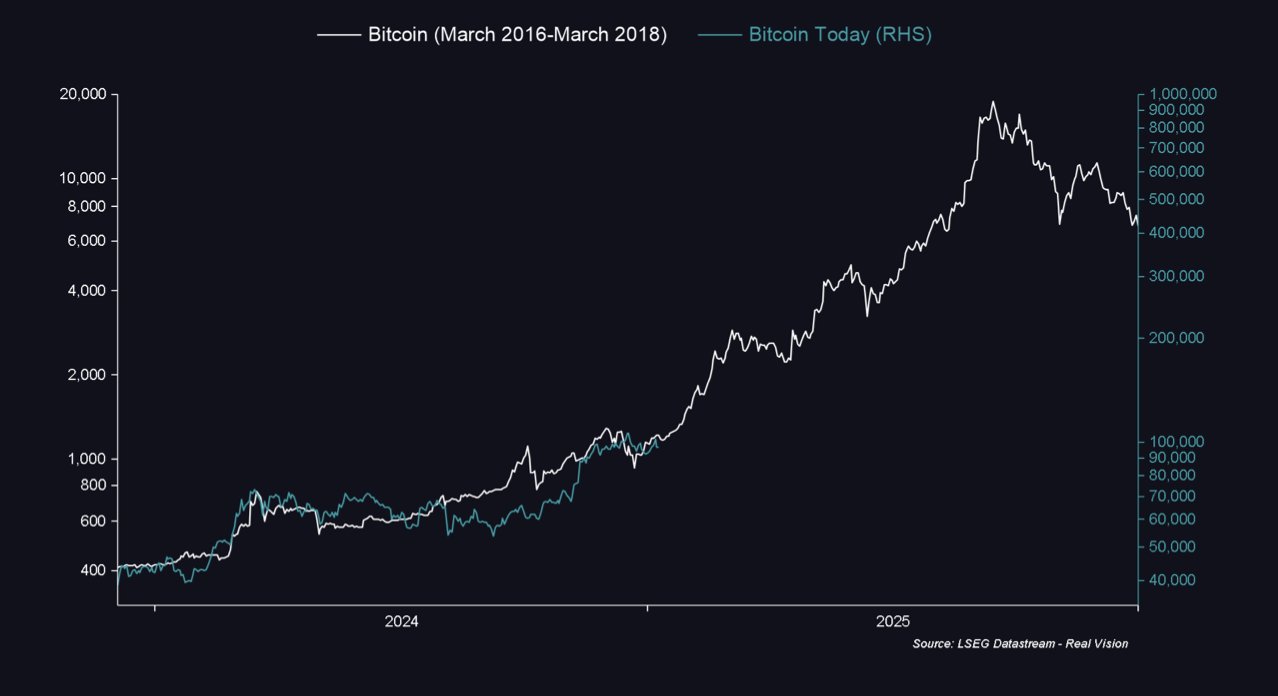

Macro strategist and ex-Goldman Sachs executve Raoul Pal believes Bitcoin could also be on the cusp of a big surge, drawing parallels to its habits in 2016.

The macro skilled identified similarities in market situations, suggesting Bitcoin may see a dramatic transfer upward, although not a precise replay of previous occasions.

Pal famous that whereas the trajectory may not mirror 2016 completely, the general sample signifies upward momentum for Bitcoin. Again in 2016, the cryptocurrency traded close to $1,000 earlier than skyrocketing to $20,000 in 2017. He suggested traders to stay affected person and concentrate on the long-term development, including, “Don’t count on a precise repeat however a rhyme. Valhalla waits.”

The worldwide M2 cash provide, a broad measure of liquidity within the world economic system, is one other key metric Pal is monitoring. He highlighted that M2 is following a sample just like the 2016-2017 interval, which coincided with Bitcoin’s historic rally. This alignment, in accordance with Pal, may sign one other vital transfer for the cryptocurrency.

Pal additionally emphasised the significance of constructing private conviction about market traits quite than relying solely on exterior opinions, encouraging traders to concentrate on Bitcoin’s long-term potential amidst short-term volatility.