Rumble, Canada’s largest video-sharing platform with over 50 million customers, has introduced its first Bitcoin buy as a part of its monetary reserve technique.

The corporate invested $20 million and indicated plans to develop its Bitcoin holdings sooner or later. This transfer displays a rising pattern amongst public corporations adopting Bitcoin as a reserve asset.

Rumble Joins a Rising Checklist of Public Firms Shopping for Bitcoin

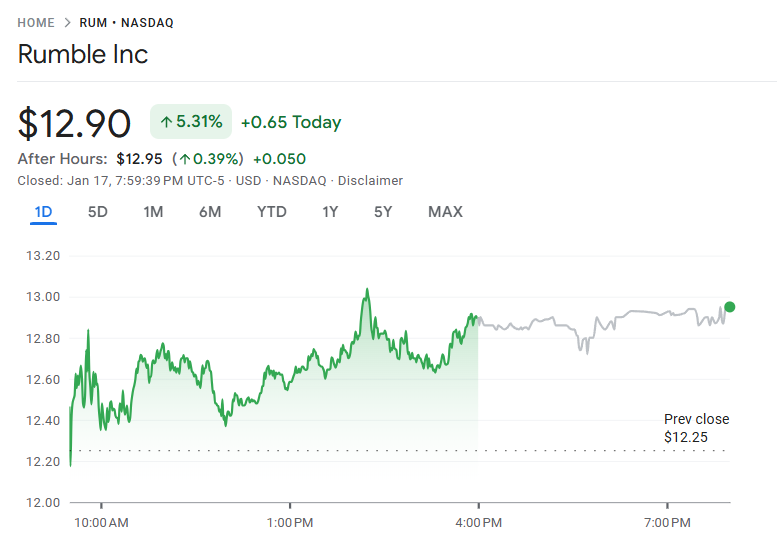

Following the announcement, Rumble’s inventory surged by greater than 5%. The publicly traded and valued at $3.6 billion firm joins a listing of different corporations integrating Bitcoin into their monetary methods.

These embody MicroStrategy, Semler Scientific, Marathon Digital, and Metaplanet, which have all applied comparable approaches.

Rumble initially outlined its Bitcoin technique in November 2024. The platform’s CEO, Chris Pavlovski, reportedly mentioned it with MicroStrategy’s Michael Saylor. This newest buy marks the corporate’s first tangible step in that path.

The transfer aligns with a broader market pattern of publicly listed corporations adopting Bitcoin as a reserve asset. These corporations are more and more being thought to be proxies for Bitcoin, attracting consideration amid Bitcoin’s accelerating progress all through the previous 12 months.

Rumble’s Bitcoin buy comes shortly after a big funding from Tether, the main stablecoin issuer. In December, Tether dedicated $775 million to Rumble.

Tether has skilled substantial progress, with income surpassing $10 billion in 2024. It additionally introduced plans to relocate its headquarters to El Salvador due to its crypto-friendly insurance policies.

Moreover, El Salvador’s president, Nayib Bukele, has invited Rumble to ascertain operations within the nation, probably aligning with its increasing Bitcoin technique.

In the meantime, different corporations are ramping up their Bitcoin purchases. Marathon Digital (MARA) not too long ago added $1.1 billion in Bitcoin to its reserves.

Total, MicroStrategy, by far, stays the most important BTC holder amongst publicly listed corporations. Its inventory soared by over 700% final 12 months, pushed by its aggressive Bitcoin acquisitions. The agency was additionally added to the illusive Nasdaq-100 resulting from this outstanding progress.

Public corporations like Rumble are actually following swimsuit, looking for to duplicate comparable success via strategic investments in Bitcoin.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.