Disclaimer: The opinions expressed by our writers are their very own and don’t symbolize the views of U.In the present day. The monetary and market data offered on U.In the present day is meant for informational functions solely. U.In the present day isn’t responsible for any monetary losses incurred whereas buying and selling cryptocurrencies. Conduct your individual analysis by contacting monetary specialists earlier than making any funding choices. We consider that each one content material is correct as of the date of publication, however sure presents talked about might not be out there.

The cryptocurrency market, and specifically the worth of digital belongings, continues to be a wild goose chase. As an illustration, after huge value swings within the final 24 hours, complete liquidations within the perpetual futures phase reached $1.24 billion, one of many largest this yr.

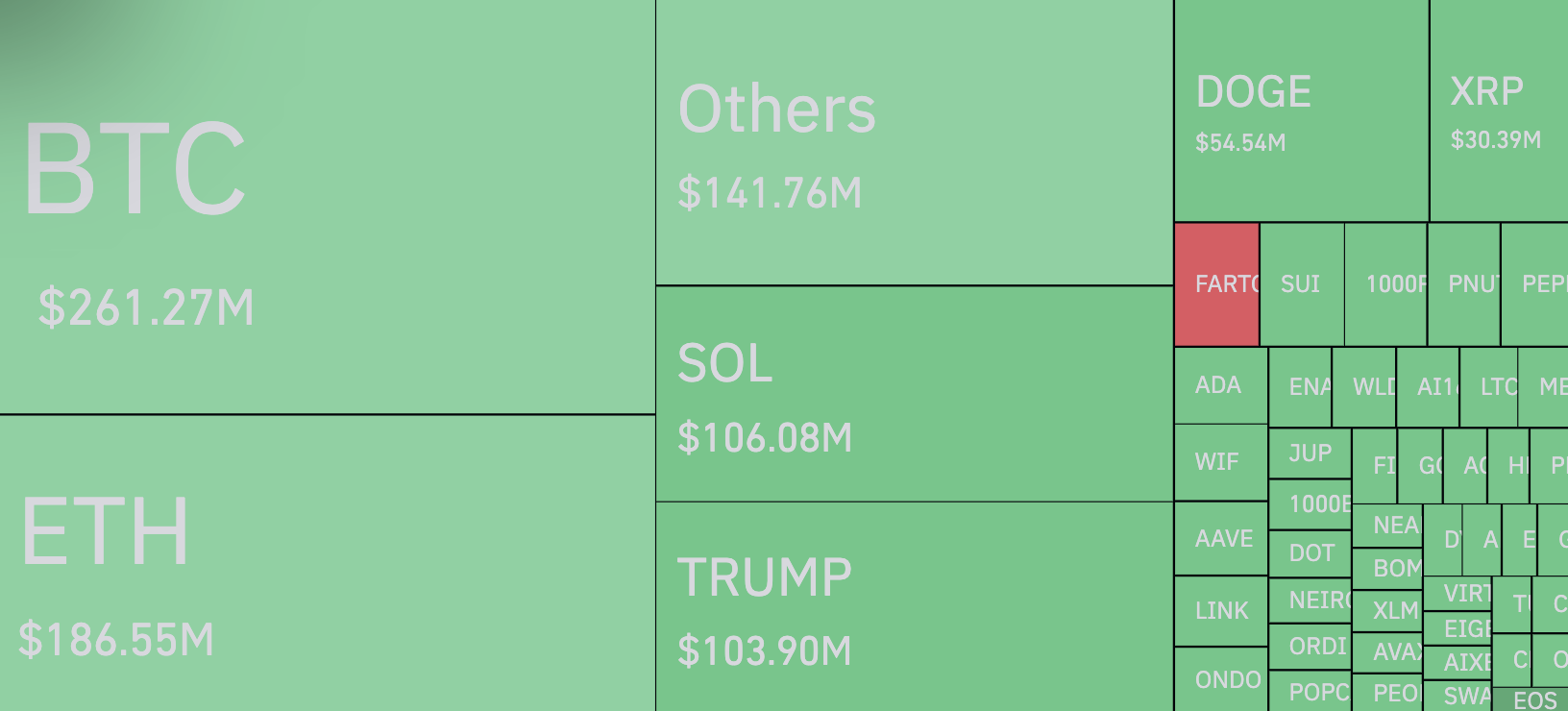

After all, the primary focus was on Bitcoin (BTC) because the main cryptocurrency. The worth motion in BTC, which took a curler coaster journey from as excessive as $106,500 to as little as $99,651, induced probably the most ache for merchants, with $261 million price of margin positions, in keeping with CoinGlass.

Nearly all of this, after all, was on the lengthy facet — $161 million, with an extra $100 million “donated” by bears who had failed of their funding choices.

Quick ahead to 12 hours later, nevertheless, and the worth of the main cryptocurrency was already above earlier highs. Extra importantly, in keeping with information from Binance, it was hitting an all-time excessive of $109,588.

Given the chain of occasions that occurred over the course of final weekend, it was very uncertain that Bitcoin would renew its all-time excessive. However right here we’re.

What occurs subsequent stays a thriller. There are too many questions and little to no solutions. To begin with, does the truth that BTC has renewed its all-time excessive change the bearish narrative that has pushed the cryptocurrency value probably the most this month?

The traditional knowledge is that when market liquidations attain $1 billion territory, it normally means a reset and a recent begin. However as all the pieces takes on a brand new, extra subtle type, the views and interpretations of such marks can also want to vary.