As we speak, roughly $3 billion value of Bitcoin (BTC) and Ethereum (ETH) choices are set to run out, creating vital anticipation within the crypto market.

These expiring crypto choices come forward of President-elect Donald Trump’s inauguration week. Bitcoin is front-running the ascension by reclaiming the $100,000 mark.

Over $2.8 Billion Bitcoin and Ethereum Choices Expire

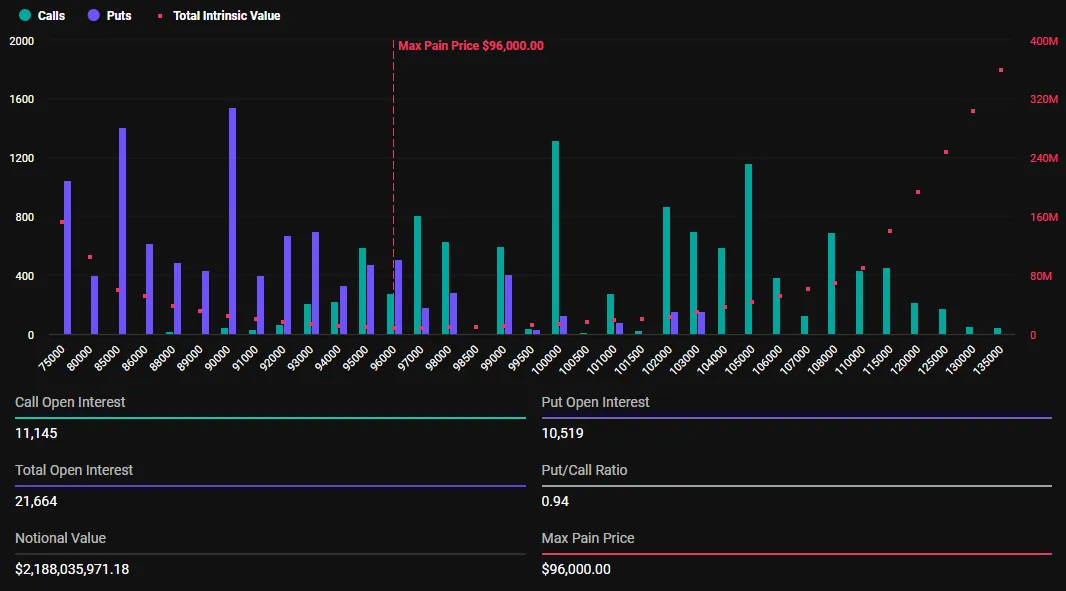

In keeping with Deribit’s information, 21,664 Bitcoin contracts, with a notional worth of roughly $2.2 billion, are set to run out in the present day. Bitcoin’s put-to-call ratio is 0.94.

The utmost ache level — the value at which the asset will trigger monetary losses to the best variety of holders — is $96,000. Right here, most contracts will expire nugatory.

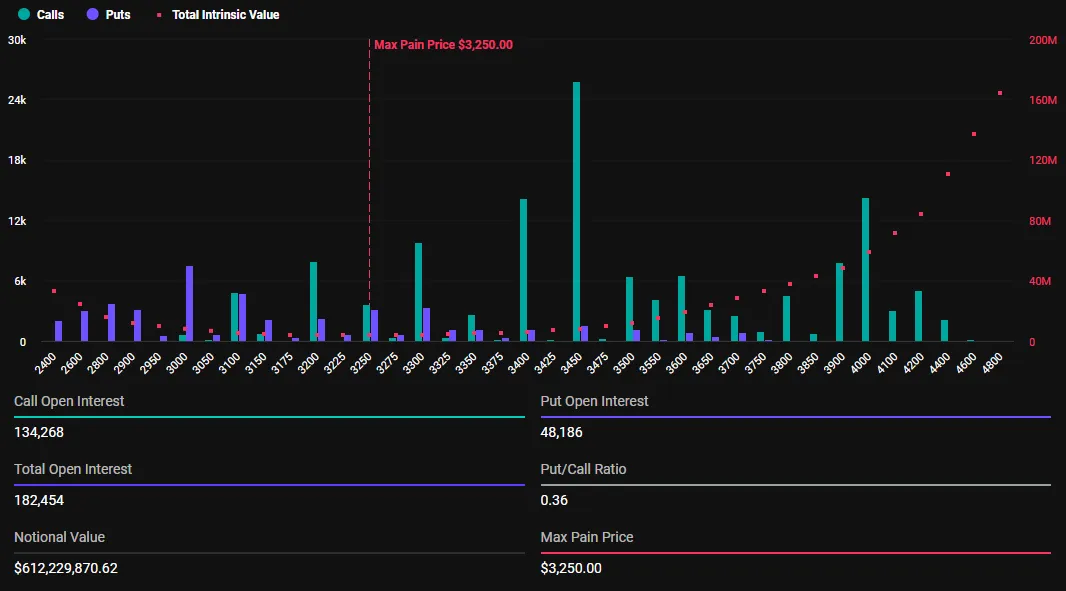

Equally, crypto markets will witness the expiry of 182,454 Ethereum contracts, with a notional worth of $612.2 million. The put-to-call ratio for these expiring Ethereum choices is 0.36, with a most ache of $3,250.

Choices expiry usually results in notable worth volatility, which makes it crucial that merchants and buyers monitor in the present day’s developments carefully. The put-to-call ratios beneath 1 for each Bitcoin and Ethereum point out optimism out there. This means that extra merchants are betting on worth will increase, reflecting optimistic market sentiment.

Bitcoin’s transfer to reclaim the $100,000 aligns with this market optimism. In the meantime, analysts at Greeks.stay ascribe the sentiment to the anticipation of Donald Trump’s presidency, as he has promised to be a “crypto president,” probably influencing business insurance policies favorably. The analysts additionally cite expectations of no fee cuts, which might affect market sentiment in the direction of cryptocurrencies.

“Bitcoin rallied once more above $100,000, sweeping away the weekend’s subdued market sentiment…Trump will formally take workplace as the brand new US President subsequent week, and it’s value keeping track of whether or not or not he’ll enact insurance policies straight favorable to cryptocurrencies this month. The US shares have picked up in latest days, and the speed assembly on the finish of the month will mainly be to take care of no fee cuts,” Greeks.stay shared on X (Twitter).

Nonetheless, the analysts observe that short-term possibility implied volatility (IV) has risen, with a major improve in lengthy power. With this, they advise buyers to buy a portion of short-term choices, citing a give attention to the anticipated coverage modifications with the federal government incumbent and the influx of ETFs (exchange-traded funds).

Additional, Greeks.stay highlights how the buying and selling conduct of various areas impacts Bitcoin’s worth. Asia and Europe offered Bitcoin, resulting in a worth drop, which was then purchased again by People, turning the market pattern optimistic. This displays the worldwide interaction in cryptocurrency markets.

“Asia and EU offered BTC in the present day after which the People purchased all of it again up on the lows? Turning a pink day right into a inexperienced day for BTC,” the publish learn.

Regardless of this in any other case snarky touch upon worth motion, this interaction, proper earlier than the anticipated volatility as a consequence of Trump’s inauguration, suggests an underlying context of political occasions influencing market sentiment.

BeInCrypto information reveals that on the time of writing, Bitcoin was buying and selling at $101,187. This represents a modest climb of 1.62% because the Friday session opened.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.