ETF analyst James Seyffart has shared that Canary Capital amended the S-1 submitting for its Litecoin ETF, a step that means elevated engagement from the US Securities and Trade Fee (SEC).

The newest growth relating to the proposed Litecoin ETF has sparked optimism available in the market.

Litecoin Might Be the Subsequent Crypto ETF to Obtain SEC Approval

Though Seyffart famous that there are “no ensures,” the amended submitting could point out that the SEC has began reviewing the proposal extra intently.

“CanaryFunds simply filed an amended S-1 for his or her Litecoin ETF submitting. No ensures — however this could be indicative of SEC engagement on the submitting. Nonetheless no 19b-4 submitting but although.(A 19b-4 would truly begin the potential approval/denial clock) h/t,” Seyffart wrote on Twitter on 16 January.

For context, the S-1 submitting is a vital step within the SEC’s approval course of for any new funding product. Whereas the modification itself doesn’t assure approval, it does sign that the SEC is taking note of the proposal.

Nevertheless, as Seyffart factors out, a 19b-4 submitting has not but been submitted. It’s a formal request to listing and commerce the ETF on a nationwide securities alternate.

This submitting is crucial to start out the official clock for the SEC’s potential approval or denial of the ETF, which means the method might nonetheless take a while.

Canary Capital filed for the Litecoin ETF in October final yr, lower than a month after it utilized for an XRP ETF.

Eric Balchunas, one other Bloomberg analyst, additional supported the concept the SEC has begun partaking with the Litecoin ETF submitting. Balchunas cited “chatter” suggesting that the SEC had offered suggestions on the S-1, which he believes strengthens the case for Litecoin to develop into the subsequent crypto to obtain ETF approval.

Balchunas and Seyffart each imagine that the approval of a Litecoin ETF could possibly be imminent. Nevertheless, they warning that the appointment of a brand new SEC chair represents a major variable that might impression the timeline. Thus far, the SEC has been cautious in approving cryptocurrency ETFs, with Bitcoin and Ethereum ETFs receiving some notable scrutiny.

The ETF information boosted Litecoin’s value as LTC was buying and selling at $119.22 at press time. The crypto’s value rose 16.8% over the previous 24 hours.

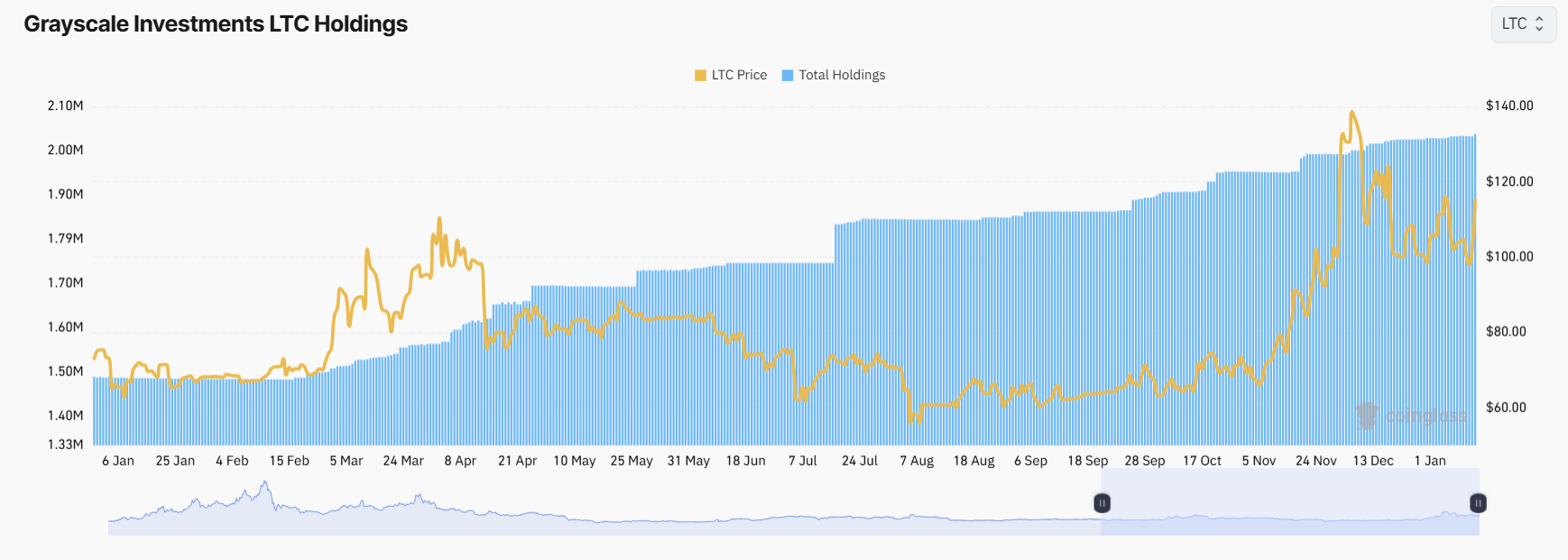

Moreover, Grayscale’s Litecoin Funding Belief already gives US traders LTC publicity by way of its ETP. It seems that the Grayscale Belief has quietly amassed over 500,000 LTC in 2024.

Based mostly on Coinglass knowledge, the Belief held lower than 1.5 million LTC cash in January 2024. A yr later, the funding big’s holdings have elevated to over 2 million. Grayscale’s transfer means that the agency anticipates robust investor curiosity in Litecoin.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.