Sonic (previously FTM) value has risen 1.8% within the final 24 hours, with buying and selling quantity surging 500% to $114 million. Technical indicators just like the ADX and EMA strains recommend a strengthening uptrend, with the potential of testing key resistance ranges if momentum holds.

Nevertheless, bearish indicators from the BBTrend indicator level to combined circumstances, suggesting that merchants ought to stay cautious a couple of potential reversal.

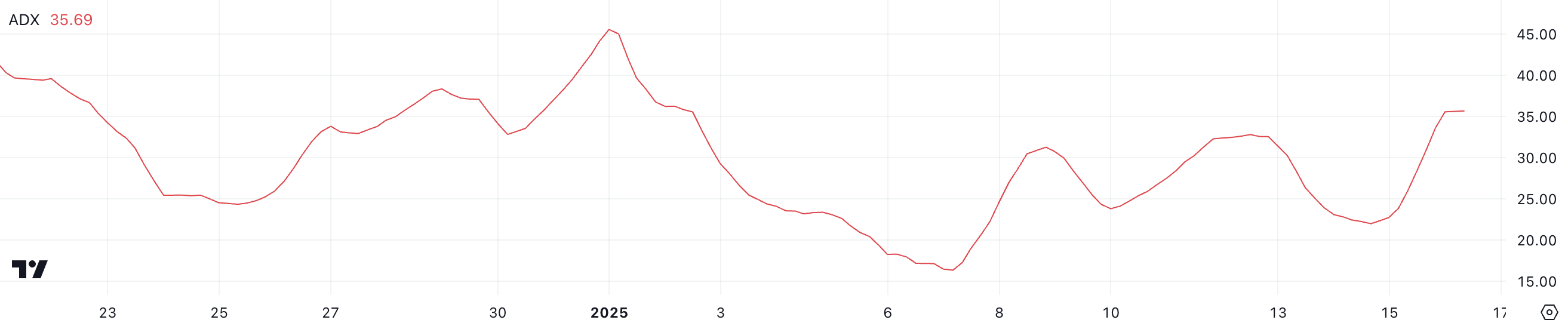

Sonic ADX Signifies a Robust Ongoing Uptrend

Sonic Common Directional Index (ADX) is at the moment at 35.6, a considerable rise from 21.9 simply two days in the past. This improve signifies a powerful and strengthening development, because the ADX has now moved nicely above the 25 threshold, which generally indicators a powerful development.

The current formation of a golden cross provides additional bullish affirmation, suggesting that Sonic is positioned to increase its present uptrend.

The ADX measures the power of a development, with values under 20 indicating weak or range-bound circumstances and values above 25 pointing to a powerful and outlined development. At 35.6, Sonic ADX displays stable momentum, supporting the continuation of its upward trajectory.

This degree of development power, mixed with the golden cross, suggests Sonic may see additional value good points if shopping for stress persists. Nevertheless, any stalling within the ADX may point out fading momentum, probably resulting in consolidation or a pullback.

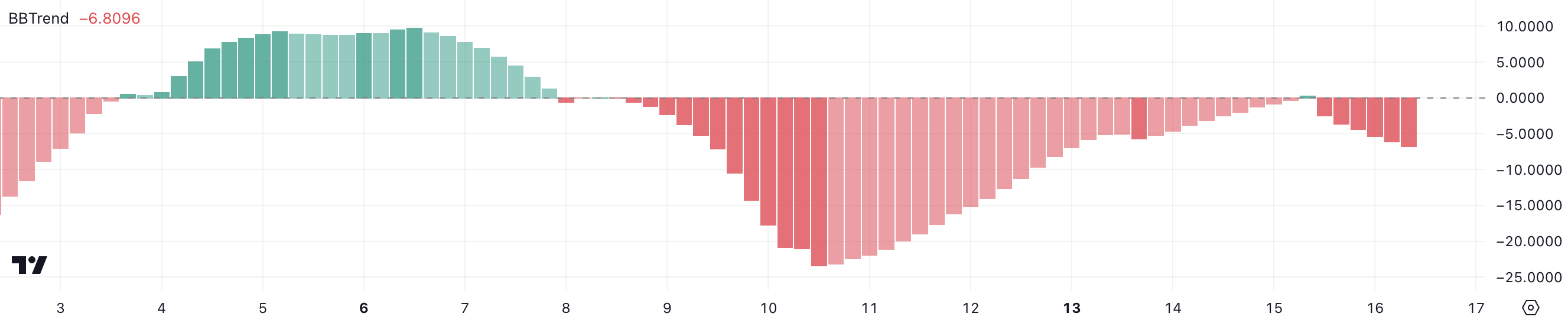

Sonic BBTrend Is Going Down

Sonic BBTrend is at the moment at -6.8, down considerably from -2.4 only a few hours in the past. This sharp decline suggests a rise in bearish stress and a shift away from potential bullish circumstances, indicating a weakening development in Sonic’s value motion.

BBTrend is a technical indicator derived from Bollinger Bands, used to measure the power and route of a development. Unfavorable values point out bearish circumstances, whereas optimistic values mirror bullish momentum. Sonic’s BBTrend at -6.8 indicators rising bearish dominance, suggesting Sonic could face downward stress within the close to time period.

If the BBTrend stays unfavourable or declines additional, Sonic value may enter a stronger downtrend; nonetheless, a restoration towards optimistic values may sign a possible reversal.

Sonic Value Prediction: Can S Rise to $1 In January?

Sonic EMA strains are exhibiting indicators {that a} new golden cross may kind quickly, probably signaling the continuation of its uptrend. If this bullish crossover happens, Sonic may take a look at the resistance at $0.87, a vital degree for its value momentum.

Breaking above $0.87 may enable Sonic value to climb additional and take a look at $1.06, representing a possible 34% upside from present ranges.

However, combined indicators from the ADX and BBTrend recommend warning, as they might point out a weakening development or a doable reversal. If Sonic value fails to maintain its upward momentum, it may take a look at the assist at $0.74.

A break under this degree would expose Sonic to additional draw back, probably falling to $0.61 and signaling a shift right into a bearish section.

Disclaimer

In step with the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.