Rumble, a Tether-backed video-sharing platform, has made its first Bitcoin acquisition two months after adopting the highest crypto as a strategic reserve asset.

On Jan. 20, Rumble CEO Chris Pavlovski introduced that the corporate had bought Bitcoin on Friday, Jan. 17.

In response to him:

“On Friday, Rumble made its first-ever buy of Bitcoin. It received’t be the final.”

Whereas the quantity acquired stays undisclosed, Pavlovski hinted that is simply the beginning of a bigger plan to strengthen Rumble’s Bitcoin place.

The acquisition aligns with Rumble’s broader crypto technique. In November 2024, the corporate revealed plans to speculate $20 million in Bitcoin, citing confidence within the asset’s long-term potential.

On the time, Pavlovski famous that Bitcoin adoption was nonetheless in its infancy, with momentum constructing resulting from supportive insurance policies and rising institutional curiosity.

He additionally highlighted Bitcoin’s resilience in opposition to inflation, citing its immunity to dilution brought on by extreme cash printing. He referred to as it a invaluable asset for the corporate’s treasury.

Rumble is a video-sharing platform with 67 million lively customers month-to-month and is famend for its relaxed content material moderation method. Final December, stablecoin issuer Tether invested over $775 million within the platform.

Broader adoption

Rumble’s Bitcoin acquisition mirrors a rising development amongst prime company corporations throughout the private and non-private sectors embracing the flagship digital asset for his or her treasuries reserve.

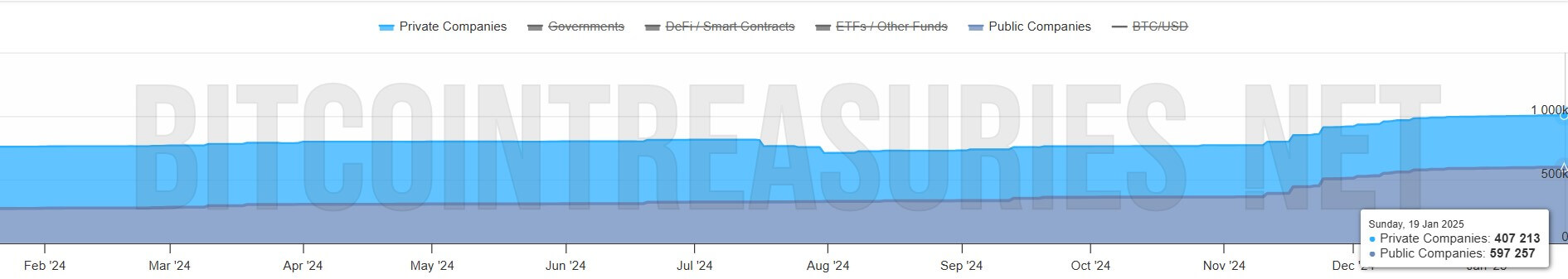

Information from Bitcoin Treasuries reveals that over 70 publicly traded firms collectively maintain round 600,000 BTC. MicroStrategy leads this cohort with 450,000 BTC in its coffers.

Then again, personal corporations like SpaceX, Tether, and Block.one have amassed 407,212 BTC.

Bitwise’s Chief Funding Officer Matthew Hougan believes this development is way from a one-off. As a substitute, he describes it as a “megatrend” that might reshape the crypto market.

Hougan attributes a part of this shift to the Monetary Accounting Requirements Board’s (FASB) introduction of ASU 2023-08. This new rule permits publicly traded corporations to document Bitcoin holdings at market worth, permitting them to replicate positive factors when Bitcoin’s value will increase.