Bloomberg Intelligence senior macro strategist Mike McGlone is warning that Bitcoin (BTC) is going through mounting resistance at one key stage.

McGlone says that altering macroeconomic situations and exceptions that the Fed will reduce charges lower than beforehand thought in 2025 could stop Bitcoin from flipping the $100,000 resistance stage into assist any time quickly.

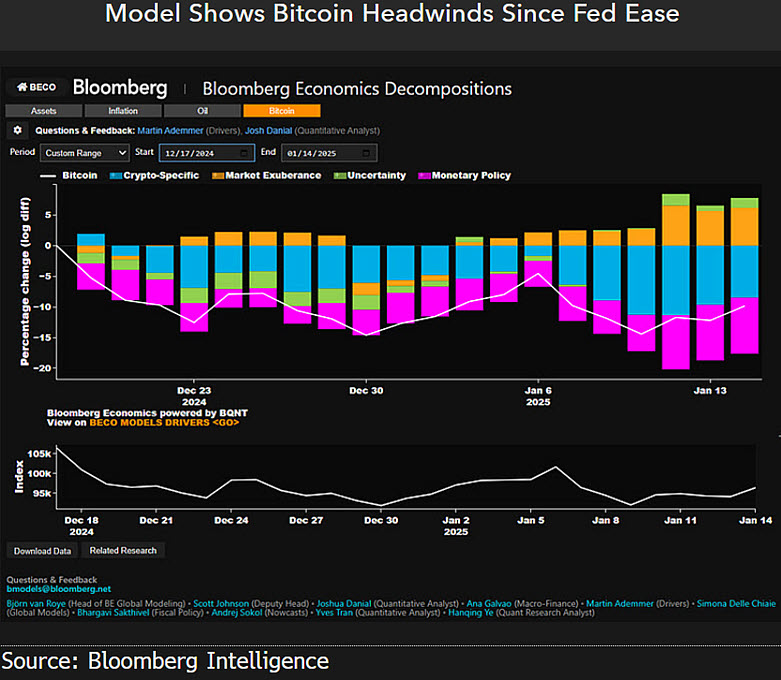

“Can Bitcoin breach $100,000? Mannequin headwinds rising: Bitcoin peaked at $108,000 on December seventeenth, the day earlier than the Federal Reserve eased, and our mannequin would possibly assist decide what to search for in 2025. My bias is that $100,000 is formidable resistance, and the mannequin reveals prime forces for Bitcoin’s virtually 15% drawdown have been altering financial coverage expectations and crypto-specific components.”

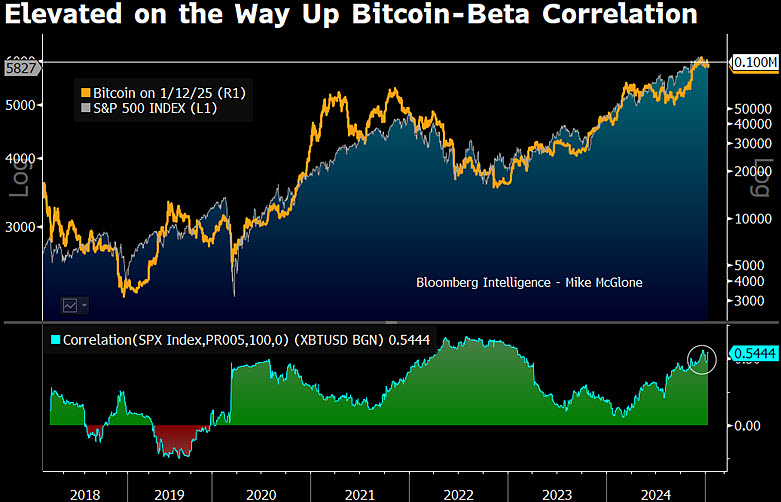

McGlone is warning that Bitcoin’s correlation with the efficiency of the S&P 500 (SPX) is elevated, suggesting value volatility.

Nevertheless, he says if Bitcoin may keep above $100,000 it might counsel the flagship crypto asset is appearing extra as a retailer of worth like gold, fairly than a risk-on tech inventory.

“Bitcoin strategic reserve dependency in 2025? Bitcoin might have to remain above the $100,000 threshold achieved in 2024 to point out risk-asset stabilization. My bias is final yr’s launch of US exchange-traded funds, Bitcoin halving, record-setting inventory market and re-election of convert turned zealot, [US President-elect Donald] Trump, could also be about pretty much as good because it will get for stretched speculative digital belongings.”

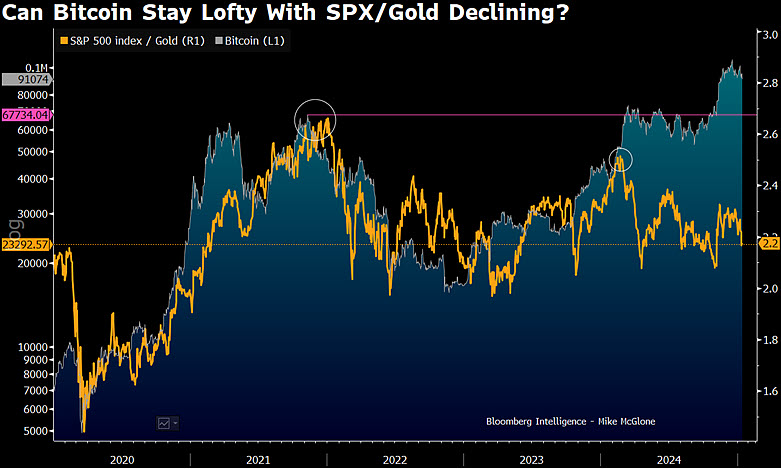

He additionally warns that gold is displaying market power in opposition to the SPX, which may sign shares could decline in addition to Bitcoin if BTC’s excessive correlation with the SPX stays intact.

“Do shares face a lose-lose versus gold, Bitcoin? Regardless of rising competitors from Bitcoin, gold has been outperforming the S&P 500 (SPX), with implications for danger belongings. Did the launch of US ETFs and Trump’s reelection change the trajectory/correlation for extremely speculative digital belongings?”

Bitcoin is buying and selling for $99,790 at time of writing, up 1.1% within the final 24 hours.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Value Motion

Observe us on X, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl will not be funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any losses it’s possible you’ll incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please be aware that The Each day Hodl participates in online marketing.

Featured Picture: Shutterstock/Alexander56891/Sensvector