SPX’s value rocketed by 50% throughout Friday’s intraday buying and selling session. This surprising value bounce triggered a wave of quick liquidations, leaving quite a few quick merchants dealing with substantial losses.

With the SPX token value poised to increase its good points, its quick merchants could face extra liquidations.

SPX Brief Merchants Document Losses

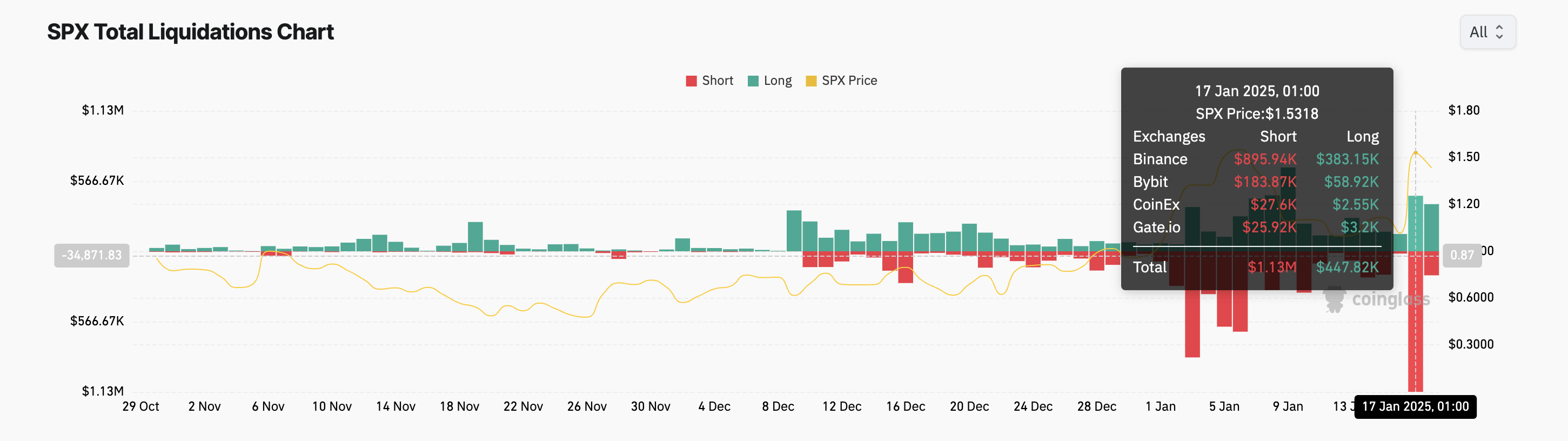

Throughout Friday’s buying and selling session, SPX worth surged by 50%, climbing to a nine-day excessive of $1.55. This value rally triggered a big quantity of quick liquidations in its futures market, totaling $1 million, in accordance with Coinglass knowledge.

Liquidations happen in an asset’s derivatives market when its worth strikes in opposition to a dealer’s place. In such circumstances, the dealer’s place is forcefully closed on account of inadequate funds to keep up it.

Brief liquidations occur when merchants with quick positions are compelled to purchase again an asset at the next value to cowl their losses as its worth will increase. This takes place when the asset’s value surpasses a crucial degree, forcing merchants who had been betting on a decline to exit the market.

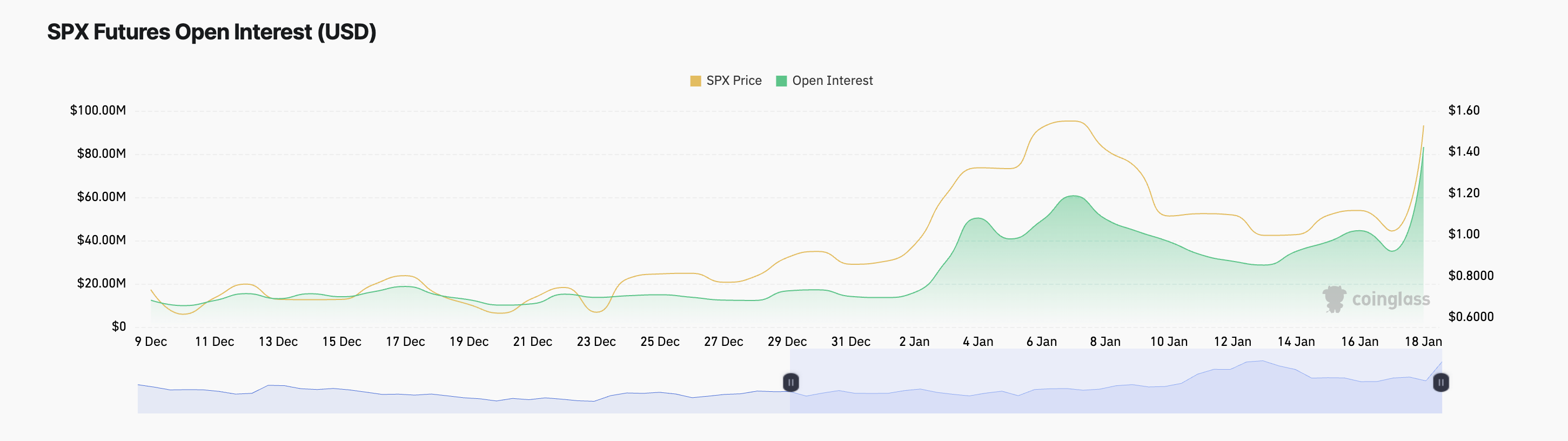

Notably, this may not be the tip of losses for SPX’s merchants as buying and selling exercise continues to climb. That is evidenced by the token’s open curiosity, which has elevated by 137% up to now 24 hours. This has occurred amid the 32% surge within the token’s worth throughout the identical interval.

Open curiosity tracks the overall variety of excellent by-product contracts that haven’t been settled, akin to futures or choices. When it spikes throughout a value rally like this, it alerts elevated market participation and confidence within the upward value motion.

Subsequently, if the SPX value uptrend persists, its quick merchants will undergo extra losses.

SPX Worth Prediction: Token Eyes All-Time Excessive

SPX’s 50% surge has prompted a shift within the place of its Tremendous Pattern indicator. It’s now a inexperienced line providing dynamic help beneath the token’s value on the each day chart.

This indicator tracks the path and power of an asset’s value pattern. It’s displayed as a line on the value chart, altering shade to suggest the present market pattern: inexperienced for an uptrend and crimson for a downtrend.

When an asset’s value trades above the Tremendous Pattern indicator, it’s in a bullish pattern. This alerts that purchasing stress outweighs promoting exercise amongst market individuals.

If this continues, SPX’s value will rally to revisit its all-time excessive at $1.65. Nonetheless, if selloffs begin, the SPX token value will lose its latest good points and will drop to $1.23.

Disclaimer

In keeping with the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.