- Leveraged buying and selling and by-product use are tempting merchants with the potential for enormous good points

- Nonetheless, excessive rewards come even increased dangers

During the last 5 years, the crypto market has been reworked by extra than simply ETFs, company holdings, and shrinking provide – Enter the rise of the derivatives market. In a record-breaking This fall, exchanges noticed a surge in leveraged trades, as daring traders positioned high-stakes bets.

Nonetheless, in a market this unstable, is excessive leverage a chance or a ticking time bomb?

Huge bets, larger dangers

One factor is obvious – The derivatives market has utterly modified the sport. With high-leverage offers now on the desk, retail merchants can place massive bets on top-tier property with out ever proudly owning them outright.

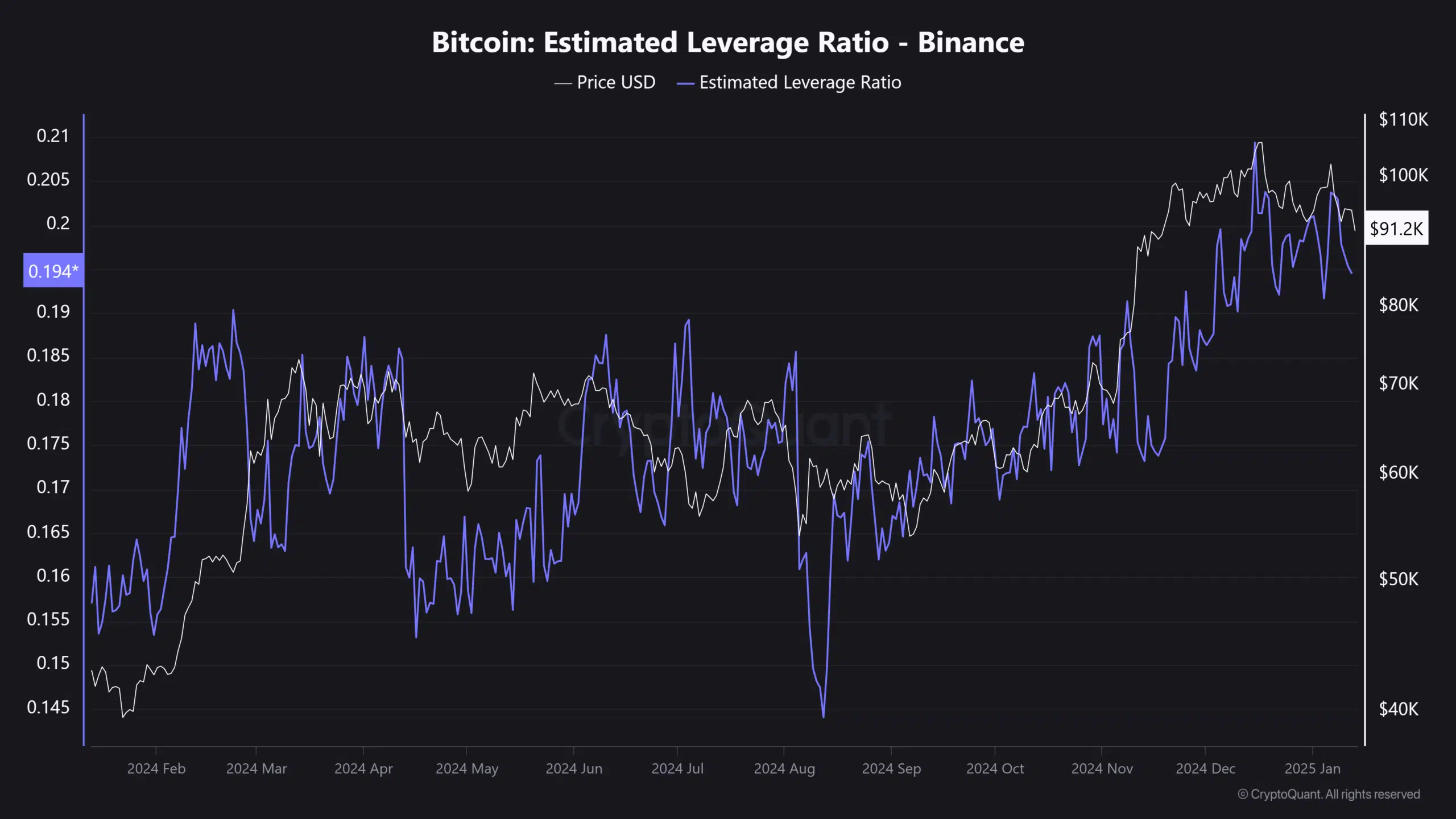

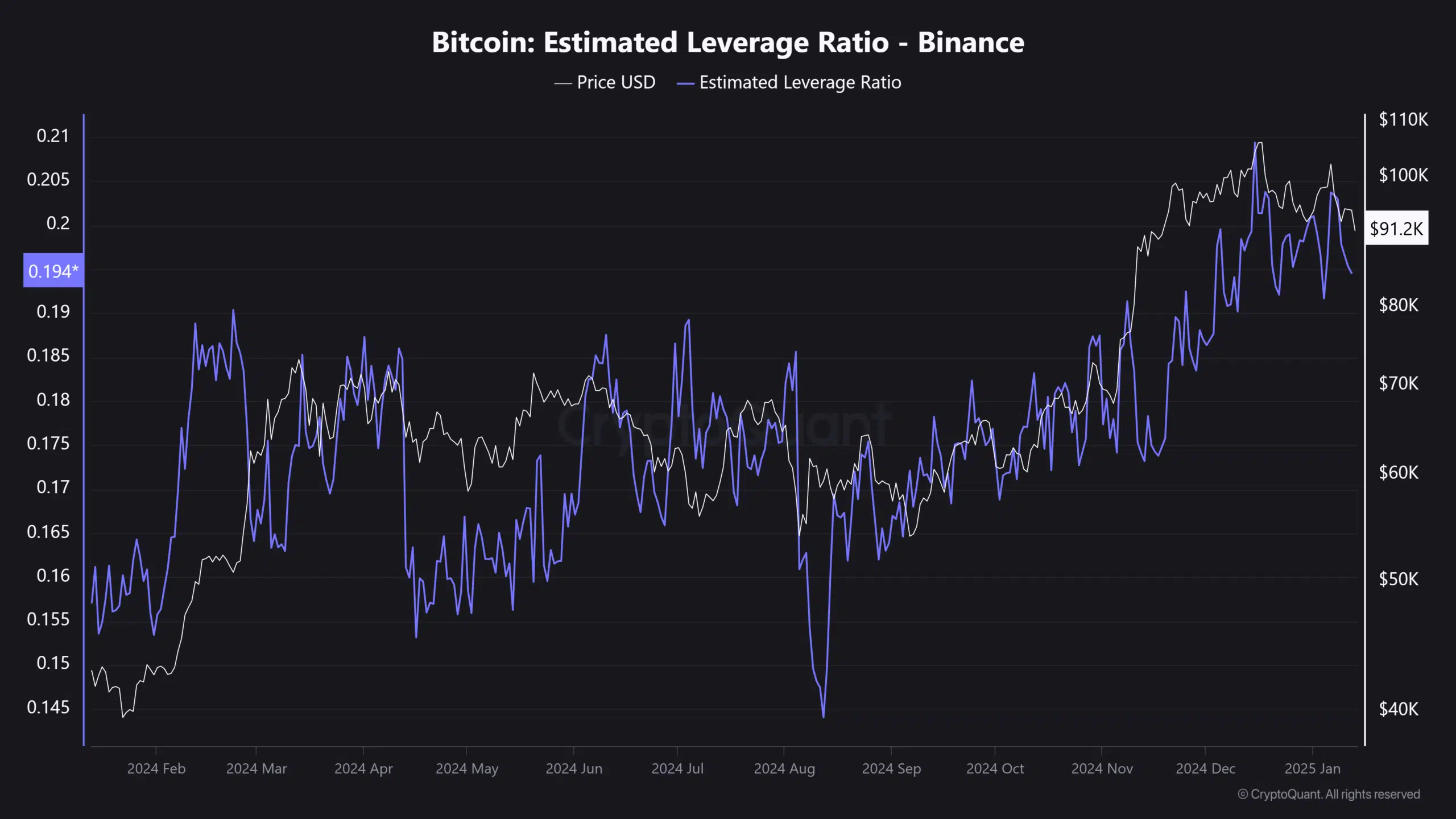

A key sign of this shift? The Estimated Leverage Ratio (ELR). This highly effective indicator exhibits how a lot leverage merchants are utilizing on common. When the ELR spikes, it’s a transparent signal that extra merchants are leaning into leverage.

Take Binance, for instance. When BTC hit $106k in mid-December, the ELR hit a yearly excessive. Merchants had been wanting to revenue from the rally, pushing Open Curiosity (OI) to a file $68 billion – It’s highest degree ever.

Supply: CryptoQuant

Nonetheless, the motion didn’t cease with Bitcoin. Even speculative property like Dogecoin [DOGE] noticed large jumps. Beginning the quarter beneath $1 billion, DOGE exploded to $2 billion, reaching a shocking $4.45 billion in OI – Mirroring Bitcoin’s explosive progress throughout the identical interval.

So, what does this inform us? Three issues are clear – First, the “Trump commerce” performed an enormous function in driving leverage. Second, even probably the most unpredictable tokens aren’t being left behind. And third, Bitcoin nonetheless leads the derivatives market.

