As the US prepares for Donald Trump’s inauguration on Jan. 20, curiosity in Bitcoin amongst US traders has elevated considerably.

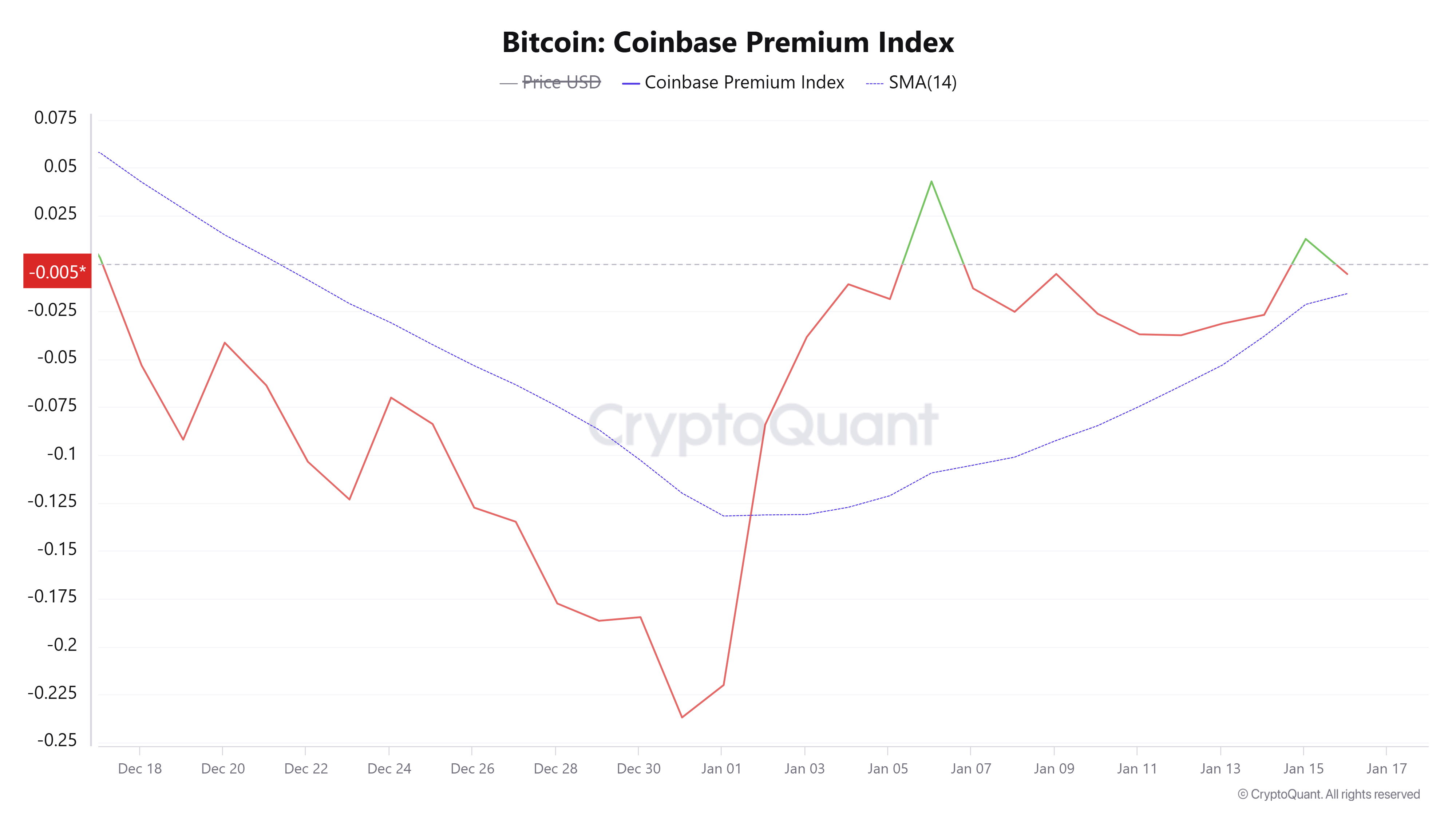

Information from CryptoQuant reveals that the Coinbase Premium Index (CPI)—a key metric evaluating Bitcoin costs on Coinbase and Binance—briefly turned optimistic on Jan. 16. This marked the primary uptick since Jan. 6, signifying a momentary enhance in demand for BTC on the US-based change.

Though the CPI has since dipped again into unfavorable territory, different indicators counsel robust accumulation traits.

