Solana (SOL) value has fallen 20% within the final seven days, bringing its market cap right down to $85 billion. Technical indicators just like the Ichimoku Cloud and DMI spotlight robust bearish momentum, with SOL buying and selling beneath essential ranges and dealing with intense promoting strain.

If the present downtrend continues, SOL dangers testing helps at $159 and $147, with a possible drop to $133, marking a 22.6% correction. Nonetheless, a restoration may see SOL problem resistance at $183 and, if damaged, goal a rebound to $203, providing hope for bullish momentum to return.

Solana Ichimoku Cloud Confirms a Bearish Setup

The Ichimoku Cloud chart for Solana reveals a bearish outlook. Its value is buying and selling nicely beneath the cloud (Kumo), signaling robust downward momentum. The cloud itself is pink and increasing, indicating an rising bearish development and resistance forward.

Moreover, each the conversion line (blue) and the baseline (pink) are trending downward, with the conversion line beneath the baseline, reinforcing the bearish setup. This alignment highlights ongoing promoting strain with no rapid indicators of reversal.

Furthermore, the lagging span (inexperienced) is beneath the worth and the cloud, additional confirming the bearish bias. Conversely, for any restoration to happen, SOL value would want to interrupt above the cloud.

SOL Present Downtrend Is Nonetheless Robust

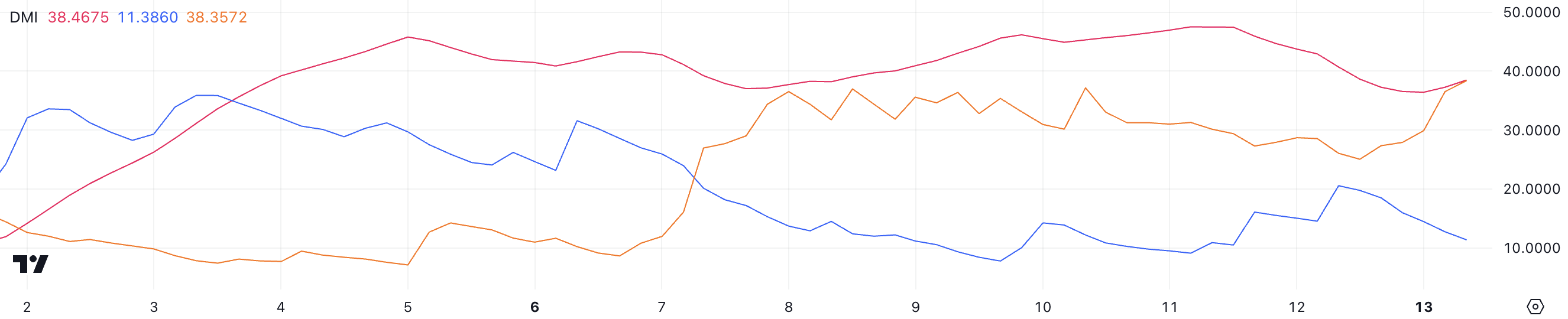

SOL DMI chart reveals its ADX at 38.4, indicating a robust development. The ADX (Common Directional Index) measures the power of a development with out specifying its path.

Values above 25 sometimes point out a robust development, and when the ADX exceeds 40, it displays very robust development power, no matter whether or not the development is bullish or bearish.

The directional indicators additional spotlight the bearish strain on SOL. The optimistic directional index (+DI) has fallen sharply from 20.5 to 11.3, signaling a major weakening of bullish momentum. In the meantime, the unfavourable directional index (-DI) has surged from 26 to 38.3, emphasizing rising bearish dominance.

Collectively, these indicators verify that SOL is firmly in a downtrend, with the robust ADX suggesting the downtrend is unlikely to reverse within the quick time period. Until +DI reveals indicators of restoration or -DI declines, SOL value might stay below strain within the close to time period.

SOL Worth Prediction: Can Solana Go Under $140 In January?

If the present downtrend persists, Solana value may check its subsequent help degree at $159. Ought to this degree fail to carry, the worth might drop additional to $147, with a continued robust downtrend doubtlessly driving it right down to $133, representing a 22.6% correction from present ranges.

Then again, if SOL value manages to get well its momentum, it may problem the resistance at $183. A break above this degree may pave the way in which for a rebound towards $203, marking a major restoration.

Disclaimer

Consistent with the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.