Main altcoin Ethereum has defied the general market pattern, witnessing a 2% drop in worth over the previous 24 hours. This comes amid the persistent decline within the demand for the coin.

As shopping for stress wanes, ETH dangers falling beneath $3000 quickly. This evaluation has the small print.

Ethereum’s Demand Loses Steam

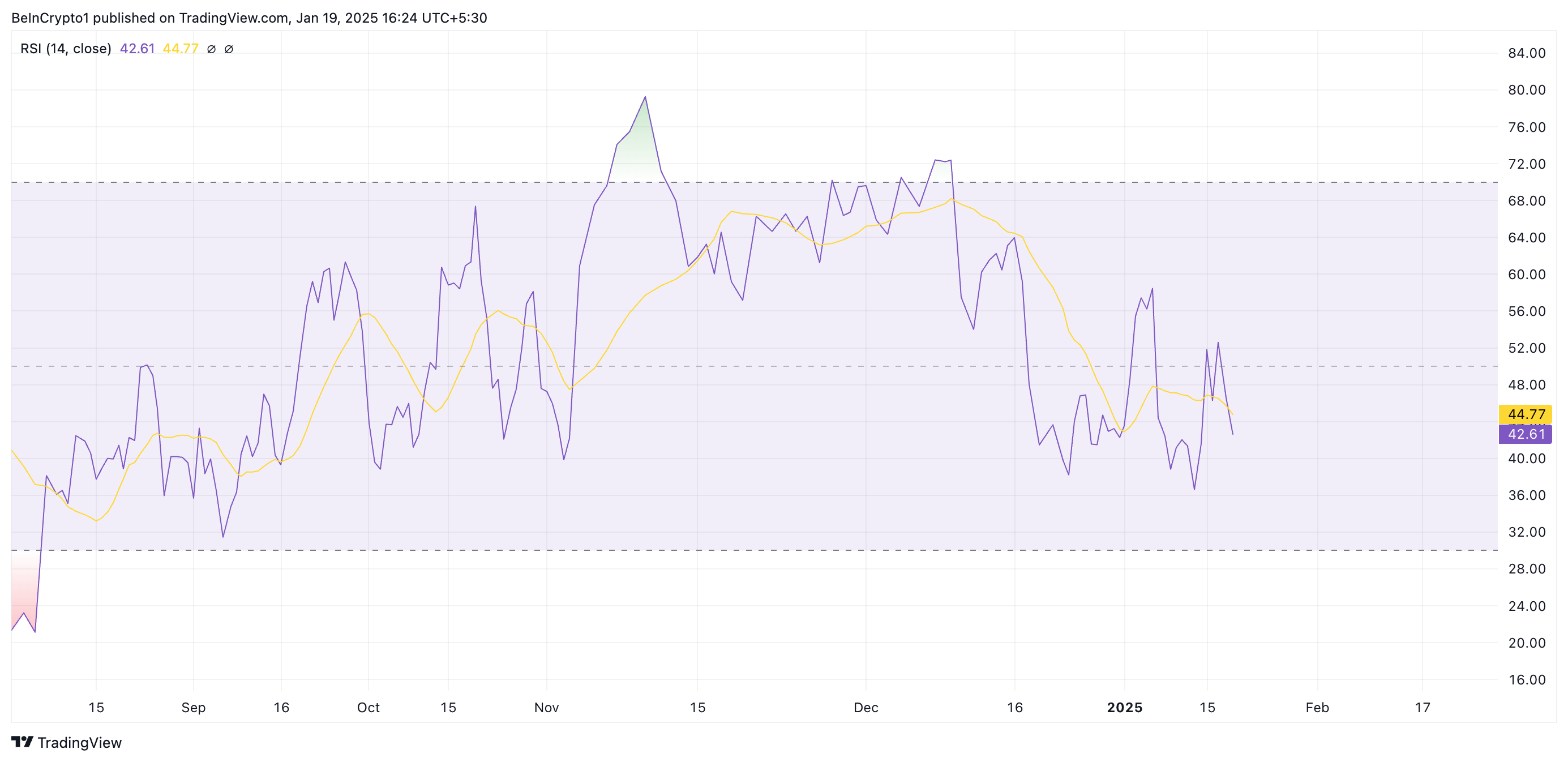

An evaluation of ETH’s momentum indicators on the ETH/USD one-day chart reveals the altcoin’s waning demand. For instance, its Relative Energy Index (RSI) is in a downward pattern and beneath the 50 impartial line. As of this writing, its worth is 42.61.

An asset’s RSI measures its overbought and oversold market circumstances. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought, whereas values beneath 30 recommend it’s oversold.

ETH’s RSI setup alerts weakening momentum and means that the asset could also be dropping shopping for curiosity, probably resulting in additional worth declines.

