Litecoin (LTC) worth has surged greater than 12% within the final 24 hours as Nasdaq filed an utility to checklist Canary Capital’s Litecoin ETF. This rally has been fueled by bullish technical indicators, together with a golden cross formation and a major rise in shopping for strain, as mirrored in key momentum indicators.

LTC’s RSI has climbed into overbought territory, and its CMF is at its highest degree since December 2024, signaling robust accumulation by buyers. With momentum constructing, LTC may check key resistance ranges, doubtlessly reaching its highest worth in over a month if the uptrend continues.

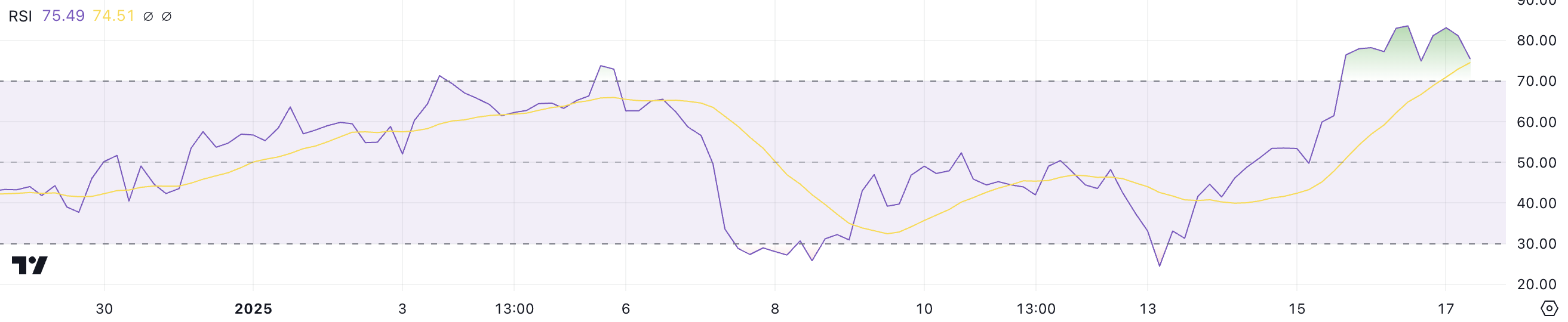

Litecoin RSI Signifies Overbought Situations

Litecoin RSI (Relative Energy Index) has climbed shortly, presently sitting at 75.4, up from 24.4 simply 4 days in the past. Yesterday, it peaked at 83.5, getting into overbought territory for the primary time since December 3. The RSI is a momentum oscillator that measures the pace and alter of worth actions on a scale from 0 to 100.

Usually, an RSI above 70 signifies overbought circumstances, suggesting the asset could also be overvalued and due for a correction, whereas an RSI under 30 indicators oversold circumstances, doubtlessly indicating undervaluation.

With Litecoin RSI presently at 75.4, the asset continues to be in overbought territory. This may sign a cooling-off interval or short-term pullback if momentum slows. Nonetheless, robust bullish momentum typically retains the RSI elevated for prolonged intervals, suggesting the potential of continued upward motion.

If shopping for strain persists, LTC worth may see additional worth positive aspects earlier than any vital retracement happens, however merchants ought to look ahead to indicators of weakening momentum to anticipate potential corrections.

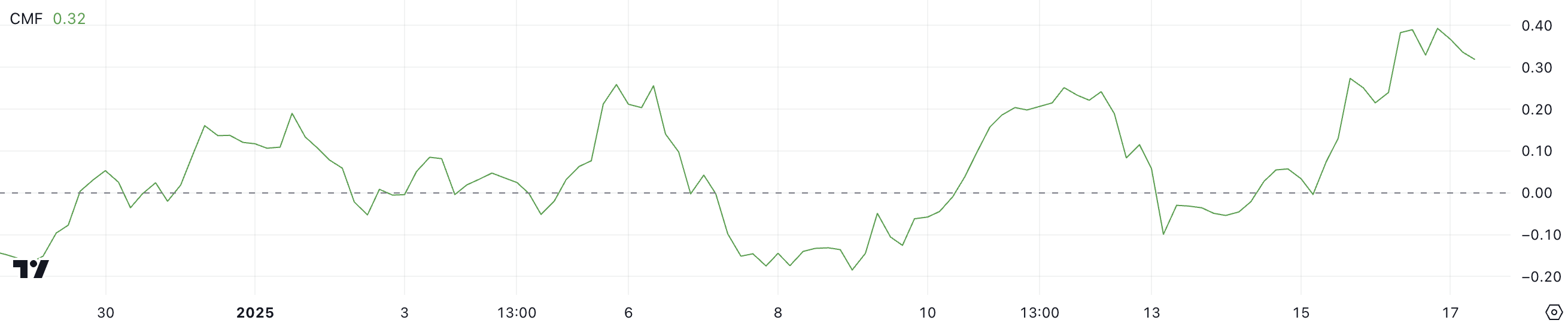

LTC CMF Factors at Shopping for Stress

CMF (Chaikin Cash Circulate) for LTC is presently at 0.32 after reaching a peak of 0.39 just a few hours in the past, up from -0.1 simply 4 days in the past. The CMF is an indicator that measures the circulation of cash into and out of an asset over a particular interval, utilizing each worth and quantity knowledge.

Values above 0 point out web shopping for strain, whereas values under 0 recommend web promoting strain. A better CMF worth usually indicators robust accumulation, which is commonly a bullish signal for worth motion.

At 0.32, with a latest peak of 0.39, Litecoin CMF is at its highest degree since December 1, 2024, reflecting vital shopping for strain. These elevated ranges recommend robust confidence amongst buyers, which may help additional worth will increase within the brief time period.

Nonetheless, if CMF begins to say no, it might point out waning accumulation, doubtlessly signaling a cooling-off interval for LTC’s worth momentum.

LTC Worth Prediction: Will Litecoin Reclaim December’s Highs?

Litecoin worth fashioned a golden cross simply sooner or later in the past, igniting its present uptrend and boosting bullish sentiment. A golden cross happens when a short-term shifting common crosses above a long-term shifting common, typically signaling the beginning of a powerful upward worth motion.

If this momentum continues, LTC may check the following resistance at $139, and breaking that degree may push the value to $147, marking its highest level since early December 2024. The subsequent information and actions round its ETF may additionally affect LTC worth.

Nonetheless, if the uptrend loses steam and the help at $131 is examined however fails to carry, LTC worth may drop to $125. Within the occasion of a stronger downtrend, additional declines may convey the value as little as $114 and even under $100, with a possible check of help at $96.8, representing a 28.3% correction.

Disclaimer

Consistent with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.