Nonetheless, the fourth level is probably the most essential. Each time the ELR has spiked, it’s been adopted by a market prime. As Open Curiosity hits new highs, it’s a warning signal that the market is overheating with leveraged positions. The outcome?

A market shakeup from leveraged bets

Coincidence or not, the present market is displaying the dangers of an overextended system. In simply the final 24 hours, liquidations throughout all exchanges totalled a staggering $523.76 million, with a large $456.09 million in lengthy positions forcibly closed. And, the most important gamers aren’t immune.

Binance alone noticed a staggering $216 million in liquidations, whereas OKX wasn’t far behind, with $106.69 million worn out.

It’s no shock, although – Regardless of the current BTC crash, Open Curiosity (OI) stays robust above $60 billion. With Bitcoin nonetheless removed from a bull run, anticipate these leveraged positions to be squeezed out within the coming days.

Supply: Coinglass

The excellent news? Over the previous week, the Estimated Leverage Ratio (ELR) has been persistently dropping throughout most exchanges. Clearly, threat is holding traders from diving into high-leverage bets.

Quite the opposite, Bitfinex tells us a distinct story. Whereas others stay cautious, the change has seen a surge in leverage, with its ELR hitting a two-year excessive. The urge for food for threat is clearly resurfacing.

Learn Bitcoin’s [BTC] Worth Prediction 2025-26

The takeaway? Excessive leverage and excessive OI could be a bullish sign, however within the unstable market of 2025, it might backfire in an enormous means. Merchants are already shedding tens of millions in liquidations, and what we’ve seen up to now is only the start.

Watch out – ‘excessive threat, excessive reward’ is changing into the brand new norm, nevertheless it’s a harmful sport to play.