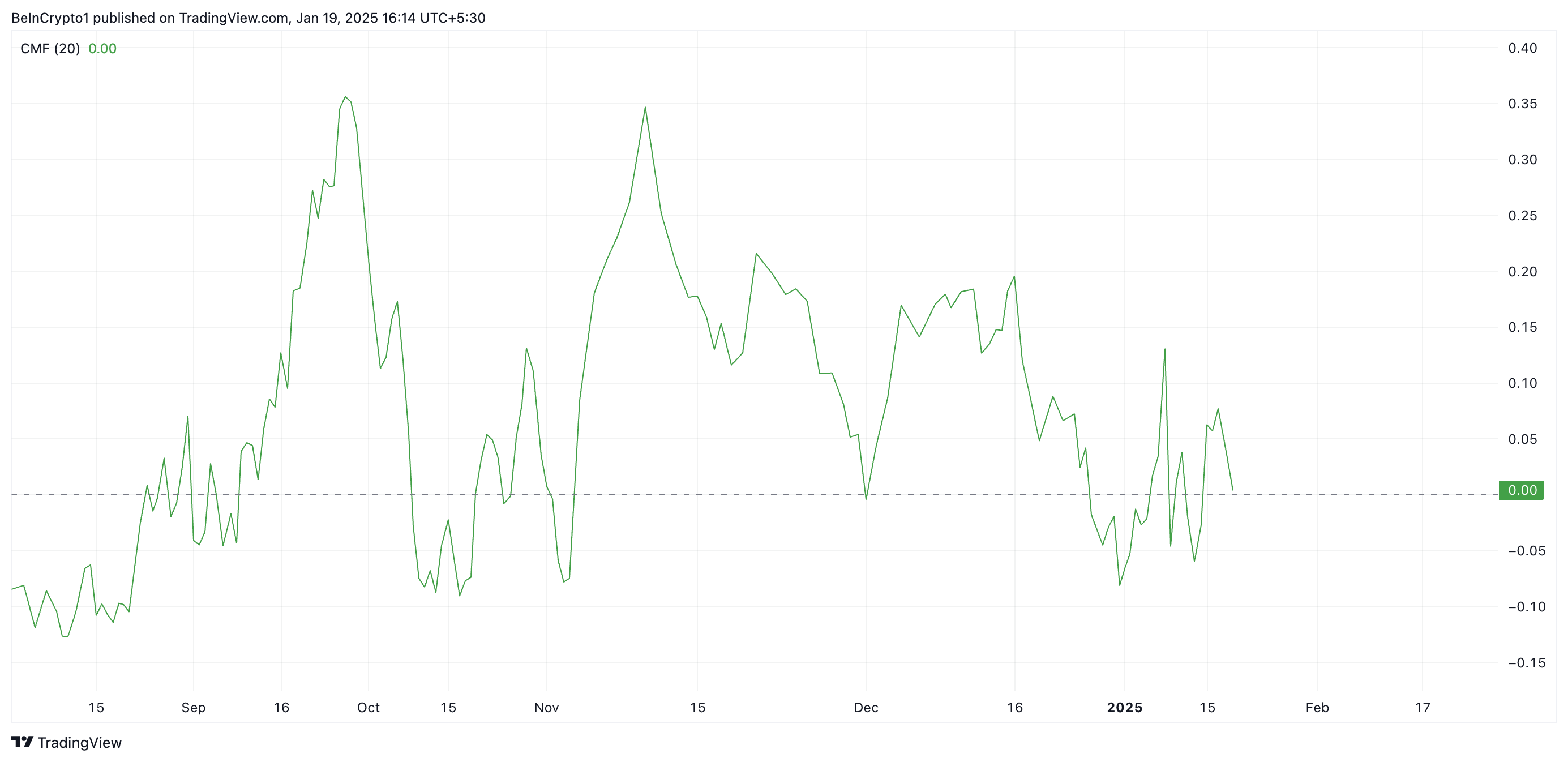

Furthermore, as of this writing, the coin’s Chaikin Cash Circulation (CMF) is poised to fall beneath the zero line, confirming the weakening demand for ETH.

The CMF indicator measures the amount of cash flowing into or out of an asset over a particular interval. When the CMF is about to fall beneath the zero line, promoting stress is growing, indicating potential bearish momentum and a doable worth decline.

ETH Worth Prediction: Drop to $2,811 or Rally to $3,476?

At press time, ETH trades at $3,175, beneath the resistance shaped at $3,249. With weakening shopping for stress, the coin’s worth may fall beneath $3,000 to commerce at $2,811 within the close to time period.

Nonetheless, if market sentiments enhance, it may push ETH’s worth above $3,249 towards $3,476.

Disclaimer

In step with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.