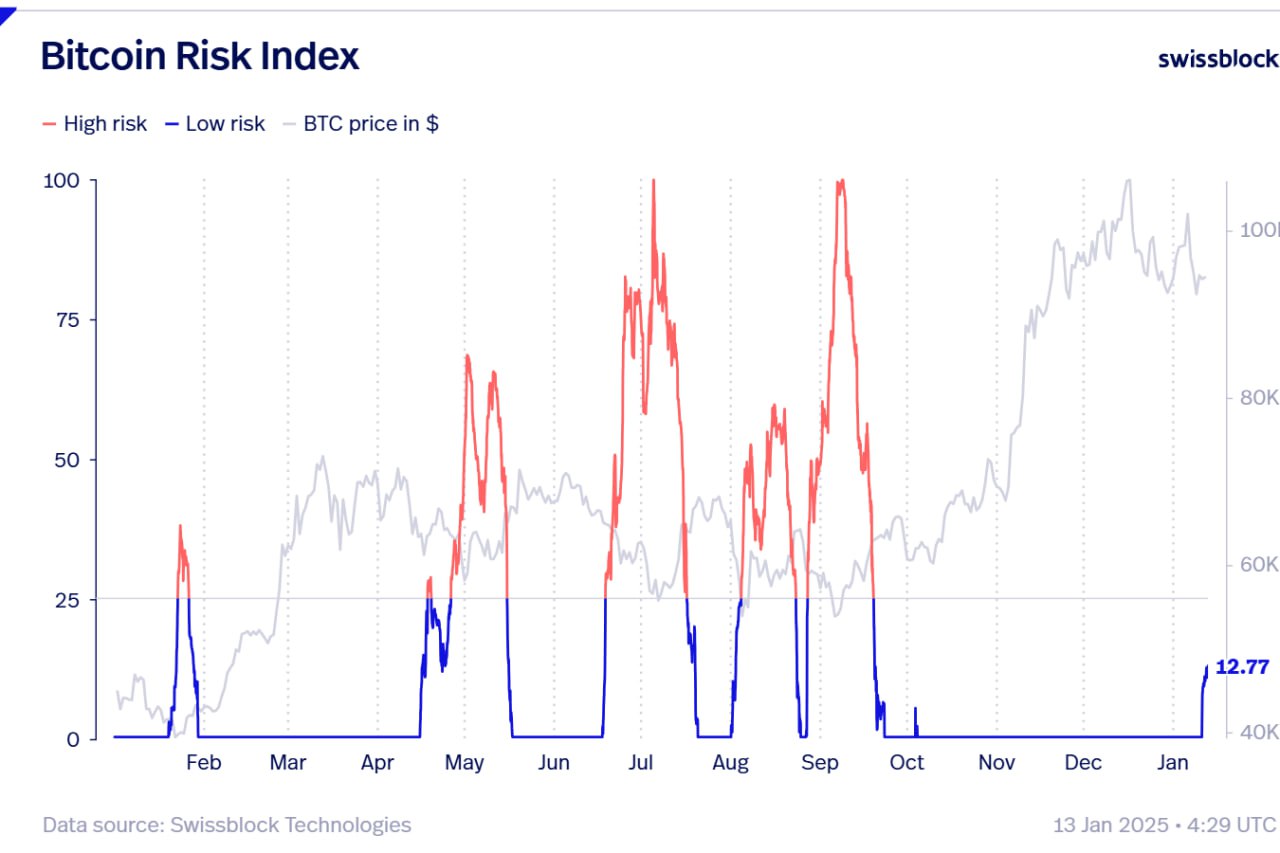

Subsequent up, Glassnode and Swissblock co-founders Jan Happel and Yann Alleman, who share the social media deal with Negentropic, say they’re intently watching their Bitcoin Danger Sign metric because it out of the blue shot up.

The Bitcoin Danger Sign makes use of metrics like worth information and on-chain information to try to find out the probability of a draw back worth motion.

“Value momentum is recovering after final week’s drop, that is the steepest shift to bearish territory since April, pre-halving. To substantiate additional decline, we’d like a danger spike – watch how rising danger aligns with falling momentum.

Key change: The Danger Index has jumped to 12 after holding at 0 since September. This might sign volatility forward. Bitcoin stays in a spread between $92,000-$100,000, however rising detrimental alerts warrant warning.”

Lastly, pseudonymous analyst The Circulate Horse tells his 255,600 followers on the social media platform X that he stays bullish on Bitcoin.

“I’m going to do the identical with $90,000 as I stated above $100,000. Bullish above till we get nearer to midrange and potential highs, bearish under. All short-term buying and selling, no concentrate on growing positions.”

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Test Value Motion

Comply with us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any losses you could incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in online marketing.

Generated Picture: DALLE3