George City, Cayman Islands, January 14th, 2025, Chainwire

Sonic Labs introduced the launch of its factors program at the moment, an modern incentive framework designed to reward customers and stimulate the expansion of DeFi on Sonic.

By means of a multi-layered strategy that mixes passive asset holding, energetic liquidity deployment, and developer-focused “Sonic Gems”, this system will distribute round 200 million S tokens as a part of the S airdrop.

This initiative positions Sonic because the premier hub for DeFi lovers and newcomers, providing an ecosystem the place customers can improve the utility and alternatives of their property.

Three Varieties of Factors

The Sonic Factors program gives customers a number of alternatives to build up factors:

1. Passive Factors

Holding whitelisted property in a Web3 pockets, comparable to Rabby or MetaMask, or a {hardware} pockets permits customers to build up passive factors, whereas property saved on centralized exchanges are excluded.

2. Exercise Factors

If customers select to deploy whitelisted property as liquidity on collaborating apps, comparable to DEXs, lending protocols, or different apps, they’ll acquire exercise factors along with their passive factors. This strategy incentivizes customers who actively contribute to the community’s liquidity.

3. App Factors (Sonic Gems)

Along with the user-focused portion of the airdrop, Sonic Labs has designed a developer-focused portion the place collaborating apps compete for an allocation often known as Sonic Gems. Apps can redeem these Gems for S tokens, which they could distribute to their customers as rewards by way of unbiased factors applications.

By controlling token distribution, apps can design tailor-made factors applications by incorporating weighting components based mostly on the entire liquidity a consumer gives or the length that capital is deployed. The aggressive facet of Sonic Gems permits customers to strategically select apps that exhibit sturdy Gems incomes potential and supply well-structured factors applications, optimizing alternatives for capital development throughout the ecosystem.

Whitelisted Property

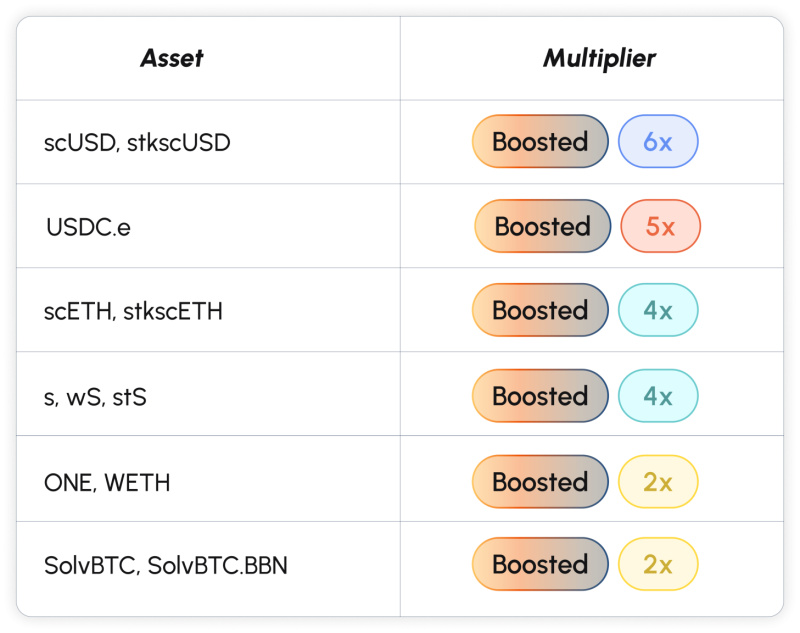

To get factors, customers should choose from Sonic’s preliminary checklist of whitelisted property, which ranges from scUSD, USDC.e, and scETH, to different choose tokens. Notably, the property have boosted multipliers within the preliminary phases of the factors program to foster speedy adoption.

Extra property could also be whitelisted sooner or later, making certain the continued evolution of the ecosystem.

Rings: Infusing Apps on Sonic With Liquidity

An essential aspect in Sonic’s liquidity technique is Rings, a yield-bearing stablecoin protocol. By depositing stablecoins or ETH-based tokens, customers can mint scUSD or scETH (each whitelisted property).

Whereas these tokens are deployed on Sonic, the collateral used to mint them is shipped to vaults on Ethereum operated by Veda, the place they generate yield. The yield generated is periodically transformed into scUSD and bridged again to Sonic, the place it’s dispersed amongst DeFi apps as liquidity infusions.

This cyclical movement not solely amplifies incomes potential for customers but in addition provides DeFi apps on Sonic with a secure influx of liquidity, which ensures deep liquidity swimming pools, extra sturdy lending markets, and a more healthy DeFi panorama general.

Rings is a third-party mission and never affiliated with Sonic Labs. Customers can study extra about Rings right here.

Airdrop Dashboard: All-in-One Hub

The Sonic factors dashboard is a complete platform on which customers can:

- Verify their earned factors

- Verify the checklist of collaborating apps

- Get whitelisted property by way of a easy interface

- Generate a referral code and share it with pals to get additional factors

- View a leaderboard that shows the factors and Gems earned by customers and apps

A New Method to DeFi

The Sonic Factors program underscores Sonic Labs’s dedication to empowering customers and builders with a dynamic vary of alternatives. By means of passive holding, energetic liquidity provision, and Sonic Gems, members can entry modern reward mechanisms whereas serving to to drive deeper liquidity and broader DeFi adoption on the platform.

Total, Sonic’s multi-layered incentive system and high-performance infrastructure set a brand new commonplace and place the chain as a premier DeFi hub.

About Sonic

Sonic is a high-performance, EVM L1 platform that provides builders enticing incentives and highly effective infrastructure for DeFi. The chain gives 10,000 TPS, sub-second affirmation occasions, and a safe gateway to Ethereum for enhanced liquidity and asset safety.

Contact

Sonic Labs

[email protected]