Disclaimer: The opinions expressed by our writers are their very own and don’t characterize the views of U.At this time. The monetary and market data offered on U.At this time is meant for informational functions solely. U.At this time is just not answerable for any monetary losses incurred whereas buying and selling cryptocurrencies. Conduct your personal analysis by contacting monetary consultants earlier than making any funding selections. We imagine that every one content material is correct as of the date of publication, however sure gives talked about might not be out there.

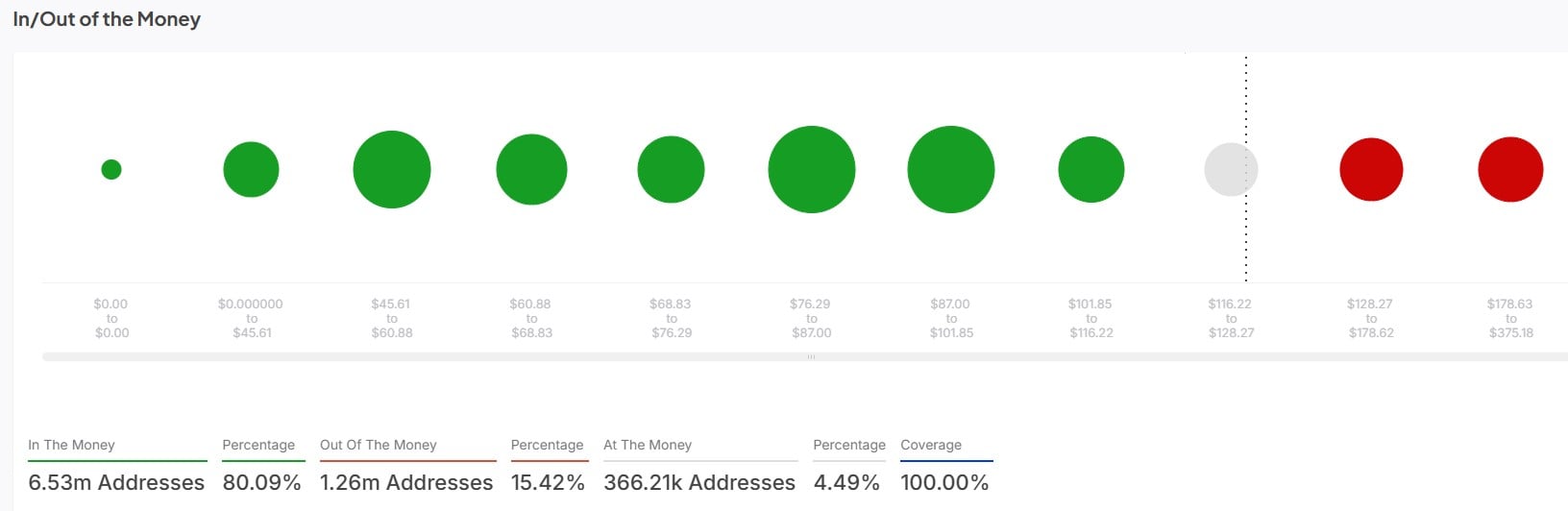

The continuing hype surrounding approvals for a Litecoin exchange-traded fund (ETF) has triggered an uncommon enhance for LTC. IntoTheBlock knowledge exhibits roughly 80% of addresses within the Litecoin community are worthwhile, demonstrating the bullish momentum.

Analyzing IntoTheBlock knowledge

The information exhibits 6.53 million addresses; roughly 80% of tracked addresses are “within the cash” or amassing revenue. Addresses out of the cash or recording losses whole 1.26 million (15.42%). In the meantime, Litecoin addresses the break-even level of 366,210, or 4.49%.

Notably, the revenue occurred amid heightened expectations of a possible Litecoin ETF launch. As reported earlier by U.At this time, Bloomberg’s Senior ETF Analyst Eric Balchunas claims Litecoin is the following crypto to obtain ETF approval.

The analyst’s feedback come after the U.S. Securities and Change Fee (SEC) acquired the amended Canary Capital’s S-1 LTC ETF submitting. Many view this motion as indicating that the SEC is transferring towards approving the ETF product.

Polymarket has predicted a 54% odds of a Litecoin ETF being authorised by 2025 and a 39% likelihood of regulatory nod by July 31. Market analysts imagine the eventual approval of an LTC ETF might result in surging cryptocurrency costs.

This sentiment is predicated on expectations of elevated adoption from institutional traders.

What’s subsequent for Litecoin

The prospects of a breakout stay comparatively excessive since most addresses are in income.

Nonetheless, Litecoin is at the moment going through intense strain in its each day chart. Throughout the final 24 hours, the value of LTC declined by 6.9% to commerce at $126.3. Nonetheless, LTC has elevated by 22% and 14.5% previously week and month, respectively. This uptrend exhibits that LTC can have a extra spectacular uptick within the brief and long run.

Thus, the each day value decline signifies that Litecoin is consolidating after hitting essential milestones this yr. This implies a restoration within the broader market is anticipated quickly and will assist additional enhance Litecoin’s value and profitability.