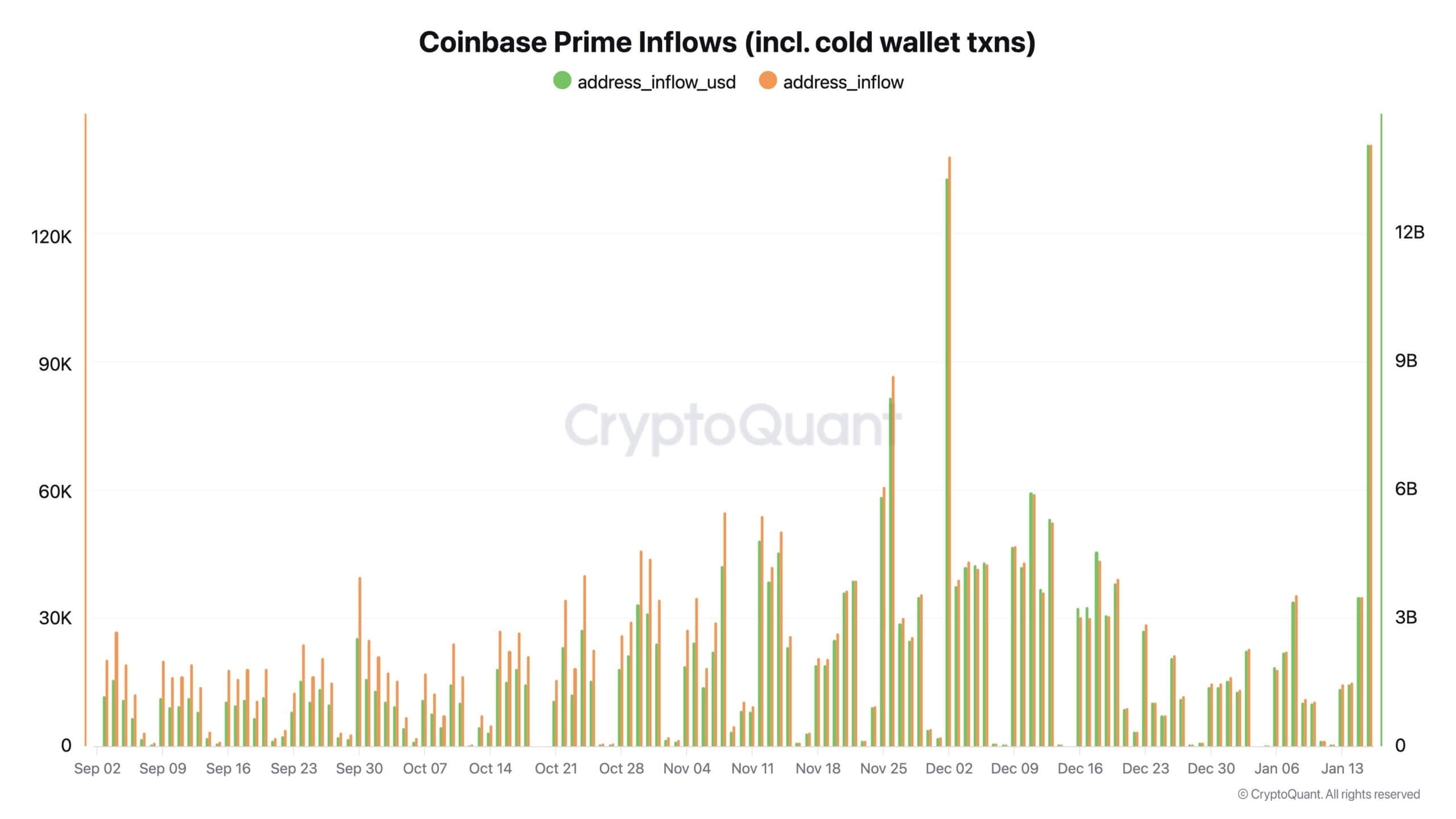

One such indicator is the rise in over-the-counter (OTC) buying and selling on Coinbase Prime, a platform institutional traders desire for giant Bitcoin transactions. This exercise indicators rising curiosity from US-based establishments, additional underscoring a bullish sentiment.

