Este artículo también está disponible en español.

A current report by crypto index fund administration agency Bitwise outlines various value projections for Solana (SOL) based mostly on its adoption and scalability enhancements. In response to the report, the ‘bull case’ state of affairs might see SOL’s value soar to $6,636 by 2030.

What Units Solana Aside?

Solana, at present the sixth-largest cryptocurrency by market capitalization, has skilled a risky few years. The digital asset was closely impacted by the FTX collapse, plummeting from its earlier all-time excessive (ATH) of $250 in November 2021 to a low of $9 in November 2022.

Associated Studying

Nonetheless, regardless of the bear market triggered by the FTX debacle, SOL staged a formidable restoration, attaining a brand new ATH of $263 in November 2024. Bitwise’s report means that SOL’s development potential stays vital within the coming years.

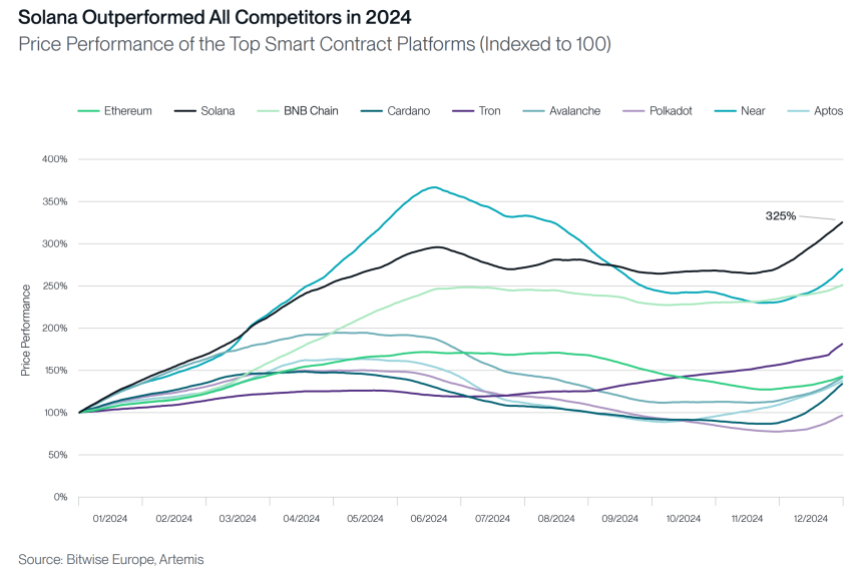

The report identifies three core pillars supporting Solana’s funding case: sustainable economics, developer attraction, and constant execution. It highlights Solana’s exceptional outperformance in comparison with different main sensible contract platforms by way of value development in 2024.

Dubbed the “iPhone second for blockchain” by the report, Solana’s standout options embody its means to course of 65,000 transactions per second (TPS) and its low transaction prices. This excessive throughput positions it as a great platform for constructing decentralized, high-volume, low-latency functions, comparable to decentralized exchanges (DEXs).

The chart beneath demonstrates that Solana’s TPS rivals that of Visa and much surpasses competing sensible contract platforms like BNB Chain and Ethereum. Moreover, Solana skilled a parabolic enhance in day by day lively addresses (DAA) in 2024, surpassing the mixed DAA of Bitcoin (BTC) and Ethereum (ETH), indicating rising adoption.

When it comes to tokenomics, the report notes that 80.7% of SOL’s whole provide is at present in circulation, with the remaining 19.3% labeled as non-circulating provide. Whereas considerations about potential token inflation persist, Solana’s inflation price decreases yearly and is projected to drop to 1.85% by 2030.

The SOL Bull Case

The report applies Metcalfe’s Legislation to estimate Solana’s community worth. For these unfamiliar, Metcalfe’s Legislation posits {that a} community’s utility will increase proportionally to the sq. of its consumer base. The report states:

For the sake of simplicity, we assume the Each day Energetic Addresses (DAA) to be the variety of customers and the market capitalization to signify the utility of the community represented in financial phrases.

Accordingly, the report shares the bear case, the bottom case, and the bull case for Solana. The bear case for SOL foresees a cumulative annual development price of 35.1%, yielding a goal value of $2,318 by 2030.

Associated Studying

Equally, the bottom case assumes a CAGR of 47.2%, leading to a value of $4,025 by 2030. Quite the opposite, the bull case for SOL tasks a value goal of $6,636 by 2030, propelled by a CAGR of 59.1%.

The report provides that the aforementioned forecasts have in mind the pure deceleration that happens as networks mature and obtain vital scale. At press time, SOL trades at $214.86, up 8% prior to now 24 hours.

Featured picture from Unsplash, Charts from Bitwise and TradingView.com