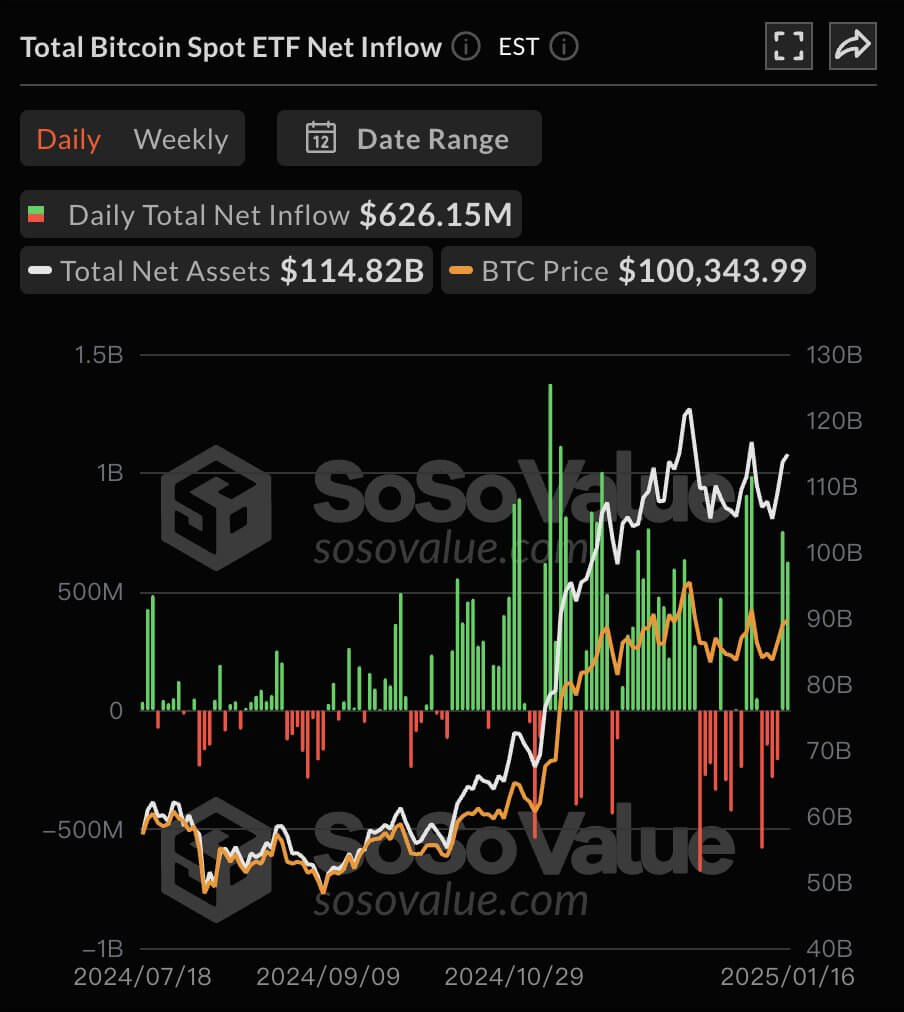

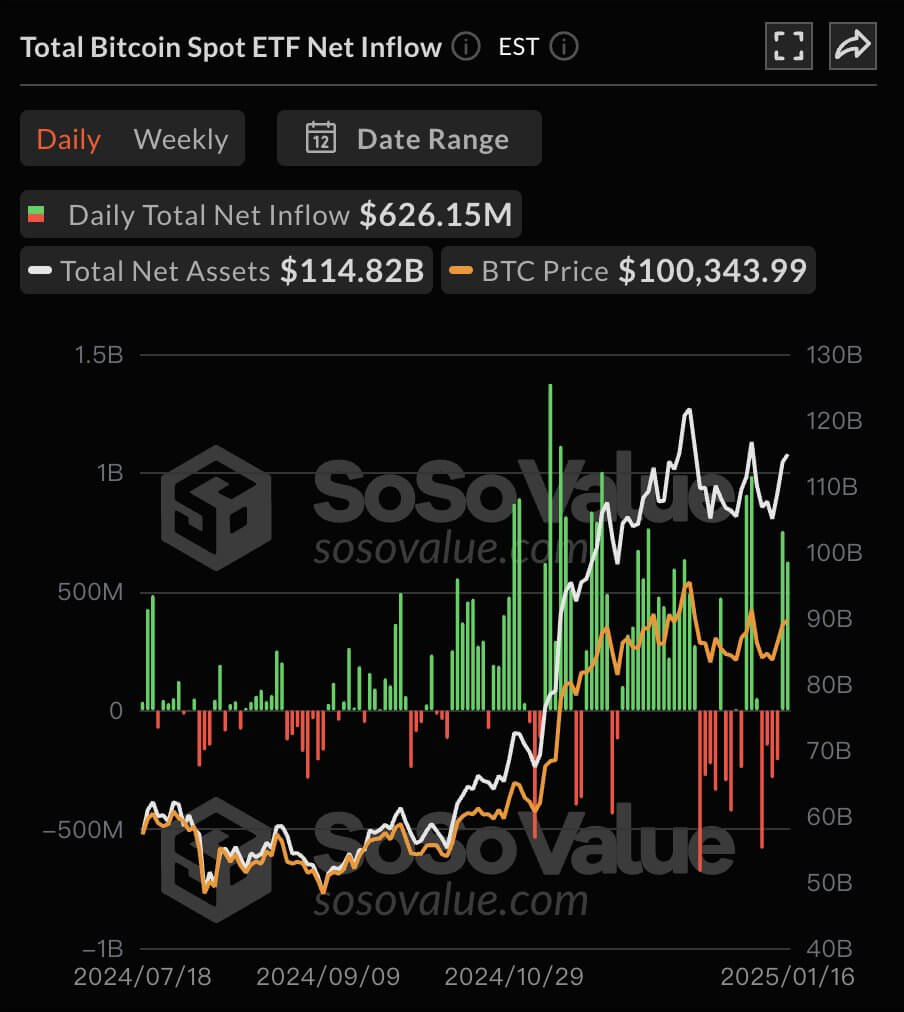

Moreover, US Bitcoin ETFs have seen a dramatic turnaround after experiencing 4 consecutive days of outflows totaling $1.2 billion. The 12 funds attracted over $1.3 billion in recent investments inside the final two days, signaling renewed investor confidence within the flagship digital asset.

Market analysts clarify that the convergence of the elevated Coinbase Premium exercise, increased OTC buying and selling, and vital ETF inflows highlights a concerted push by US traders to solidify their stake within the Bitcoin market.

This momentum might be crucial in shaping Bitcoin’s value trajectory because the inauguration approaches. Notably, BTC’s value has risen greater than 3% within the final 24 hours to $104,000 as of press time.